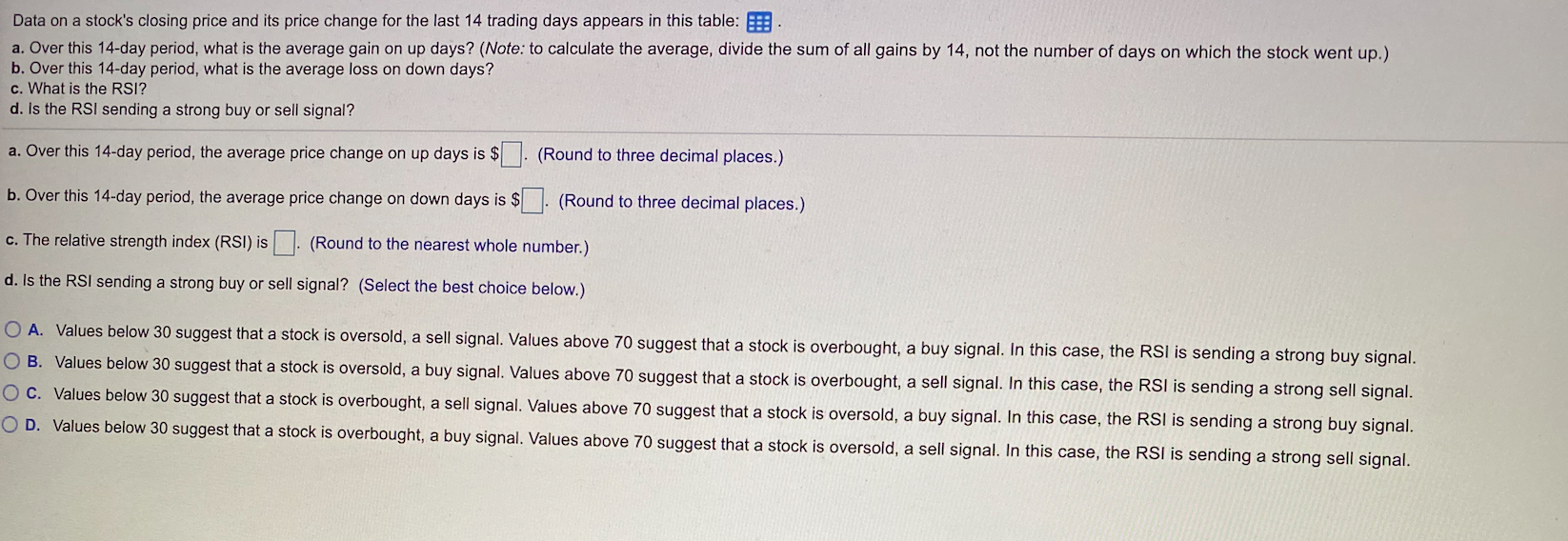

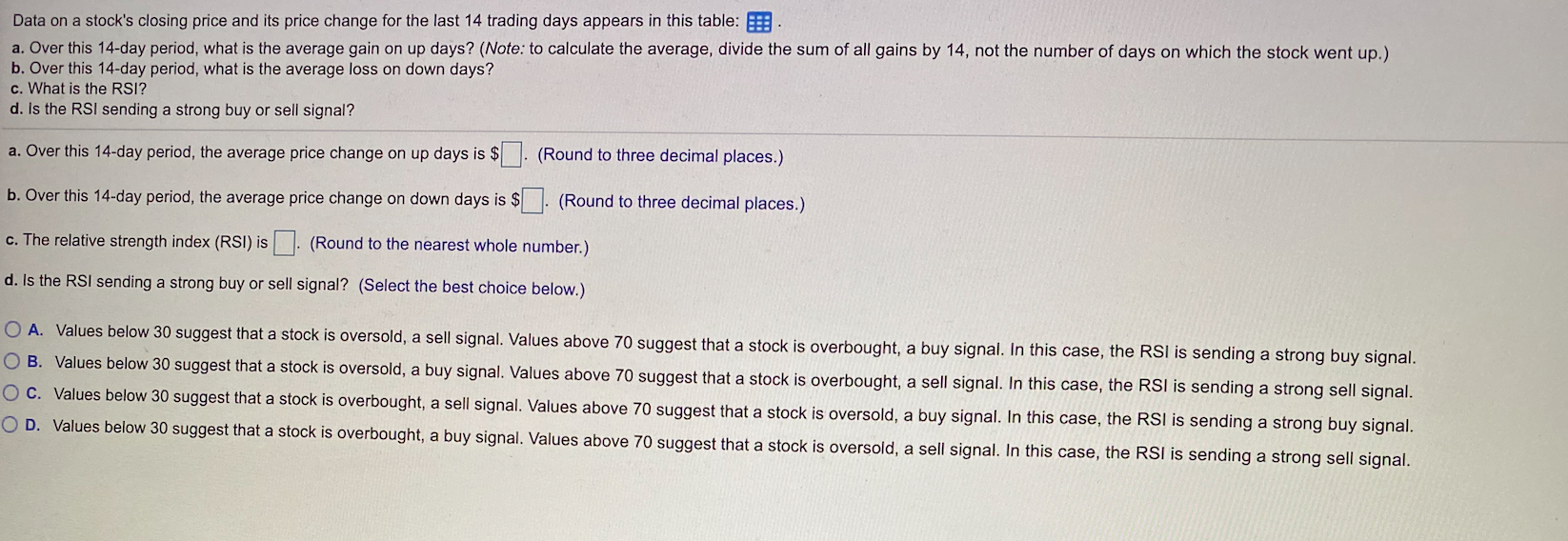

Data on a stock's closing price and its price change for the last 14 trading days appears in this table: a. Over this 14-day period, what is the average gain on up days? (Note: to calculate the average, divide the sum of all gains by 14, not the number of days on which the stock went up.) b. Over this 14-day period, what is the average loss on down days? c. What is the RSI? d. Is the RSI sending a strong buy or sell signal? a. Over this 14-day period, the average price change on up days is $ (Round to three decimal places.) b. Over this 14-day period, the average price change on down days is $. (Round to three decimal places.) c. The relative strength index (RSI) is I. (Round to the nearest whole number.) d. Is the RSI sending a strong buy or sell signal? (Select the best choice below.) O A. Values below 30 suggest that a stock is oversold, a sell signal. Values above 70 suggest that a stock is overbought, a buy signal. In this case, the RSI is sending a strong buy signal. O B. Values below 30 suggest that a stock is oversold, a buy signal. Values above 70 suggest that a stock is overbought, a sell signal. In this case, the RSI is sending a strong sell signal. O C. Values below 30 suggest that a stock is overbought, a sell signal. Values above 70 suggest that a stock is oversold, a buy signal. In this case, the RSI is sending a strong buy signal. OD. Values below 30 suggest that a stock is overbought, a buy signal. Values bove 70 suggest that a stock is oversold, a sell signal. In this case, the RSI is sending a strong sell signal. Data on a stock's closing price and its price change for the last 14 trading days appears in this table: a. Over this 14-day period, what is the average gain on up days? (Note: to calculate the average, divide the sum of all gains by 14, not the number of days on which the stock went up.) b. Over this 14-day period, what is the average loss on down days? c. What is the RSI? d. Is the RSI sending a strong buy or sell signal? a. Over this 14-day period, the average price change on up days is $ (Round to three decimal places.) b. Over this 14-day period, the average price change on down days is $. (Round to three decimal places.) c. The relative strength index (RSI) is I. (Round to the nearest whole number.) d. Is the RSI sending a strong buy or sell signal? (Select the best choice below.) O A. Values below 30 suggest that a stock is oversold, a sell signal. Values above 70 suggest that a stock is overbought, a buy signal. In this case, the RSI is sending a strong buy signal. O B. Values below 30 suggest that a stock is oversold, a buy signal. Values above 70 suggest that a stock is overbought, a sell signal. In this case, the RSI is sending a strong sell signal. O C. Values below 30 suggest that a stock is overbought, a sell signal. Values above 70 suggest that a stock is oversold, a buy signal. In this case, the RSI is sending a strong buy signal. OD. Values below 30 suggest that a stock is overbought, a buy signal. Values bove 70 suggest that a stock is oversold, a sell signal. In this case, the RSI is sending a strong sell signal