Question

Data Relating to Brother Smith Corporation for 2018 follows: 1. Financial Income before tax was $120,000. 2. Prepaid Insurance on 12/31/2018 is $60,000. This insurance

Data Relating to Brother Smith Corporation for 2018 follows:

1. Financial Income before tax was $120,000.

2. Prepaid Insurance on 12/31/2018 is $60,000. This insurance coverage will be used up equally in 2019, 2020, and 2021.

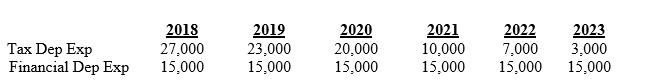

3. Depreciation schedules for financial and tax purposes follow on the company's only fixed asset, which was acquired on 1/1/2018:

4. Unearned Revenue on 1/1/2018 was $20,000, which is to be earned equally in 2018, 2019, 2020 and 2021.

5. Brother Smith paid a pollution fine of $35,000 in 2018.

6. Assume that the enacted tax rates are as follows: 40% in 2018, 30% in 2019, 35% in 2020 and beyond.

Required:

1. What is Taxes Payable for 2018?

2. Prepare a Tax Table for 2018.

B/S Evidence Future Taxable (Deductible) Amt Enacted Tax DTLC DTLNC DTAC DTANC Rate

3. What is Tax Expense for 2018? Tax Exp = Taxes Payable † ADTLC + ADTLNC+ ADTAC # ADTANC

4. Prepare Journal Entries for 2018.

Tax Dep Exp Financial Dep Exp 2018 27,000 15,000 2019 23,000 15,000 2020 20,000 15,000 2021 10,000 15,000 2022 7,000 15,000 2023 3,000 15,000

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Particulars 2018 Financial income before tax 120000 Less Tax depreciation 27000 Insurance expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started