Answered step by step

Verified Expert Solution

Question

1 Approved Answer

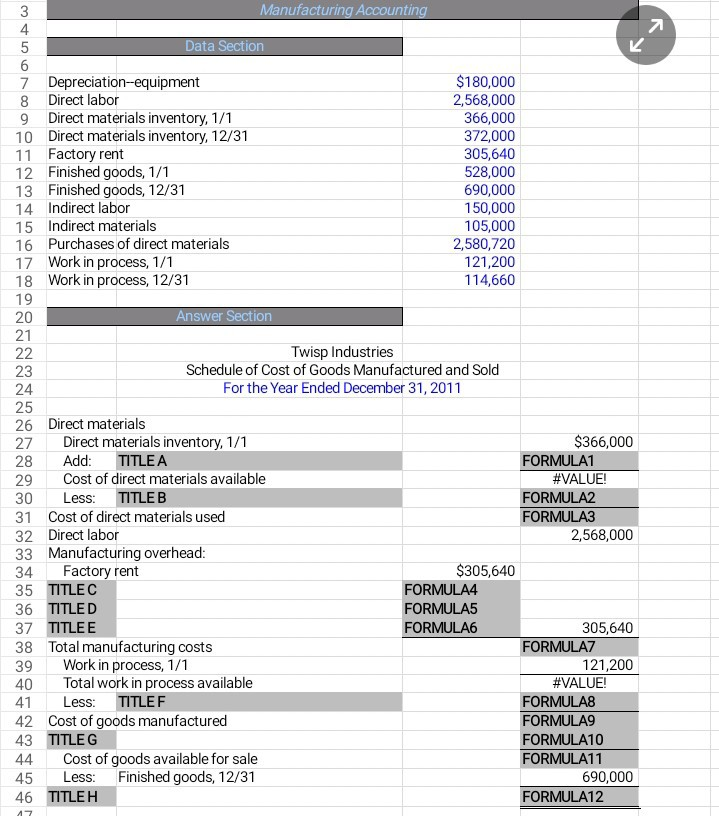

data section 2 3 Manufacturing Accounting 4 5 Data Section K 6 7 Depreciation--equipment $180,000 8 Direct labor 2,568,000 9 Direct materials inventory, 1/1 366,000

data section

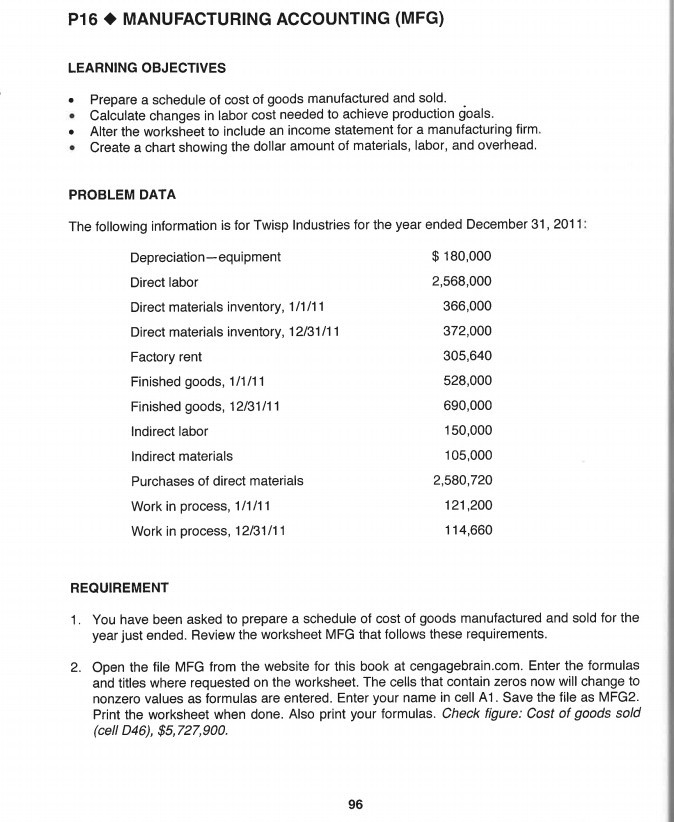

2 3 Manufacturing Accounting 4 5 Data Section K 6 7 Depreciation--equipment $180,000 8 Direct labor 2,568,000 9 Direct materials inventory, 1/1 366,000 10 Direct materials inventory, 12/31 372,000 11 Factory rent 305,640 12 Finished goods, 1/1 528,000 13 Finished goods, 12/31 690,000 14 Indirect labor 150,000 15 Indirect materials 105,000 16 Purchases of direct materials 2,580,720 17 Work in process, 1/1 121,200 18 Work in process, 12/31 114,660 19 20 Answer Section 21 22 Twisp Industries 23 Schedule of Cost of Goods Manufactured and Sold 24 For the Year Ended December 31, 2011 25 26 Direct materials 27 Direct materials inventory, 1/1 $366,000 28 Add: TITLE A FORMULA1 29 Cost of direct materials available #VALUE! 30 Less: TITLEB FORMULA2 31 Cost of direct materials used FORMULA3 32 Direct labor 2,568,000 33 Manufacturing overhead: 34 Factory rent $305,640 35 TITLEC FORMULA4 36 TITLED FORMULA5 37 TITLEE FORMULA6 305,640 38 Total manufacturing costs FORMULAZ 39 Work in process, 1/1 121,200 40 Total work in process available #VALUE! 41 Less: TITLEF FORMULAS 42 Cost of goods manufactured FORMULAS 43 TITLEG FORMULA10 44 Cost of goods available for sale FORMULA11 45 Less: Finished goods, 12/31 690,000 46 TITLEH FORMULA12 47 P16 MANUFACTURING ACCOUNTING (MFG) LEARNING OBJECTIVES Prepare a schedule of cost of goods manufactured and sold. Calculate changes in labor cost needed to achieve production goals. Alter the worksheet to include an income statement for a manufacturing firm. Create a chart showing the dollar amount of materials, labor, and overhead. PROBLEM DATA The following information is for Twisp Industries for the year ended December 31, 2011: Depreciation--equipment $ 180,000 Direct labor 2,568,000 Direct materials inventory, 1/1/11 366,000 Direct materials inventory, 12/31/11 372,000 Factory rent 305,640 Finished goods, 1/1/11 528,000 Finished goods, 12/31/11 690,000 Indirect labor 150,000 Indirect materials 105,000 Purchases of direct materials 2,580,720 Work in process, 1/1/11 121,200 Work in process, 12/31/11 114,660 REQUIREMENT 1. You have been asked to prepare a schedule of cost of goods manufactured and sold for the year just ended. Review the worksheet MFG that follows these requirements. 2. Open the file MFG from the website for this book at cengagebrain.com. Enter the formulas and titles where requested on the worksheet. The cells that contain zeros now will change to nonzero values as formulas are entered. Enter your name in cell A1. Save the file as MFG2. Print the worksheet when done. Also print your formulas. Check figure: Cost of goods sold (cell D46), $5,727,900. 96Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started