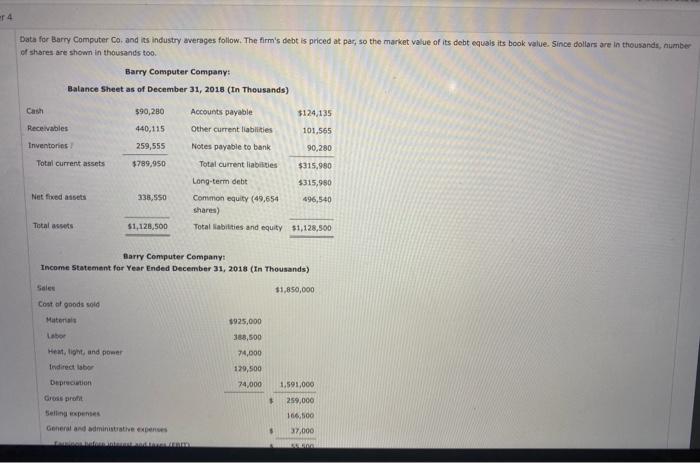

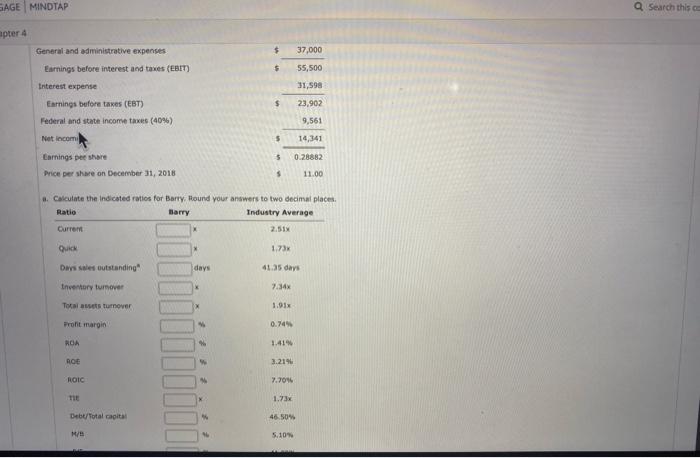

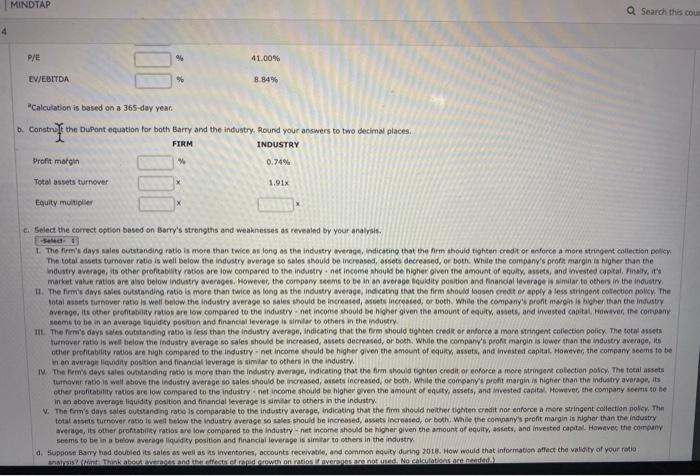

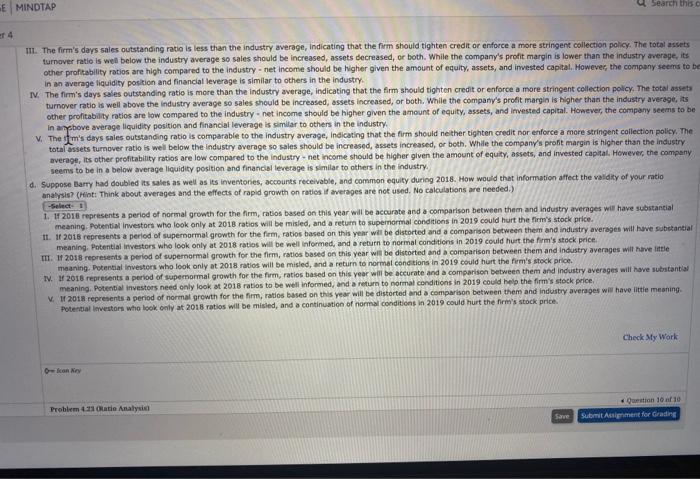

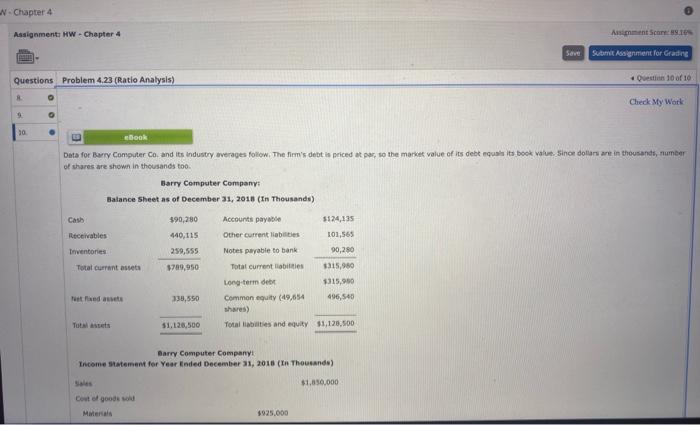

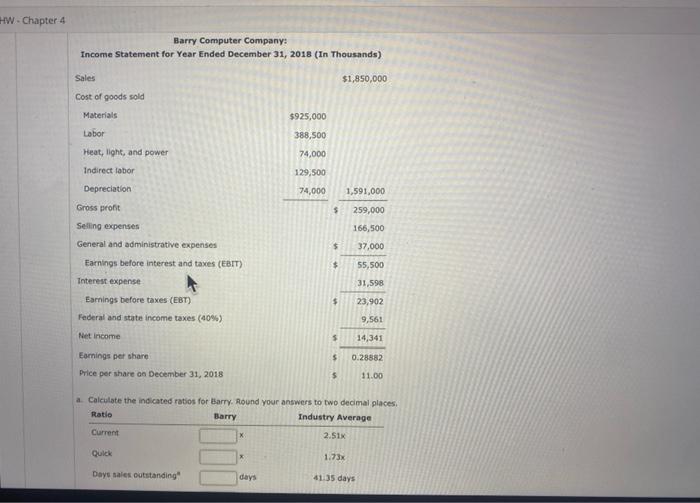

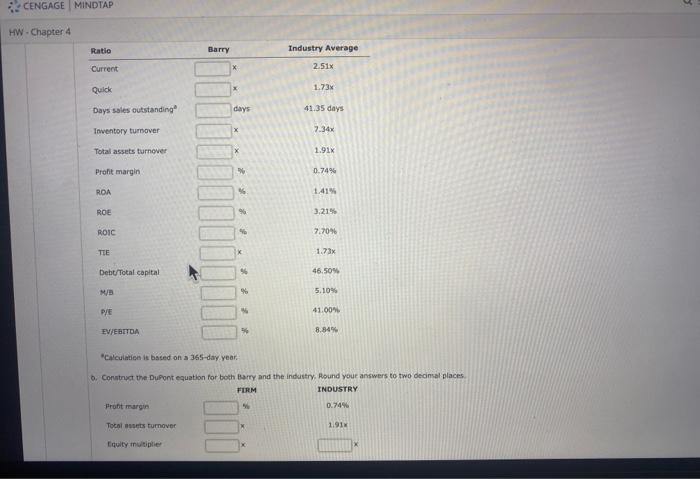

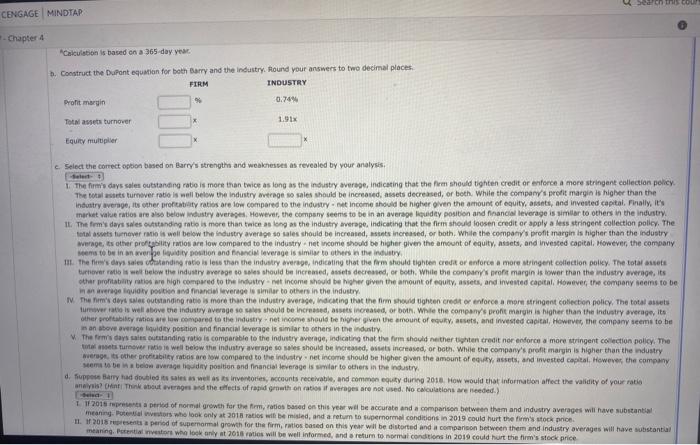

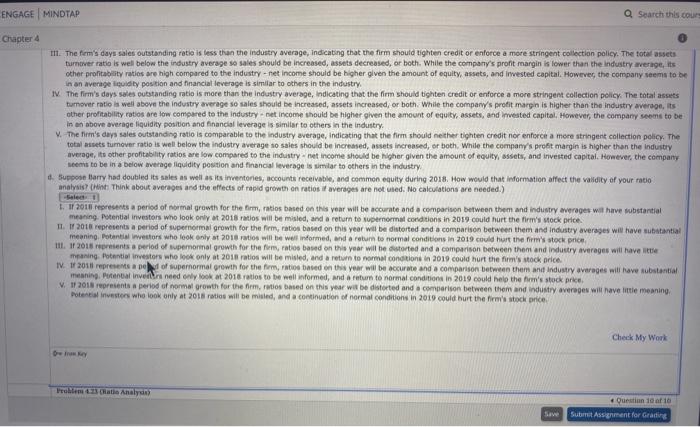

Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since dollars are in thousands, number of shares are shown in thousands too. Barry Computer Company: Income Statement for Year Ended December 31, 2018 (In Thousands) a. Cakculate the indcated ratios for Barry, Hound your answers to two decimal places. Frofit margici nch not llote tit \begin{tabular}{|c|c|} \hline Barry & Industry Average \\ \hline & x \\ \hline \end{tabular} "Calculation is based on a 365 -day year. b. Constryoft the Dupont equation for both Barry and the industry, Round your answers to two Gecimal places. c. Select the correct eption based on Barry's strengths and weaknesses as revealed by your analysis. 1. The firm's days sales outstanding ratio is more than twice as long as the industry werege, indicating that the firm shouid tighten credit or enforce a more stringevt caliection palicy. The total assets tumover retie is well below the industry average so sales should be increased, assots decreased, of both. While the company's profit margin it higher than the ndustry averege, its other profitablity ratios are low compared to the incusetry - net income ahould be higher given the amoutit of equity, assets, and invested captal. Finsily, ifs market vahue ratios are atwo beiow industry avernges. Howevet, the compony seems to be in an average fiquidity position and finandal leyerage is similar to others in the incistiry, 7. The firm's days swies outsanding ratio is more than twice as leng as the industry werage indicating that the firm should loosen crect or apply a less stringent coltection policy. The total astets turnover ratio is well below the industry average wo saies thould be increated, ascets incroated, or both. While the company's proft margin is bipher than the industry reems to be in an ayerage liquidisy posilien and finuncial leverage is simiar to ottiers in the indusir. 17. The firm's days weses putatanding ratio is less than the industry aversph, indicating that the firm should tighten credit or anforce a mare stringent coliectien policy The total assets tuentiver ratio is wes thelow the inaustry average so sales should be incressed, assets decreased, or beth. While the company's profit margin is lower than the industry average, its other profitability retios are high compared to the industry - net income thould be higher given the amount of equity, atsets, and invested capital. Hawever the company seems to the in an average liquidity position and financial leverage is similar to others in the industry. IV. The lemb devs tales outstanding retio is more than the industry averape, indicating that the firm should tighten credit of enforce a more atringent colection polon The tocal assets turiover rabs is well above the industry average so sales should be increased, wisets incresied, oe both. While the company's prefit margin is higher than the industry average, its cother proftabitity ratios are low compared to the industry . net income should be higher given the amount of equaty, assets, and invested casita. Howet the company seems to the in en abowe toverope liquidity position and finandal leverage is similar to others in the induatry. v. Thi from's days sales outstanding rato is comparable to the industry average, indicating that the firm shocld neither tighten credit nor enforce a more stringent collection poler. The average, its other profitabiity ratios are low compared to the industry - net income should be higher given the amount of equity, assepts, and inverted capital Hanaiver, the coirpany seems to he in a below average liqudity position and financial leverspe is simitar to others in the industry III. The firm's days sales outstanding ratio is less than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy. The total assets turnover ratie is well below the industry average so sales should be increased, assets decreased, or both. While the company's profit margin is lower than the industry average, its other profitability ratios are high compared to the industry - net income should be Wigher given the amount of equity, assets, and imested capital, However, the company seems to I in an average liquidity position and financial leverage is similar to others in the industry. N. The firm's days sales outstanding ratio is more than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy, The total assets turnover ratio is well above the industry average so sales should be incressed, assets increased, or both. While the company's profit margin is higher than the industry average, its other profitability rotios are low compared to the industry - net income should be higher given the amount of equity, assets, and imested capital. However, the company seems to bi in arpobove average liquidity position and financial leverage is cimilar to others in the industry. V. The y'm's days cales outstanding ratio is comparable to the industry average, indicating that the firm should nether tighten credit nor enforce a more stringent coliection policy. The totai assets turnover ratio is well below the industry average so sales should be increased, assets increased, or beth, While the company's profit margin is higher than the industry avenage, its other profitability ratios are low compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. However, the company seems to be in a below average liquidity position and financial leverage is similar to others in the industry. d. Suppose Barry had doubled its sales as well as its inventones, accounts receivable, and common equity during 2018. How would that information affect the valdity of your netio analissis? (Hint: Think about averages and the effects of rapid growth on roties if averages are not used. No calculations are needed.) 1. If 2018 represents a pericd of normal growth for the firm, ratios based on this year will be accurate and a comparison between them and industry averages will have substantial meaning. fotential investors who look only at 2018 ratios will be misled, and a retum to supernormal conditions in 2019 could hurt the firm's stock price. meaning. Potential investors who look only at 2018 ratios will be well informed, and oreturn to normal conditicns in 2019 could hurt the firm's stock price. III. If 2018 represents a period of supernormal growth for the firm, ratios based on this year will be diktorted and a comparison between them and industry averages wilt heve ittle maaning. Potential investors who look only at 2018 ratios will be misled, and a return to normel congtions in 2019 could hurt the firm's stock price. TV. If 2018 represents a period of supemormat growth for the firm, ratios based on this year will be accurate and a comparison between them and industry averages will have sutsitantial meaning. Potentid investoos need only look at 2018 ratios to be well informed, and a return to normal conditions in 2019 could heip the firm's stock peice. v. If 2018 represents a period of normal growth for the firm, ratios bassed on this year will be distorted and a comparison between them and industry averages will have littie meaning. fotertial lemestars who look orily at 2018 ratios will be misied, and a continustion of normal conditicns in 2019 could hurt the firm's stock price. of thares are shown in thousanids too. Barmy Computer Company: Balance sheet as of December 31, 2018 (In Theusands) Darry Computer Company! Tricome 5tatement for Year Ended December 31, 2018 (In Thousands) Barry Computer Company: Income Statement for Year Ended December 31, 2018 (In Thousands) a Calculate the indicated ratios for Barry. Round your answers to two decimal places; Pealculatien is baced on a 355-day year. Constryat the Dufont equation for both Barry and the industry. Aound your answers to two decinul places. ACatculotion is based on a 365 -day yeac: 7. Construct the Dupant equatian for beth Barry and the industry. Hound your answers to two decimal places: c. Select the comect opbon bused on Barry's strengths and weakerses as revealed by your analysis. 1. The firmit days sales outatanding ratie is more than twice as long as the insustry oversge, indicating that the firm should tighten credit or entorce a more stringent collection pelicy. The tohal assets turnsver rate is sell below the industry average so saies should be incresesed, assets decreased, or beth. While the compan/'s profit margin is higher than the market value ratios are ass below industry avereges. However, the compsny seems to be in an averape lesidey posiben and financial leverage is 1imilar to others in the induter. 14. The frm' dayt swes cututandeg rato is more than taice as leng at the industry averape, indicating that the firm should loosen credit or apply a less stringent collection policy. The total ascets tuenever ravio is well below the industry average so sales should be increated, astets increased, or both. While the compativ's proft margin is higher than the industry werage, ts other proftebility ratios are low compared to the industry - net uncome showd be higher given the amcunt of equity, assets, and invested capital, fowever, the company. in as arenge iquioty poitien and financiel leverage is similar to others in the industry. titio awets turoover ratis is well bebw the industry average so wes should be increased, bisets increased, or both. While the company's oreft margin is higher than the ndustry Mema to be in a belaw average ligudify nosition and financial leyerage is smilar to others in the industry. [1siea: 1] IIt. The fem's days sales outstanding ratio is less than the industry average, indicating that the firm should tighten credit of enforce a more stringent coligction policy. The fotail assets turnwer ratio is well below the industry average so sales should be increased, assets decreased, or both. While the company's proft margin is lower than the industry arerage, its other profitabitity ratios are high compared to the industry - ret income should be higher glven the amount of equity, assets, and imested capitai. However, the company seems to be in an average ficuldty postion and financial leverage is simelar to others in the industry. TW. The firm's days saies pubtanding ratio is more than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection pelicy. The total assets turnover ratio is well above the industy tweage so sales should be increased, assets increased; or both. While the company/s protit margin is higher than the industry average, its other profitablity ratios are low compared to the industry - net income thould be higher given the amourt of equity, assets, and imvested capital, However, the company seems to be in an above average liquidity position and financial leverage is similiar to others in the industry. 4. The firm's deys sales outstanding ratio is comparable to the industry average, indicating that the firm should nether tichten credit nor enfiscce a mece stringert collection poli. The total assets tumover ratio is well below the industry average so saies should be increased, assets increased, or both. While the compamy's proft margin is higher then the industry average, its other profitability ratios are low compared to the industry - net income should be Nighor given the amount of equity, sssets, and invested capital, However, the company seems to be in a below twerage liquldity postion and financal leverage is similar to others in the industry. 4. 5uppose blarry had doubled its sales as well as its incentonies, accounts receivable, and common equity during 2018 . How would that information affect the valifity of your ratio anatyois? (hent Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.) 5. If 2011 i resesents a perios of normal growth for the firm, ratios based on this vear will be accurate and o comporison between them and industry averages wit harve cubstantial meaning. Pyential investars who look orey at 2018 tatios will be misled, and a rotum to supernomal condtions in 2019 could hurt the firm's wock price. II. If 201 e repretents a period of supernormal growth for the frm, ratios based on this yeer will be distorted and a comparison between them and industry averages will have subatantial meaning. Fotential imeetors who leok only st 20 te ratios will be weil indormed, and a retum to normal conditions in 2019 could hurt the firm's stokk pricer Potental investers whe look only at 20 sts ratios will be misied, and a continuation of normal conditions in 2019 could burt the firmis atocir price. Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since dollars are in thousands, number of shares are shown in thousands too. Barry Computer Company: Income Statement for Year Ended December 31, 2018 (In Thousands) a. Cakculate the indcated ratios for Barry, Hound your answers to two decimal places. Frofit margici nch not llote tit \begin{tabular}{|c|c|} \hline Barry & Industry Average \\ \hline & x \\ \hline \end{tabular} "Calculation is based on a 365 -day year. b. Constryoft the Dupont equation for both Barry and the industry, Round your answers to two Gecimal places. c. Select the correct eption based on Barry's strengths and weaknesses as revealed by your analysis. 1. The firm's days sales outstanding ratio is more than twice as long as the industry werege, indicating that the firm shouid tighten credit or enforce a more stringevt caliection palicy. The total assets tumover retie is well below the industry average so sales should be increased, assots decreased, of both. While the company's profit margin it higher than the ndustry averege, its other profitablity ratios are low compared to the incusetry - net income ahould be higher given the amoutit of equity, assets, and invested captal. Finsily, ifs market vahue ratios are atwo beiow industry avernges. Howevet, the compony seems to be in an average fiquidity position and finandal leyerage is similar to others in the incistiry, 7. The firm's days swies outsanding ratio is more than twice as leng as the industry werage indicating that the firm should loosen crect or apply a less stringent coltection policy. The total astets turnover ratio is well below the industry average wo saies thould be increated, ascets incroated, or both. While the company's proft margin is bipher than the industry reems to be in an ayerage liquidisy posilien and finuncial leverage is simiar to ottiers in the indusir. 17. The firm's days weses putatanding ratio is less than the industry aversph, indicating that the firm should tighten credit or anforce a mare stringent coliectien policy The total assets tuentiver ratio is wes thelow the inaustry average so sales should be incressed, assets decreased, or beth. While the company's profit margin is lower than the industry average, its other profitability retios are high compared to the industry - net income thould be higher given the amount of equity, atsets, and invested capital. Hawever the company seems to the in an average liquidity position and financial leverage is similar to others in the industry. IV. The lemb devs tales outstanding retio is more than the industry averape, indicating that the firm should tighten credit of enforce a more atringent colection polon The tocal assets turiover rabs is well above the industry average so sales should be increased, wisets incresied, oe both. While the company's prefit margin is higher than the industry average, its cother proftabitity ratios are low compared to the industry . net income should be higher given the amount of equaty, assets, and invested casita. Howet the company seems to the in en abowe toverope liquidity position and finandal leverage is similar to others in the induatry. v. Thi from's days sales outstanding rato is comparable to the industry average, indicating that the firm shocld neither tighten credit nor enforce a more stringent collection poler. The average, its other profitabiity ratios are low compared to the industry - net income should be higher given the amount of equity, assepts, and inverted capital Hanaiver, the coirpany seems to he in a below average liqudity position and financial leverspe is simitar to others in the industry III. The firm's days sales outstanding ratio is less than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy. The total assets turnover ratie is well below the industry average so sales should be increased, assets decreased, or both. While the company's profit margin is lower than the industry average, its other profitability ratios are high compared to the industry - net income should be Wigher given the amount of equity, assets, and imested capital, However, the company seems to I in an average liquidity position and financial leverage is similar to others in the industry. N. The firm's days sales outstanding ratio is more than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy, The total assets turnover ratio is well above the industry average so sales should be incressed, assets increased, or both. While the company's profit margin is higher than the industry average, its other profitability rotios are low compared to the industry - net income should be higher given the amount of equity, assets, and imested capital. However, the company seems to bi in arpobove average liquidity position and financial leverage is cimilar to others in the industry. V. The y'm's days cales outstanding ratio is comparable to the industry average, indicating that the firm should nether tighten credit nor enforce a more stringent coliection policy. The totai assets turnover ratio is well below the industry average so sales should be increased, assets increased, or beth, While the company's profit margin is higher than the industry avenage, its other profitability ratios are low compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. However, the company seems to be in a below average liquidity position and financial leverage is similar to others in the industry. d. Suppose Barry had doubled its sales as well as its inventones, accounts receivable, and common equity during 2018. How would that information affect the valdity of your netio analissis? (Hint: Think about averages and the effects of rapid growth on roties if averages are not used. No calculations are needed.) 1. If 2018 represents a pericd of normal growth for the firm, ratios based on this year will be accurate and a comparison between them and industry averages will have substantial meaning. fotential investors who look only at 2018 ratios will be misled, and a retum to supernormal conditions in 2019 could hurt the firm's stock price. meaning. Potential investors who look only at 2018 ratios will be well informed, and oreturn to normal conditicns in 2019 could hurt the firm's stock price. III. If 2018 represents a period of supernormal growth for the firm, ratios based on this year will be diktorted and a comparison between them and industry averages wilt heve ittle maaning. Potential investors who look only at 2018 ratios will be misled, and a return to normel congtions in 2019 could hurt the firm's stock price. TV. If 2018 represents a period of supemormat growth for the firm, ratios based on this year will be accurate and a comparison between them and industry averages will have sutsitantial meaning. Potentid investoos need only look at 2018 ratios to be well informed, and a return to normal conditions in 2019 could heip the firm's stock peice. v. If 2018 represents a period of normal growth for the firm, ratios bassed on this year will be distorted and a comparison between them and industry averages will have littie meaning. fotertial lemestars who look orily at 2018 ratios will be misied, and a continustion of normal conditicns in 2019 could hurt the firm's stock price. of thares are shown in thousanids too. Barmy Computer Company: Balance sheet as of December 31, 2018 (In Theusands) Darry Computer Company! Tricome 5tatement for Year Ended December 31, 2018 (In Thousands) Barry Computer Company: Income Statement for Year Ended December 31, 2018 (In Thousands) a Calculate the indicated ratios for Barry. Round your answers to two decimal places; Pealculatien is baced on a 355-day year. Constryat the Dufont equation for both Barry and the industry. Aound your answers to two decinul places. ACatculotion is based on a 365 -day yeac: 7. Construct the Dupant equatian for beth Barry and the industry. Hound your answers to two decimal places: c. Select the comect opbon bused on Barry's strengths and weakerses as revealed by your analysis. 1. The firmit days sales outatanding ratie is more than twice as long as the insustry oversge, indicating that the firm should tighten credit or entorce a more stringent collection pelicy. The tohal assets turnsver rate is sell below the industry average so saies should be incresesed, assets decreased, or beth. While the compan/'s profit margin is higher than the market value ratios are ass below industry avereges. However, the compsny seems to be in an averape lesidey posiben and financial leverage is 1imilar to others in the induter. 14. The frm' dayt swes cututandeg rato is more than taice as leng at the industry averape, indicating that the firm should loosen credit or apply a less stringent collection policy. The total ascets tuenever ravio is well below the industry average so sales should be increated, astets increased, or both. While the compativ's proft margin is higher than the industry werage, ts other proftebility ratios are low compared to the industry - net uncome showd be higher given the amcunt of equity, assets, and invested capital, fowever, the company. in as arenge iquioty poitien and financiel leverage is similar to others in the industry. titio awets turoover ratis is well bebw the industry average so wes should be increased, bisets increased, or both. While the company's oreft margin is higher than the ndustry Mema to be in a belaw average ligudify nosition and financial leyerage is smilar to others in the industry. [1siea: 1] IIt. The fem's days sales outstanding ratio is less than the industry average, indicating that the firm should tighten credit of enforce a more stringent coligction policy. The fotail assets turnwer ratio is well below the industry average so sales should be increased, assets decreased, or both. While the company's proft margin is lower than the industry arerage, its other profitabitity ratios are high compared to the industry - ret income should be higher glven the amount of equity, assets, and imested capitai. However, the company seems to be in an average ficuldty postion and financial leverage is simelar to others in the industry. TW. The firm's days saies pubtanding ratio is more than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection pelicy. The total assets turnover ratio is well above the industy tweage so sales should be increased, assets increased; or both. While the company/s protit margin is higher than the industry average, its other profitablity ratios are low compared to the industry - net income thould be higher given the amourt of equity, assets, and imvested capital, However, the company seems to be in an above average liquidity position and financial leverage is similiar to others in the industry. 4. The firm's deys sales outstanding ratio is comparable to the industry average, indicating that the firm should nether tichten credit nor enfiscce a mece stringert collection poli. The total assets tumover ratio is well below the industry average so saies should be increased, assets increased, or both. While the compamy's proft margin is higher then the industry average, its other profitability ratios are low compared to the industry - net income should be Nighor given the amount of equity, sssets, and invested capital, However, the company seems to be in a below twerage liquldity postion and financal leverage is similar to others in the industry. 4. 5uppose blarry had doubled its sales as well as its incentonies, accounts receivable, and common equity during 2018 . How would that information affect the valifity of your ratio anatyois? (hent Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.) 5. If 2011 i resesents a perios of normal growth for the firm, ratios based on this vear will be accurate and o comporison between them and industry averages wit harve cubstantial meaning. Pyential investars who look orey at 2018 tatios will be misled, and a rotum to supernomal condtions in 2019 could hurt the firm's wock price. II. If 201 e repretents a period of supernormal growth for the frm, ratios based on this yeer will be distorted and a comparison between them and industry averages will have subatantial meaning. Fotential imeetors who leok only st 20 te ratios will be weil indormed, and a retum to normal conditions in 2019 could hurt the firm's stokk pricer Potental investers whe look only at 20 sts ratios will be misied, and a continuation of normal conditions in 2019 could burt the firmis atocir price