Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Data provided in Case) If the Argentine peso was devalued by 15%, how would it affect your contribution in the home currency, or U.S. dollars?

(Data provided in Case)

If the Argentine peso was devalued by 15%, how would it affect your contribution in the home currency, or U.S. dollars? How much more sales revenue would be needed in Argentina to maintain your current contribution?

How can companies predict or forecast the likelihood of country stability or instability?

What country in a different part of the world (not in the Americas) do you feel is susceptible to instability and currency devaluation? Why do you draw this conclusion?

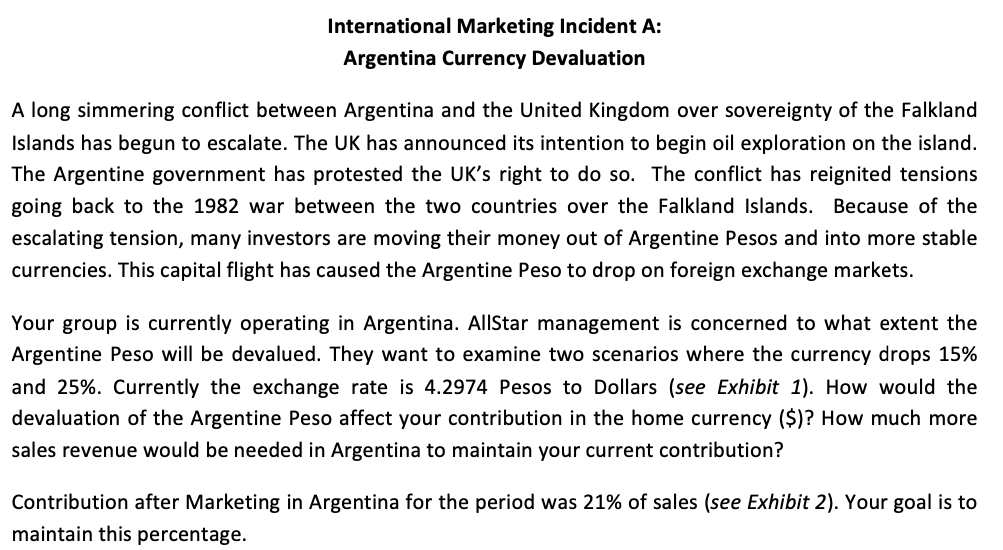

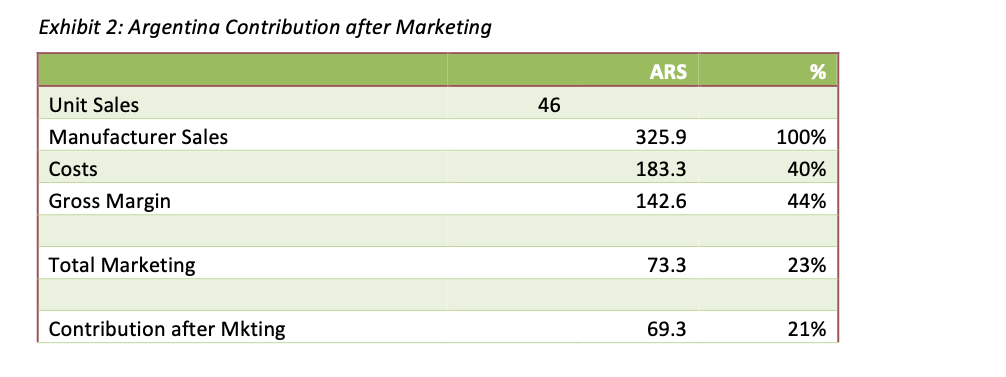

International Marketing Incident A: Argentina Currency Devaluation A long simmering conflict between Argentina and the United Kingdom over sovereignty of the Falkland Islands has begun to escalate. The UK has announced its intention to begin oil exploration on the island. The Argentine government has protested the UK's right to do so. The conflict has reignited tensions going back to the 1982 war between the two countries over the Falkland Islands. Because of the escalating tension, many investors are moving their money out of Argentine Pesos and into more stable currencies. This capital flight has caused the Argentine Peso to drop on foreign exchange markets. Your group is currently operating in Argentina. AllStar management is concerned to what extent the Argentine Peso will be devalued. They want to examine two scenarios where the currency drops 15% and 25%. Currently the exchange rate is 4.2974 Pesos to Dollars (see Exhibit 1). How would the devaluation of the Argentine Peso affect your contribution in the home currency ($)? How much more sales revenue would be needed in Argentina to maintain your current contribution? Contribution after Marketing in Argentina for the period was 21% of sales (see Exhibit 2). Your goal is to maintain this percentage. Exhibit 1: Exchange Rates Chi. Peso Home Dollar ($) Arg. Peso (ARS) Bra. Real (BRL) Mex. Peso (MXN) Peru Sol (PEN) Ven. Bolivar (VEB) | (CLP) 4.2974 1.9376 0.4509 518.13 1 20.57 267.41 Home Argentina Brazil Chile Mexico Peru Venezuela 12.2699 2.8552 6.3325 0.0237 0.2327 0.5161 0.0019 0.0815 0.3403 0.1761 2.2179 0.0083 0.3502 1.4624 0.7568 0.6838 1.5166 0.0057 0.2395 5.6786 1.3214 2.9307 0.011 0.4628 1.9324 0.0037 0.1579 0.6594 0.3412 42.23 176.32 91.24 4.1755 2.1607 0.5175 Exhibit 2: Argentina Contribution after Marketing ARS % 46 Unit Sales Manufacturer Sales Costs Gross Margin 325.9 183.3 142.6 100% 40% 44% Total Marketing 73.3 23% Contribution after Mkting 69.3 21%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started