Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Data from the unadjusted trial balance of Joe's Plumbing Services as at the financial year-ended 30 June 2022 is as follows: Cash Accounts receivable

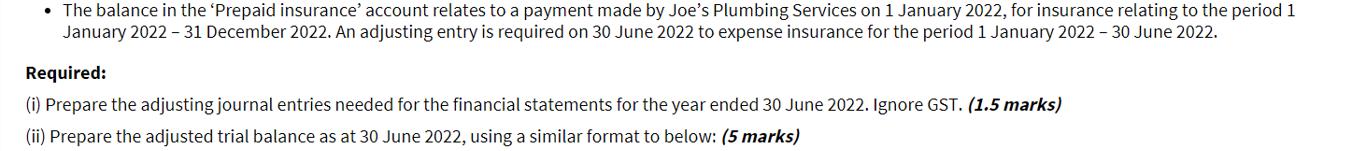

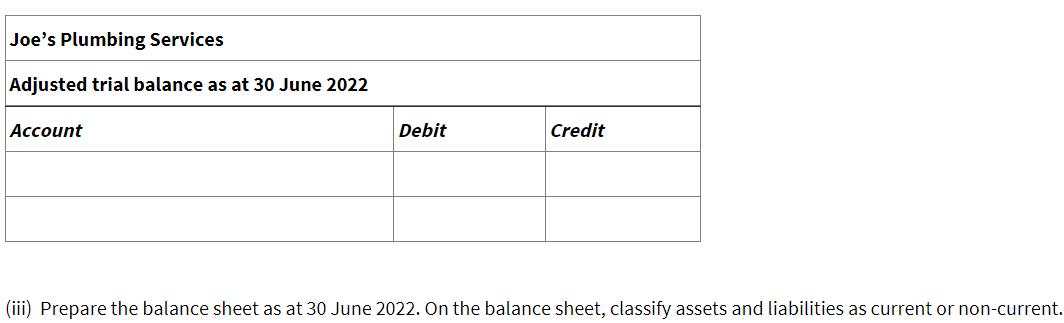

Data from the unadjusted trial balance of Joe's Plumbing Services as at the financial year-ended 30 June 2022 is as follows: Cash Accounts receivable Equipment Accumulated depreciation Prepaid insurance Accounts payable Pete Jones, capital (1 July 2021) Service revenue Insurance expense Salary expense Repairs expense Depreciation expense $ 31,850 0 45,500 17,500 3,800 6,200 28,700 123,000 950 92,200 1,100 0 Adjustment data for 30 June 2022 is as follows: Accrued service revenue of $4,000 needs to be recognised, in relation to services provided to a customer in June 2022. Depreciation expense to be recognised for the year ended 30 June 2022 is $1,800. The balance in the 'Prepaid insurance' account relates to a payment made by Joe's Plumbing Services on 1 January 2022, for insurance relating to the period 1 January 2022 - 31 December 2022. An adjusting entry is required on 30 June 2022 to expense insurance for the period 1 January 2022 - 30 June 2022. Required: (i) Prepare the adjusting journal entries needed for the financial statements for the year ended 30 June 2022. Ignore GST. (1.5 marks) (ii) Prepare the adjusted trial balance as at 30 June 2022, using a similar format to below: (5 marks) Joe's Plumbing Services Adjusted trial balance as at 30 June 2022 Account Debit Credit (iii) Prepare the balance sheet as at 30 June 2022. On the balance sheet, classify assets and liabilities as current or non-current.

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started