Answered step by step

Verified Expert Solution

Question

1 Approved Answer

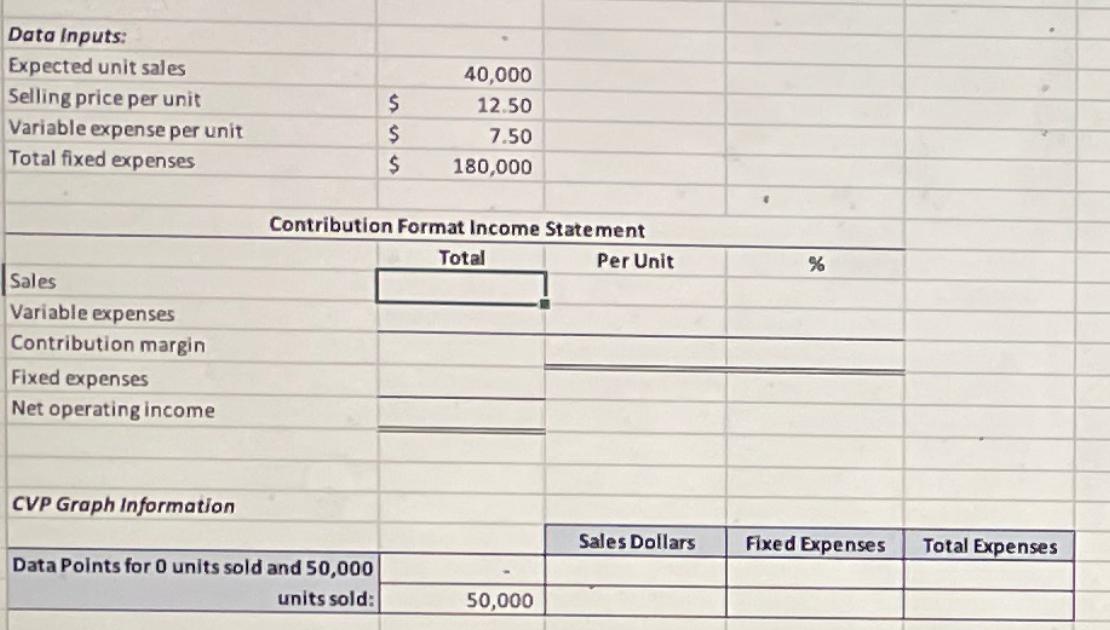

Data Inputs: Expected unit sales 40,000 Selling price per unit $ 12.50 Variable expense per unit $ 7.50 Total fixed expenses $ 180,000 Sales

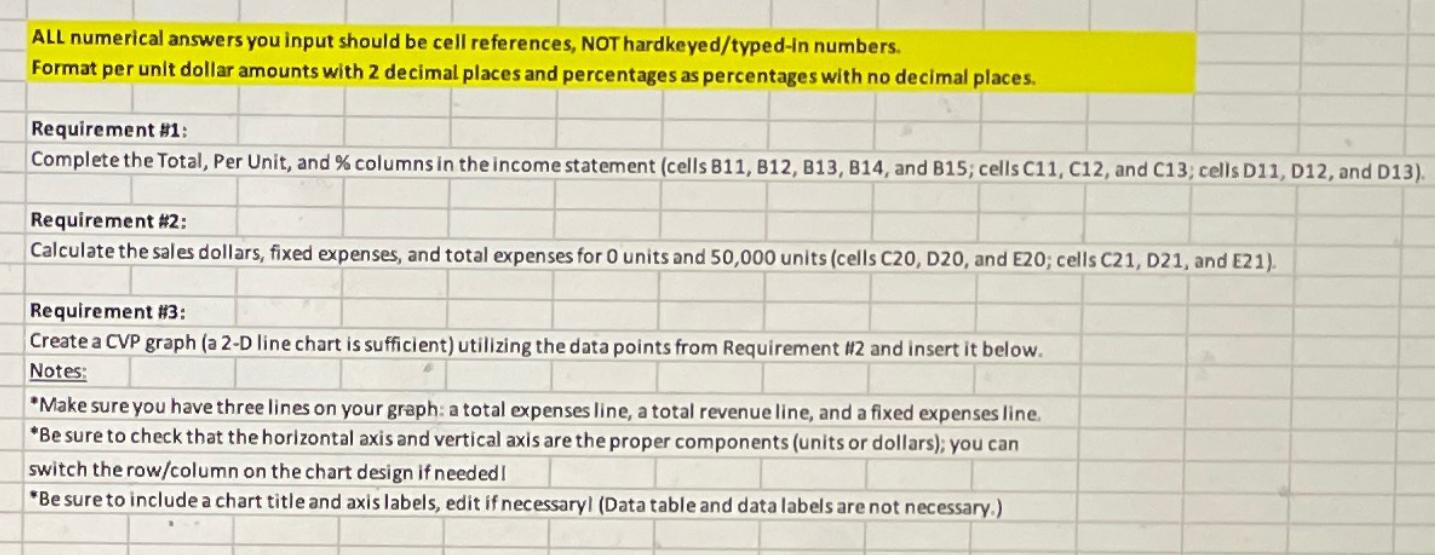

Data Inputs: Expected unit sales 40,000 Selling price per unit $ 12.50 Variable expense per unit $ 7.50 Total fixed expenses $ 180,000 Sales Variable expenses Contribution margin Fixed expenses Net operating income Contribution Format Income Statement CVP Graph Information Data Points for 0 units sold and 50,000 Total Per Unit % Sales Dollars Fixed Expenses Total Expenses units sold: 50,000 ALL numerical answers you input should be cell references, NOT hardkeyed/typed-in numbers. Format per unit dollar amounts with 2 decimal places and percentages as percentages with no decimal places. Requirement #1: Complete the Total, Per Unit, and % columns in the income statement (cells B11, B12, B13, B14, and B15; cells C11, C12, and C13; cells D11, D12, and D13). Requirement #2: Calculate the sales dollars, fixed expenses, and total expenses for O units and 50,000 units (cells C20, D20, and E20; cells C21, D21, and E21). Requirement #3: Create a CVP graph (a 2-D line chart is sufficient) utilizing the data points from Requirement #2 and insert it below. Notes: *Make sure you have three lines on your graph: a total expenses line, a total revenue line, and a fixed expenses line. *Be sure to check that the horizontal axis and vertical axis are the proper components (units or dollars); you can switch the row/column on the chart design if needed! *Be sure to include a chart title and axis labels, edit if necessaryl (Data table and data labels are not necessary.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started