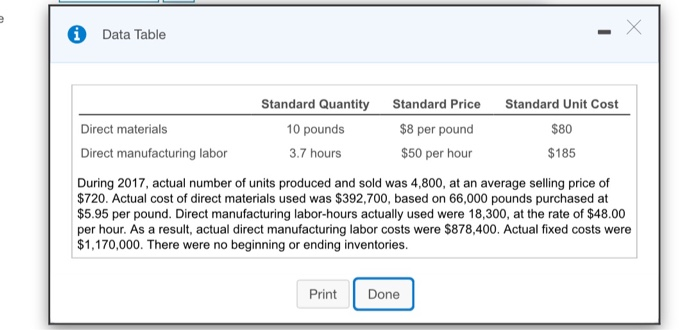

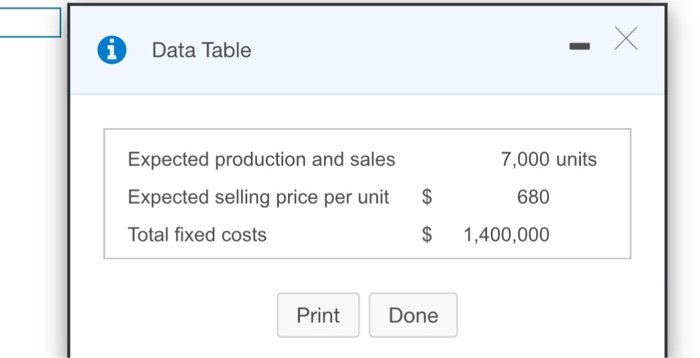

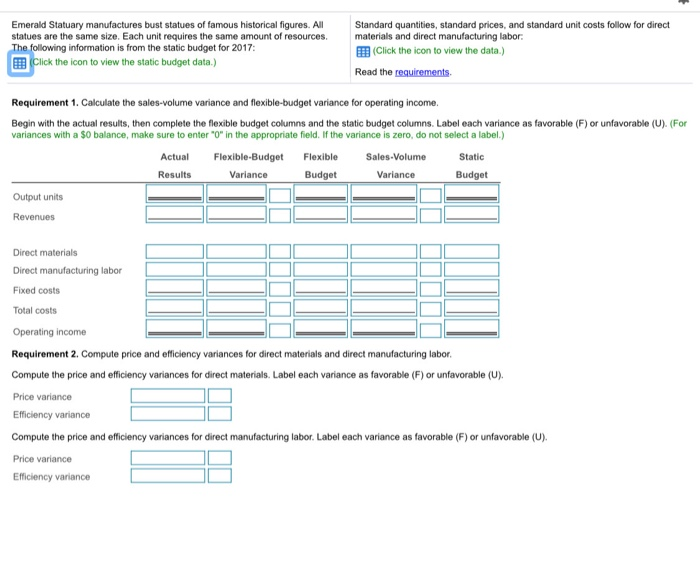

Data Table $80 Standard Quantity Standard Price Standard Unit Cost Direct materials 10 pounds $8 per pound Direct manufacturing labor 3.7 hours $50 per hour $185 During 2017, actual number of units produced and sold was 4,800, at an average selling price of $720. Actual cost of direct materials used was $392,700, based on 66,000 pounds purchased at $5.95 per pound. Direct manufacturing labor-hours actually used were 18,300, at the rate of $48.00 per hour. As a result, actual direct manufacturing labor costs were $878,400. Actual fixed costs were $1,170,000. There were no beginning or ending inventories. Print Done 0 Data Table 7,000 units Expected production and sales Expected selling price per unit Total fixed costs $ 680 $ 1,400,000 Print Done Emerald Statuary manufactures bust statues of famous historical figures. All statues are the same size. Each unit requires the same amount of resources. The following information is from the static budget for 2017: Click the icon to view the static budget data.) Standard quantities, standard prices, and standard unit costs follow for direct materials and direct manufacturing labor Click the icon to view the data.) Read the requirements Requirement 1. Calculate the sales-volume variance and flexible-budget variance for operating income. Begin with the actual results, then complete the flexible budget columns and the static budget columns. Label each variance as favorable (F) or unfavorable (U). (For variances with a $0 balance, make sure to enter "O" in the appropriate field. If the variance is zero, do not select a label.) Actual Flexible-Budget Flexible Sales-Volume Static Results Variance Budget Variance Budget Output units Revenues Direct materials Direct manufacturing labor Fixed costs Total costs Operating income Requirement 2. Compute price and efficiency variances for direct materials and direct manufacturing labor. Compute the price and efficiency variances for direct materials. Label each variance as favorable (F) or unfavorable (U). Price variance Efficiency variance Compute the price and efficiency variances for direct manufacturing labor. Label each variance as favorable (F) or unfavorable (U). Price variance Efficiency variance