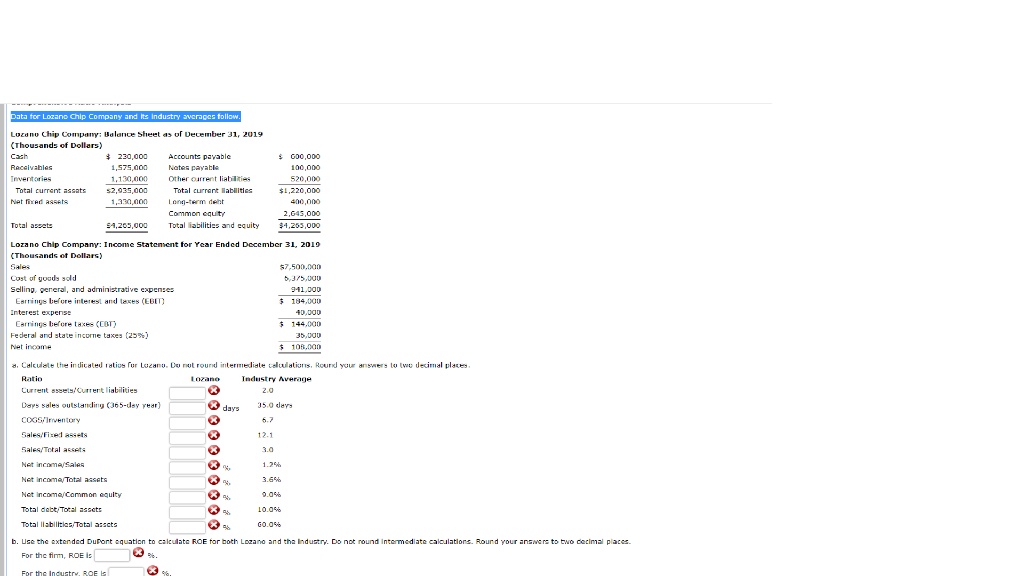

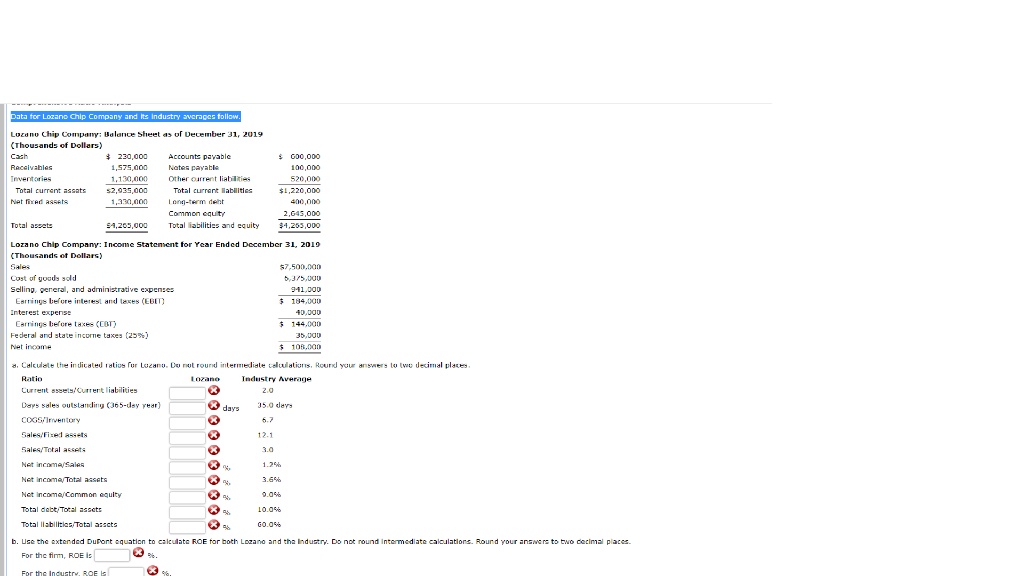

Data for Lozano Chip Company and its industry averages follow. Lozano Chip Company: Balance Sheet as of December 31, 2019 (Thousands of Dollars) $ 230,000 Accounts payable Receivables 1,575.000 Nates payable Tnventories 1,130,000 Other current liabilities Total current assats 52,035,000 Total current abilities Net fixed assets 1,100,000 long-term det Common equit Total assets 54,265,000 Total liabilities and equity $ 600,000 100,000 520,000 $1,220,000 400,000 2.643.000 $4,255,000 Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars) $7.500.000 Cost of goods sold 5375.000 Selling, pereral, and administrative expenses 941,00D Earrings before interest and loses (EBIT) $ 184,000 Interest expense 40.000 Carrings before Laxe (CBT $ 144.000 Federal and state income taxes (25%) 35,000 Net income $ 100,000 a. Calculate the indicated ratios for Lucanu. Do not round intermediate celulations, Round your answers to we decimal places Ratio Lozano Industry Average Current sets/Current liabilities 2.0 Days sales outstanding (365-usy year) days 35.0 ders COXGG/Inventory ex Sales/Fixed Assets ex 12.1 Sales/Total acts 3.0 1.2. Net incomales Net Income Total assets 3.69 Net Income/Common equity ex 94 0.04 Total debt, Total assets 10.05 Total liabilities/Total assets GO. b. Use the extended DuPont equation to calculate ROE for both Lozano and the Industry. Do not round Intermediate calculations. Round your answers to two decimal places. For the firm, ROE IS 26. For the industry. ROES 90 Data for Lozano Chip Company and its industry averages follow. Lozano Chip Company: Balance Sheet as of December 31, 2019 (Thousands of Dollars) $ 230,000 Accounts payable Receivables 1,575.000 Nates payable Tnventories 1,130,000 Other current liabilities Total current assats 52,035,000 Total current abilities Net fixed assets 1,100,000 long-term det Common equit Total assets 54,265,000 Total liabilities and equity $ 600,000 100,000 520,000 $1,220,000 400,000 2.643.000 $4,255,000 Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars) $7.500.000 Cost of goods sold 5375.000 Selling, pereral, and administrative expenses 941,00D Earrings before interest and loses (EBIT) $ 184,000 Interest expense 40.000 Carrings before Laxe (CBT $ 144.000 Federal and state income taxes (25%) 35,000 Net income $ 100,000 a. Calculate the indicated ratios for Lucanu. Do not round intermediate celulations, Round your answers to we decimal places Ratio Lozano Industry Average Current sets/Current liabilities 2.0 Days sales outstanding (365-usy year) days 35.0 ders COXGG/Inventory ex Sales/Fixed Assets ex 12.1 Sales/Total acts 3.0 1.2. Net incomales Net Income Total assets 3.69 Net Income/Common equity ex 94 0.04 Total debt, Total assets 10.05 Total liabilities/Total assets GO. b. Use the extended DuPont equation to calculate ROE for both Lozano and the Industry. Do not round Intermediate calculations. Round your answers to two decimal places. For the firm, ROE IS 26. For the industry. ROES 90