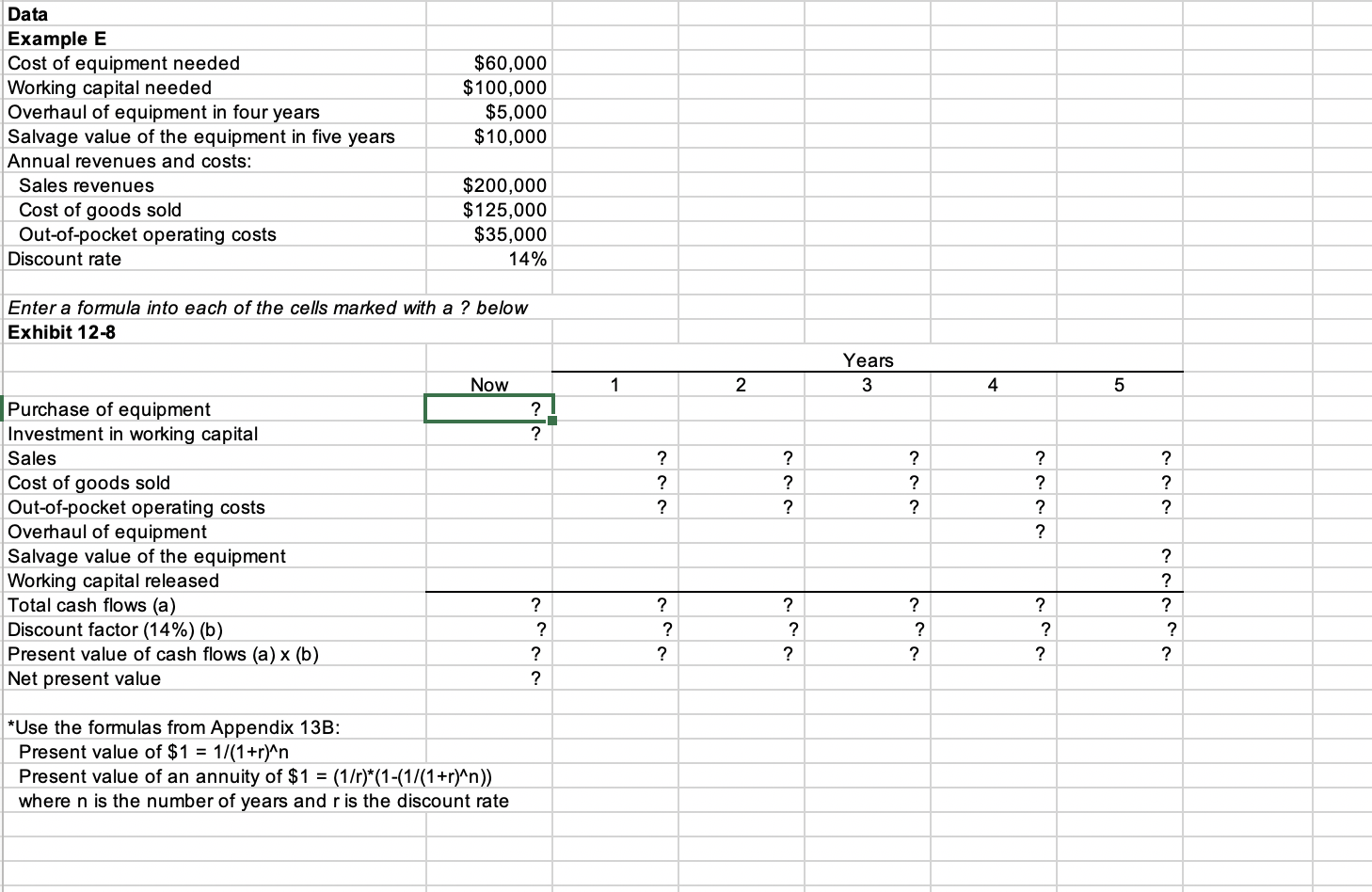

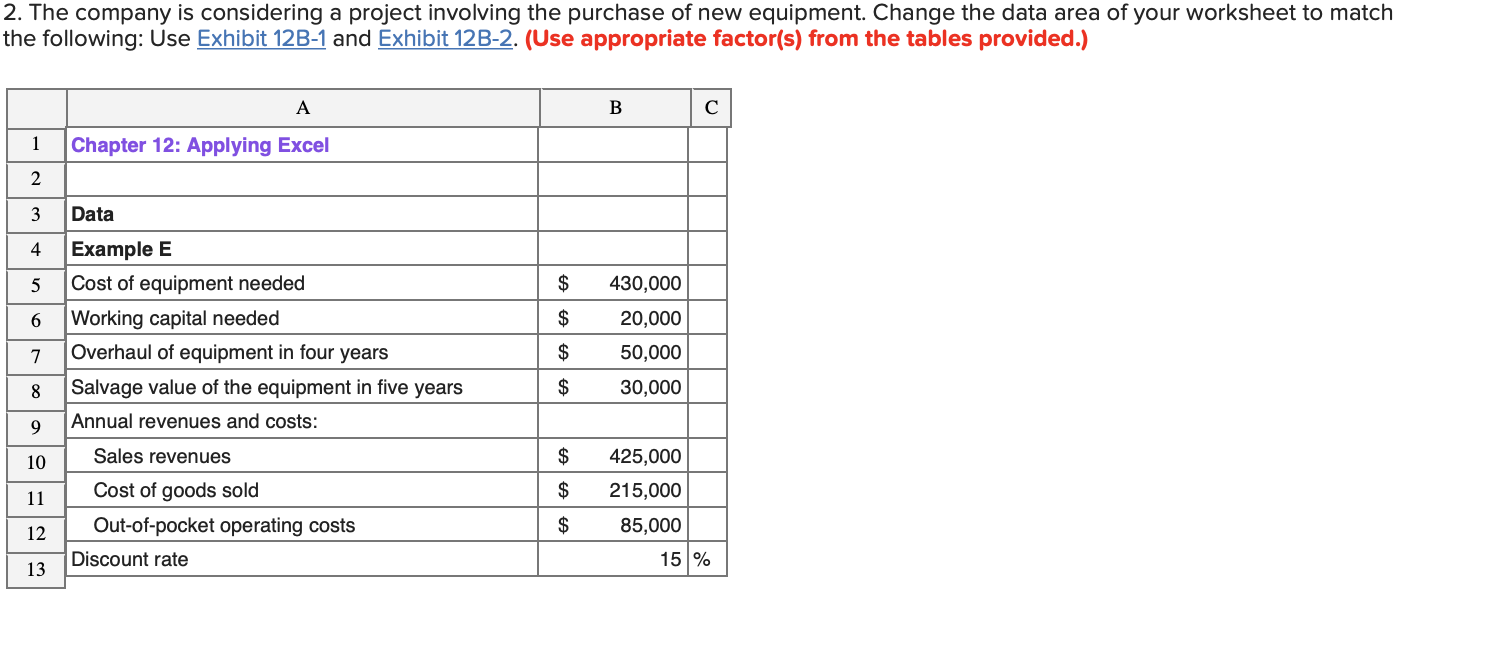

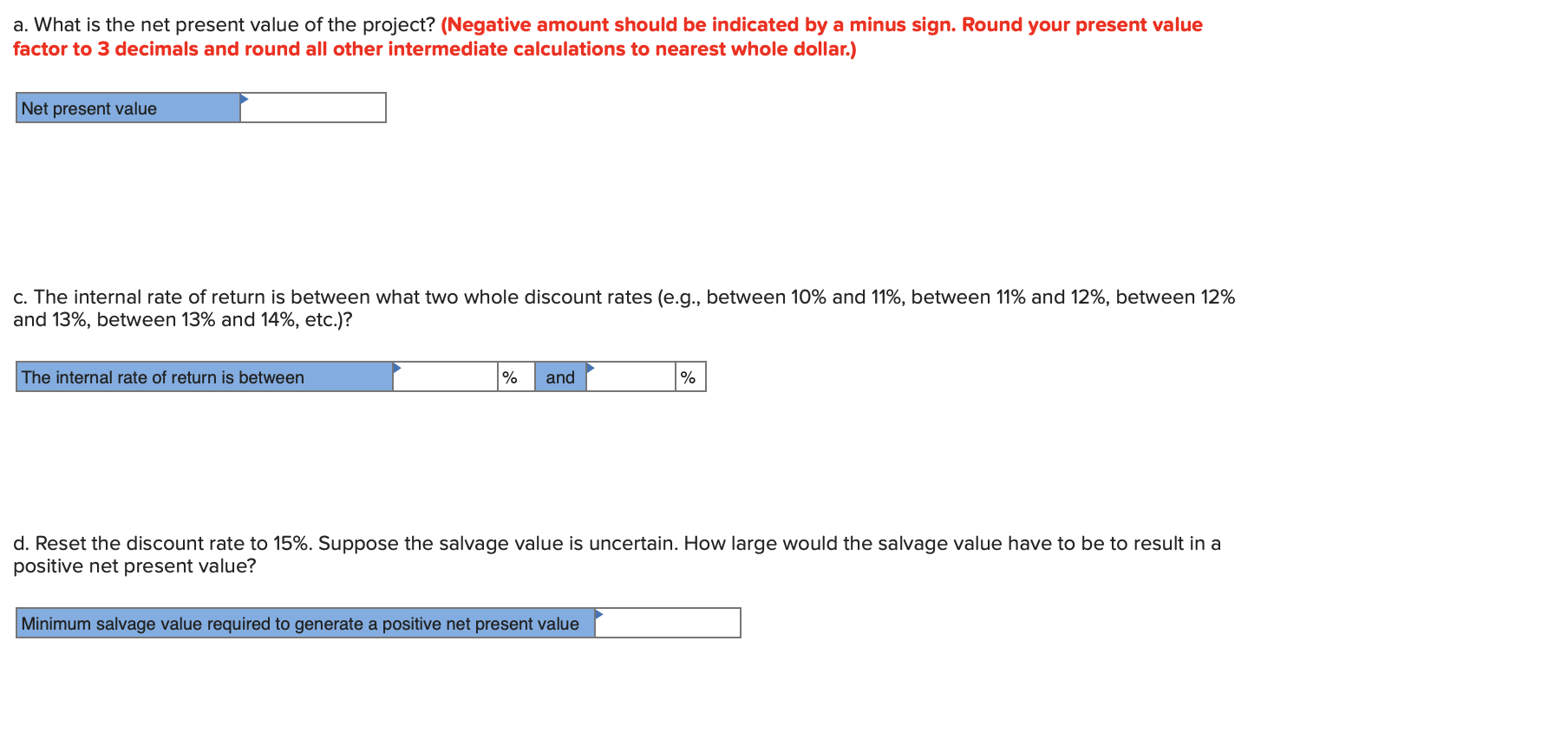

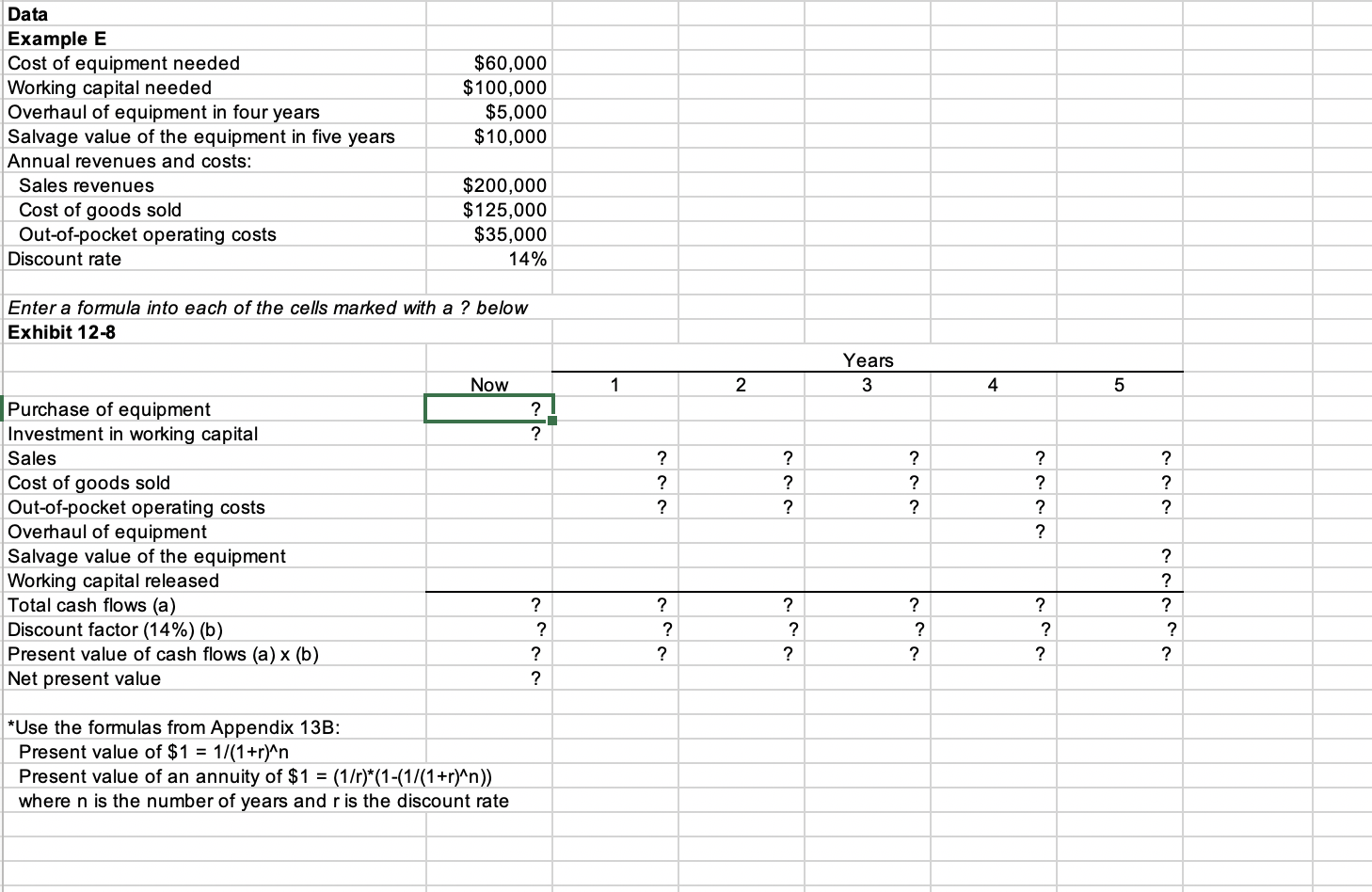

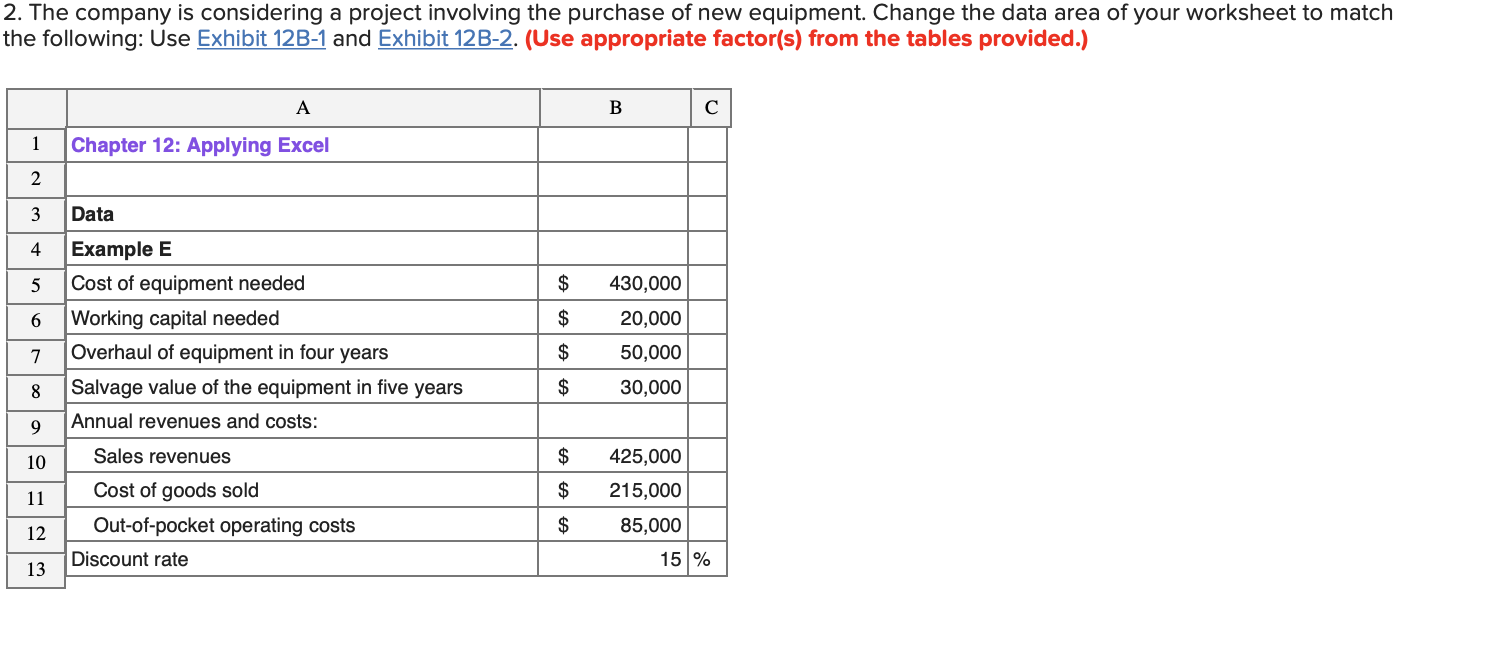

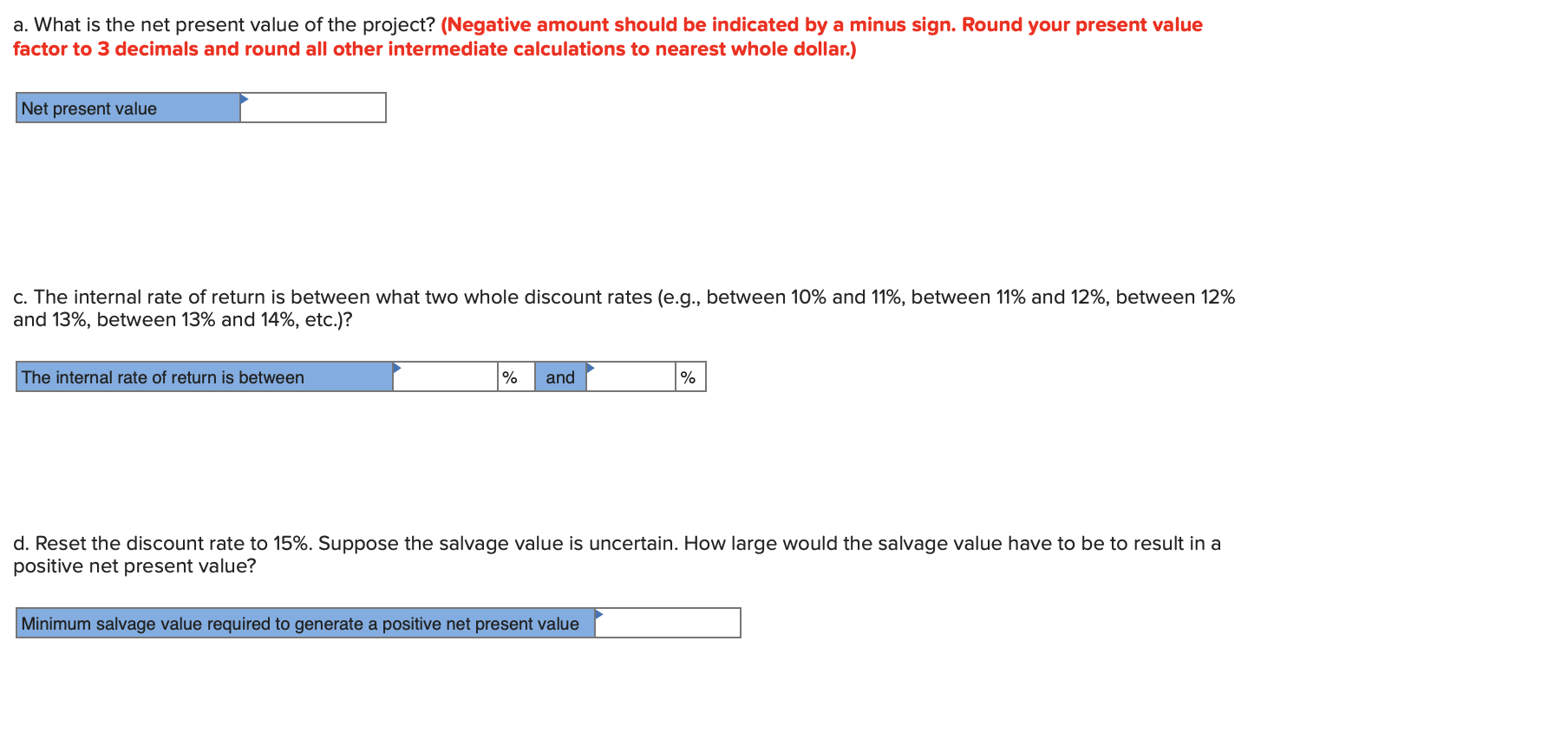

Data Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment in five years Annual revenues and costs: Sales revenues Cost of goods sold Out-of-pocket operating costs Discount rate $60,000 $100,000 $5,000 $10,000 $200,000 $125,000 $35,000 14% Enter a formula into each of the cells marked with a ? below Exhibit 12-8 Years 3 Now 1 2 4 5 ? ? ? ? ? ? ? ? ? ? Purchase of equipment Investment in working capital Sales Cost of goods sold Out-of-pocket operating costs Overhaul of equipment Salvage value of the equipment Working capital released Total cash flows (a) Discount factor (14%) (b) Present value of cash flows (a) x (b) Net present value ? a. ? ? ? ? ? ? ? ? ? *Use the formulas from Appendix 13B: Present value of $1 = 1/(1+r)^n Present value of an annuity of $1 = (1/r)*(1-(1/(1+r)^n)) where n is the number of years and r is the discount rate 2. The company is considering a project involving the purchase of new equipment. Change the data area of your worksheet to match the following: Use Exhibit 12B-1 and Exhibit 12B-2. (Use appropriate factor(s) from the tables provided.) 1 Ich Chapter 12: Applying Excel $ 6 Data Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment in five years Annual revenues and costs: Sales revenues Cost of goods sold Out-of-pocket operating costs Discount rate 430,000 20,000 50,000 30,000 $ $ $ $ 425,000 215,000 85,000 15 12 13 % a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Round your present value factor to 3 decimals and round all other intermediate calculations to nearest whole dollar.) Net present value c. The internal rate of return is between what two whole discount rates (e.g., between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etc.)? The internal rate of return is between % and 1 % d. Reset the discount rate to 15%. Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a positive net present value? Minimum salvage value required to generate a positive net present value