Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Data since 1977 of the monthly return to investors that have invested their money in fund X, labeled variable RX. Size of the fund,

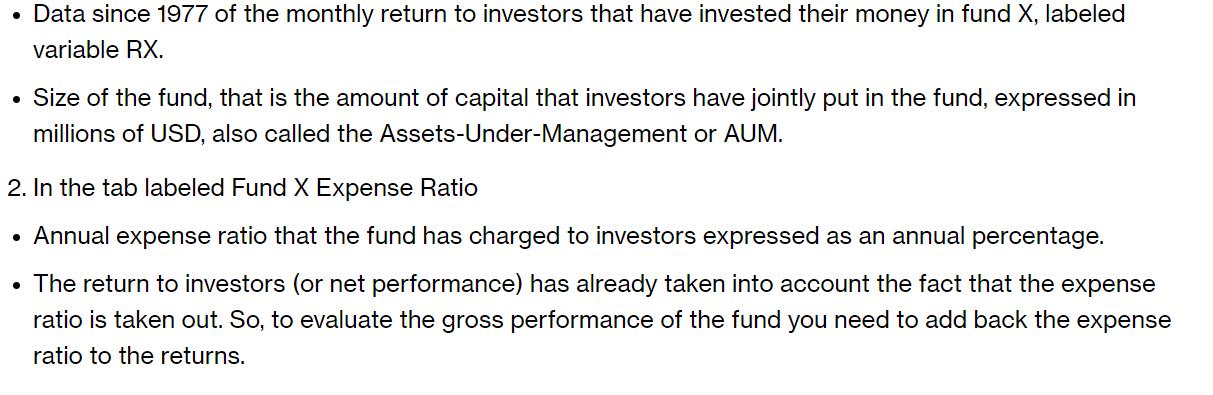

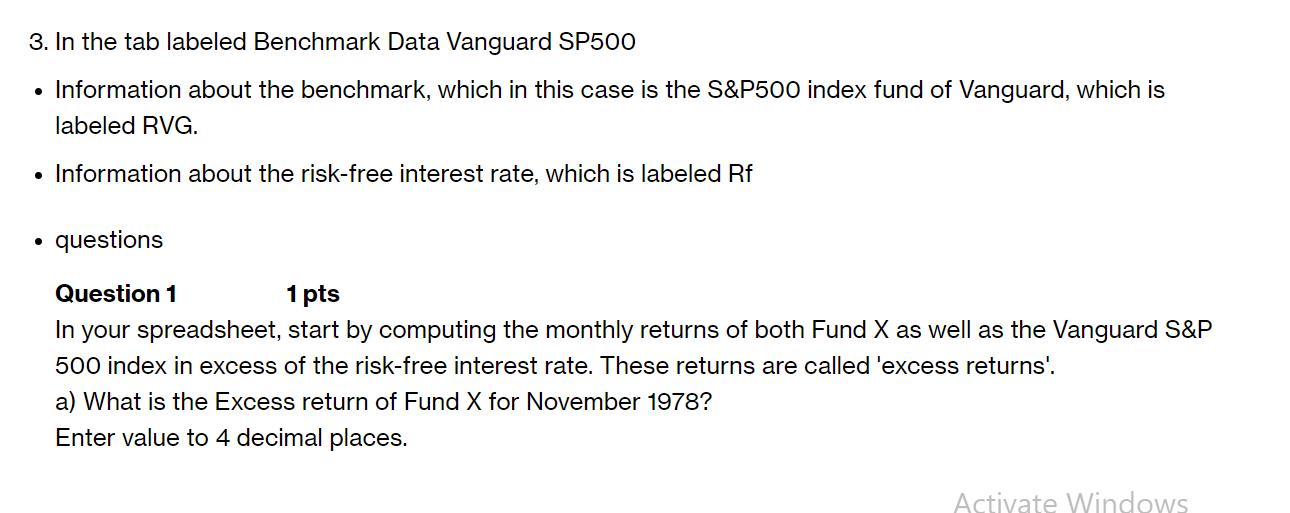

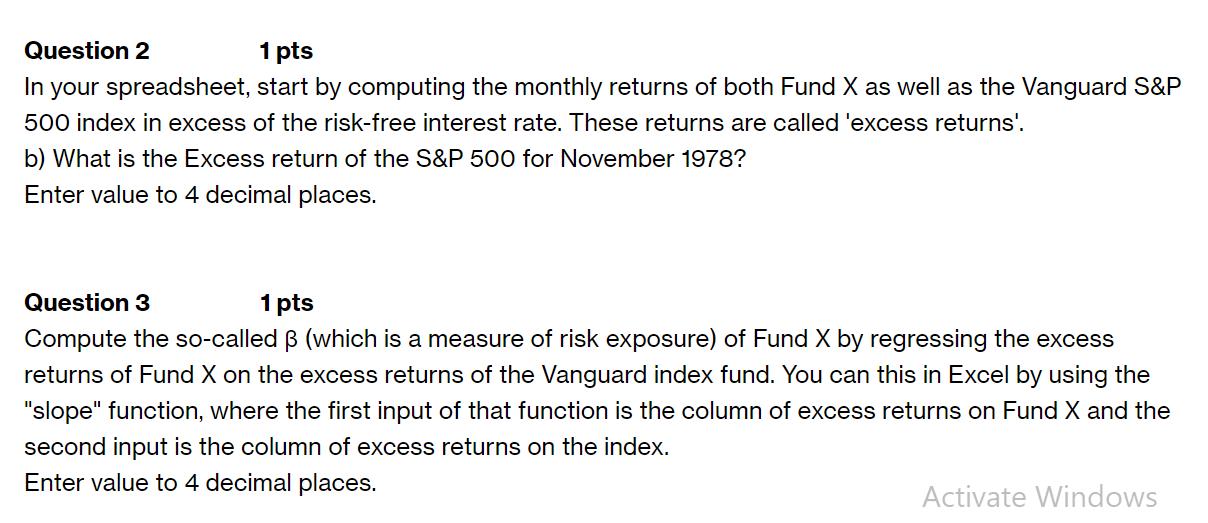

Data since 1977 of the monthly return to investors that have invested their money in fund X, labeled variable RX. Size of the fund, that is the amount of capital that investors have jointly put in the fund, expressed in millions of USD, also called the Assets-Under-Management or AUM. 2. In the tab labeled Fund X Expense Ratio Annual expense ratio that the fund has charged to investors expressed as an annual percentage. The return to investors (or net performance) has already taken into account the fact that the expense ratio is taken out. So, to evaluate the gross performance of the fund you need to add back the expense ratio to the returns. 3. In the tab labeled Benchmark Data Vanguard SP500 Information about the benchmark, which in this case is the S&P500 index fund of Vanguard, which is labeled RVG. Information about the risk-free interest rate, which is labeled Rf questions Question 1 1 pts In your spreadsheet, start by computing the monthly returns of both Fund X as well as the Vanguard S&P 500 index in excess of the risk-free interest rate. These returns are called 'excess returns'. a) What is the Excess return of Fund X for November 1978? Enter value to 4 decimal places. Activate Windows. Question 2 1 pts In your spreadsheet, start by computing the monthly returns of both Fund X as well as the Vanguard S&P 500 index in excess of the risk-free interest rate. These returns are called 'excess returns'. b) What is the Excess return of the S&P 500 for November 1978? Enter value to 4 decimal places. Question 3 1 pts Compute the so-called (which is a measure of risk exposure) of Fund X by regressing the excess returns of Fund X on the excess returns of the Vanguard index fund. You can this in Excel by using the "slope" function, where the first input of that function is the column of excess returns on Fund X and the second input is the column of excess returns on the index. Enter value to 4 decimal places. Activate Windows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To compute the excess returns of Fund X and the Vanguard SP 500 index in November 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66427cd0660f1_979868.pdf

180 KBs PDF File

66427cd0660f1_979868.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started