Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Data from problem: BETA -all equity firm with $4,680,000 value and 130,000 shares outstanding; GAMMA -levered firm with same value as beta, but $1,404,000 in

Data from problem: BETA-all equity firm with $4,680,000 value and 130,000 shares outstanding; GAMMA-levered firm with same value as beta, but $1,404,000 in debt at 7%, and 91,000 shares outstanding; DELTA-levered firm with same value as beta&gamma, but with $2,808,000 in debt at 14% and 52,000 shares outstanding; corporate tax rate of 20%

Data from problem: BETA-all equity firm with $4,680,000 value and 130,000 shares outstanding; GAMMA-levered firm with same value as beta, but $1,404,000 in debt at 7%, and 91,000 shares outstanding; DELTA-levered firm with same value as beta&gamma, but with $2,808,000 in debt at 14% and 52,000 shares outstanding; corporate tax rate of 20%

what is the break-even EBIT for: Beta&Gamma, Beta&Delta, and Gamma&Delta companies?

please show all working steps with formulas or excel

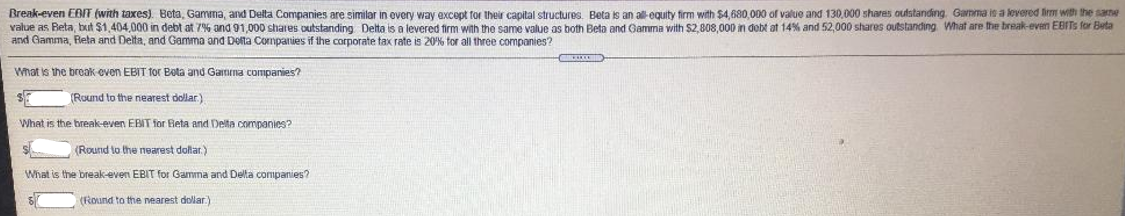

Break-even EBIT (with taxes). Beta, Gamma, and Deita Companies are similar in every way except for their capital structures. Beta is an all-equity firm with $4,680,000 of value and 130.000 shares outstanding, Gamma is a vered win the same value as Beta, but $1.404,000 in debt at 79 and 91,000 shares outstanding Delta is a levered firm with the same value as both Beta and Gamma with $2,808,000 in dobt at 14% and 52,000 shares outstanding What are the break-even EBFTS for Beta and Gamma, Rela and Delta, and Gamma and Delta Companies if the corporate tax rate is 20% for all three companies? What is the break oven EBIT for Bota and Gamma companies? (Round to the nearest dollar) What is the break-even EBIT for Beta and Delta companies? (Round to the nearest dollar) What is the break-even EBIT for Garna and Della companies (Round to the nearest dollar) Break-even EBIT (with taxes). Beta, Gamma, and Deita Companies are similar in every way except for their capital structures. Beta is an all-equity firm with $4,680,000 of value and 130.000 shares outstanding, Gamma is a vered win the same value as Beta, but $1.404,000 in debt at 79 and 91,000 shares outstanding Delta is a levered firm with the same value as both Beta and Gamma with $2,808,000 in dobt at 14% and 52,000 shares outstanding What are the break-even EBFTS for Beta and Gamma, Rela and Delta, and Gamma and Delta Companies if the corporate tax rate is 20% for all three companies? What is the break oven EBIT for Bota and Gamma companies? (Round to the nearest dollar) What is the break-even EBIT for Beta and Delta companies? (Round to the nearest dollar) What is the break-even EBIT for Garna and Della companies (Round to the nearest dollar)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started