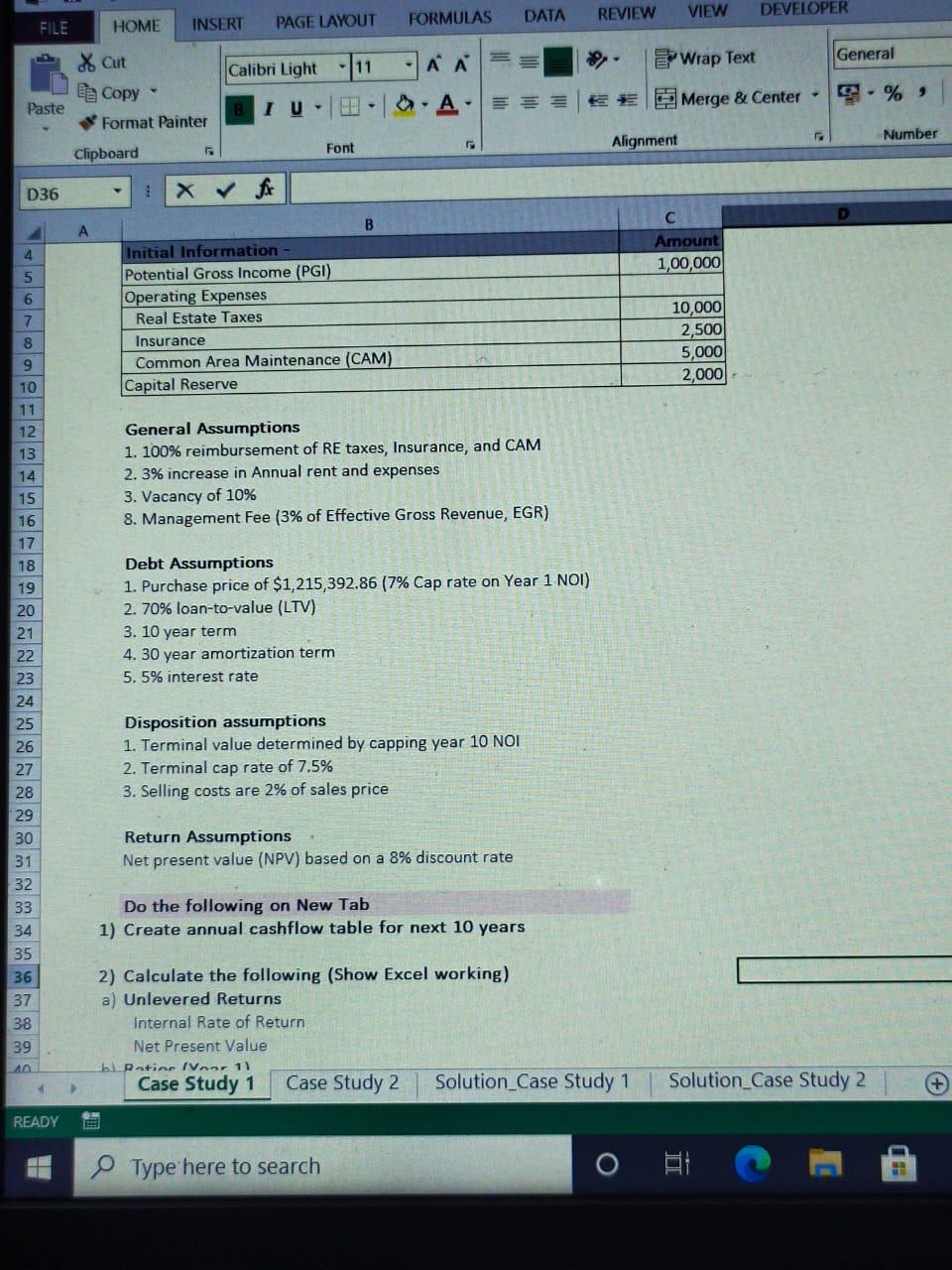

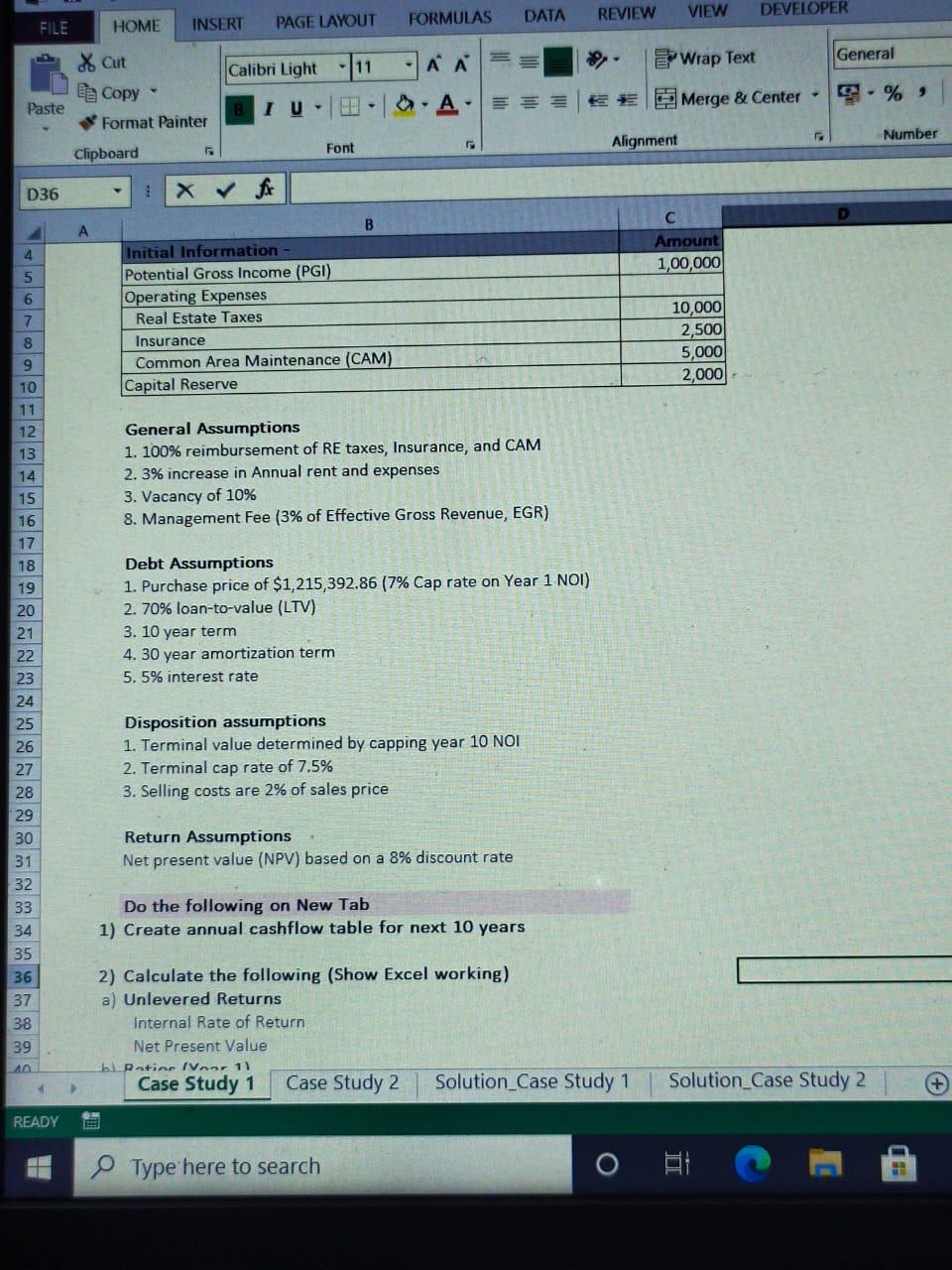

DATA REVIEW VIEW FILE FORMULAS DEVELOPER HOME INSERT PAGE LAYOUT General 11 Calibri Light Wrap Text - A A Cut E Copy Format Painter 9. %, Paste IU-HI- * Merge & Center A: A = = = Number Clipboard Font Alignment D36 . 4 5 Amount 1,00,000 6 B Initial Information Potential Gross Income (PGI) Operating Expenses Real Estate Taxes Insurance Common Area Maintenance (CAM) Capital Reserve 7 8 10,000 2,500 5,000 2,000 9 10 11 12 13 14 15 16 General Assumptions 1. 100% reimbursement of RE taxes, Insurance, and CAM 2.3% increase in Annual rent and expenses 3. Vacancy of 10% 8. Management Fee (3% of Effective Gross Revenue, EGR) 17 18 Debt Assumptions 1. Purchase price of $1,215,392.86 (7% Cap rate on Year 1 NOI) 2. 70% loan-to-value (LTV) 3. 10 year term 4. 30 year amortization term 5. 5% interest rate Disposition assumptions 1. Terminal value determined by capping year 10 NOI 2. Terminal cap rate of 7.5% 3. Selling costs are 2% of sales price 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Return Assumptions Net present value (NPV) based on a 8% discount rate Do the following on New Tab 1) Create annual cashflow table for next 10 years 2) Calculate the following (Show Excel working) a) Unlevered Returns Internal Rate of Return Net Present Value blatine Ivar 11 Case Study 1 Case Study 2 Solution_Case Study 1 Solution_Case Study 2 + READY Type here to search O AI DATA REVIEW VIEW FILE FORMULAS DEVELOPER HOME INSERT PAGE LAYOUT General 11 Calibri Light Wrap Text - A A Cut E Copy Format Painter 9. %, Paste IU-HI- * Merge & Center A: A = = = Number Clipboard Font Alignment D36 . 4 5 Amount 1,00,000 6 B Initial Information Potential Gross Income (PGI) Operating Expenses Real Estate Taxes Insurance Common Area Maintenance (CAM) Capital Reserve 7 8 10,000 2,500 5,000 2,000 9 10 11 12 13 14 15 16 General Assumptions 1. 100% reimbursement of RE taxes, Insurance, and CAM 2.3% increase in Annual rent and expenses 3. Vacancy of 10% 8. Management Fee (3% of Effective Gross Revenue, EGR) 17 18 Debt Assumptions 1. Purchase price of $1,215,392.86 (7% Cap rate on Year 1 NOI) 2. 70% loan-to-value (LTV) 3. 10 year term 4. 30 year amortization term 5. 5% interest rate Disposition assumptions 1. Terminal value determined by capping year 10 NOI 2. Terminal cap rate of 7.5% 3. Selling costs are 2% of sales price 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Return Assumptions Net present value (NPV) based on a 8% discount rate Do the following on New Tab 1) Create annual cashflow table for next 10 years 2) Calculate the following (Show Excel working) a) Unlevered Returns Internal Rate of Return Net Present Value blatine Ivar 11 Case Study 1 Case Study 2 Solution_Case Study 1 Solution_Case Study 2 + READY Type here to search O AI