Data on benchmark US T-bonds are provided below. Three proposed US T-bond portfolios I, II, III are also shown. Each has the same market

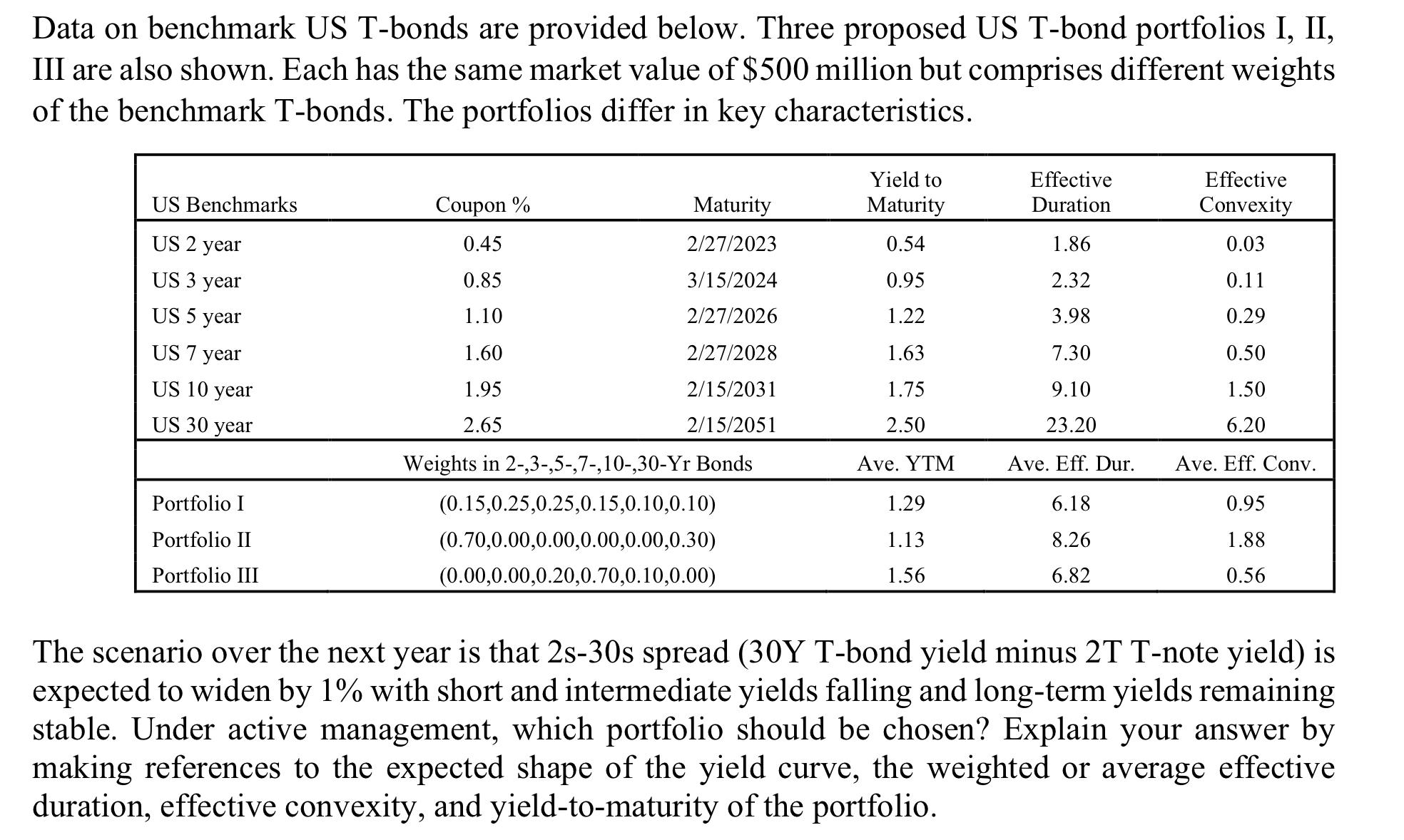

Data on benchmark US T-bonds are provided below. Three proposed US T-bond portfolios I, II, III are also shown. Each has the same market value of $500 million but comprises different weights of the benchmark T-bonds. The portfolios differ in key characteristics. US Benchmarks US 2 year US 3 year US 5 year US 7 year US 10 year US 30 year Portfolio I Portfolio II Portfolio III Coupon % 0.45 Maturity 2/27/2023 0.85 3/15/2024 1.10 2/27/2026 1.60 2/27/2028 1.95 2/15/2031 2.65 2/15/2051 Weights in 2-,3-,5-,7-,10-,30-Yr Bonds (0.15,0.25,0.25,0.15,0.10,0.10) (0.70,0.00,0.00,0.00,0.00,0.30) (0.00,0.00,0.20,0.70,0.10,0.00) Yield to Maturity 0.54 0.95 1.22 1.63 1.75 2.50 Ave. YTM 1.29 1.13 1.56 Effective Duration 1.86 2.32 3.98 7.30 9.10 23.20 Ave. Eff. Dur. 6.18 8.26 6.82 Effective Convexity 0.03 0.11 0.29 0.50 1.50 6.20 Ave. Eff. Conv. 0.95 1.88 0.56 The scenario over the next year is that 2s-30s spread (30Y T-bond yield minus 2T T-note yield) is expected to widen by 1% with short and intermediate yields falling and long-term yields remaining stable. Under active management, which portfolio should be chosen? Explain your answer by making references to the expected shape of the yield curve, the weighted or average effective duration, effective convexity, and yield-to-maturity of the portfolio.

Step by Step Solution

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To determine which portfolio should be chosen under the given scenario we need to consider the expected shape of the yield curve and the characteristi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started