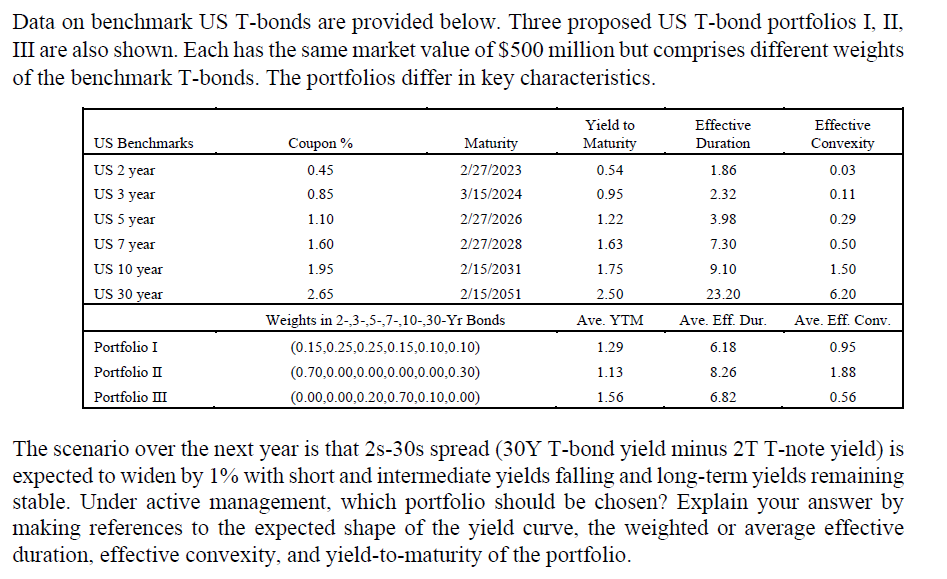

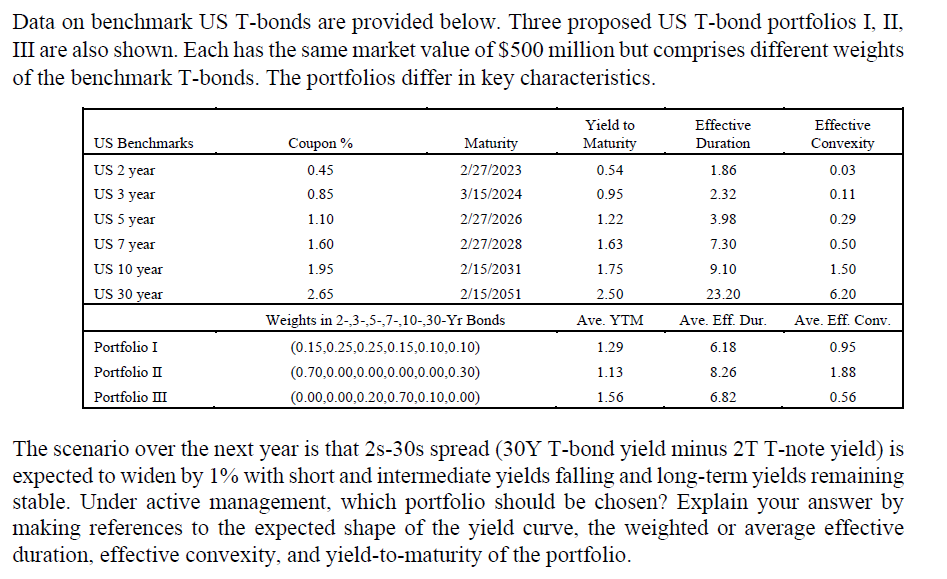

Data on benchmark US T-bonds are provided below. Three proposed US T-bond portfolios I, II, III are also shown. Each has the same market value of $500 million but comprises different weights of the benchmark T-bonds. The portfolios differ in key characteristics. Effective Duration Yield to Maturity 0.54 0.95 US Benchmarks US 2 year US 3 year US 5 year US 7 year US 10 year US 30 year 1.86 2.32 3.98 Effective Convexity 0.03 0.11 0.29 1.22 1.63 7.30 0.50 Coupon % Maturity 0.45 2/27/2023 0.85 3/15/2024 1.10 2/27/2026 1.60 2/27/2028 1.95 2/15/2031 2.65 2/15/2051 Weights in 2-3-,5-,7-10-30-Yr Bonds (0.15,0.25,0.25,0.15,0.10.0.10) (0.70,0.00,0.00,0.00,0.00.0.30) (0.00,0.00,0.20,0.70,0.10,0.00) 1.75 9.10 1.50 2.50 Ave. YTM 23.20 Ave. Eff. Dur. 6.18 1.29 Portfolio I Portfolio I Portfolio III 6.20 Ave. Eff. Conv. 0.95 1.88 0.56 8.26 1.13 1.56 6.82 The scenario over the next year is that 25-30s spread (30Y T-bond yield minus 2T T-note yield) is expected to widen by 1% with short and intermediate yields falling and long-term yields remaining stable. Under active management, which portfolio should be chosen? Explain your answer by making references to the expected shape of the yield curve, the weighted or average effective duration, effective convexity, and yield-to-maturity of the portfolio. Data on benchmark US T-bonds are provided below. Three proposed US T-bond portfolios I, II, III are also shown. Each has the same market value of $500 million but comprises different weights of the benchmark T-bonds. The portfolios differ in key characteristics. Effective Duration Yield to Maturity 0.54 0.95 US Benchmarks US 2 year US 3 year US 5 year US 7 year US 10 year US 30 year 1.86 2.32 3.98 Effective Convexity 0.03 0.11 0.29 1.22 1.63 7.30 0.50 Coupon % Maturity 0.45 2/27/2023 0.85 3/15/2024 1.10 2/27/2026 1.60 2/27/2028 1.95 2/15/2031 2.65 2/15/2051 Weights in 2-3-,5-,7-10-30-Yr Bonds (0.15,0.25,0.25,0.15,0.10.0.10) (0.70,0.00,0.00,0.00,0.00.0.30) (0.00,0.00,0.20,0.70,0.10,0.00) 1.75 9.10 1.50 2.50 Ave. YTM 23.20 Ave. Eff. Dur. 6.18 1.29 Portfolio I Portfolio I Portfolio III 6.20 Ave. Eff. Conv. 0.95 1.88 0.56 8.26 1.13 1.56 6.82 The scenario over the next year is that 25-30s spread (30Y T-bond yield minus 2T T-note yield) is expected to widen by 1% with short and intermediate yields falling and long-term yields remaining stable. Under active management, which portfolio should be chosen? Explain your answer by making references to the expected shape of the yield curve, the weighted or average effective duration, effective convexity, and yield-to-maturity of the portfolio