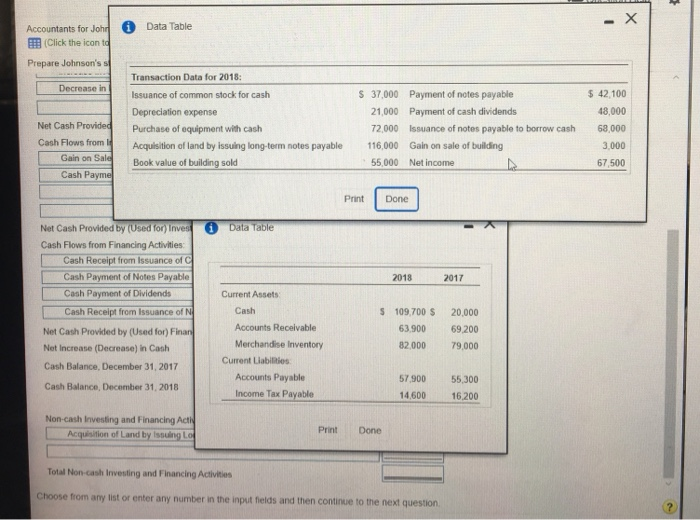

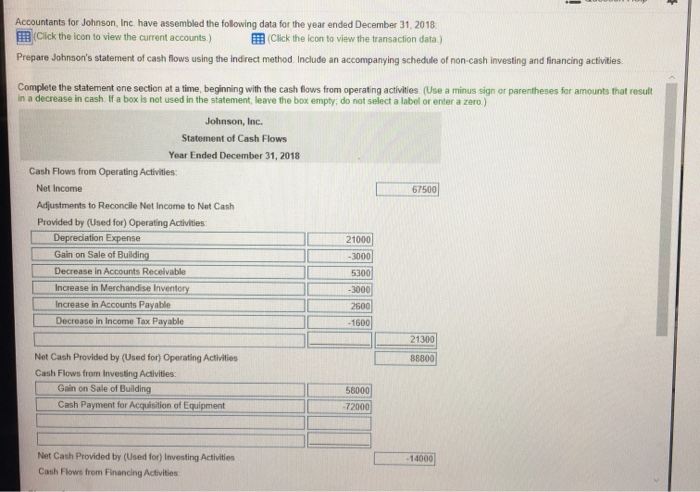

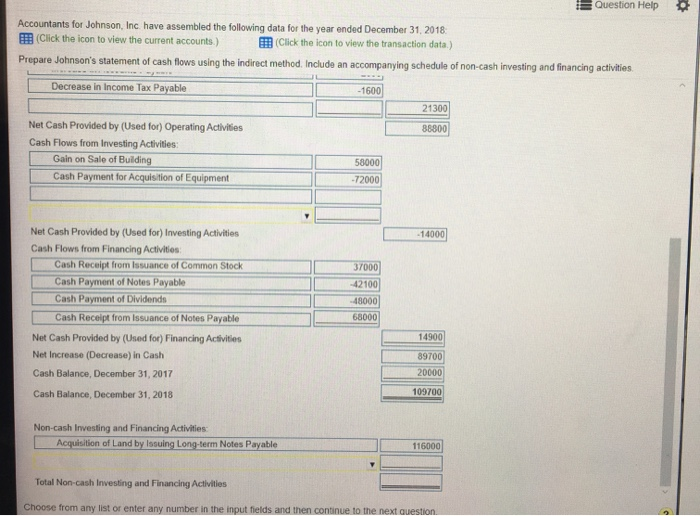

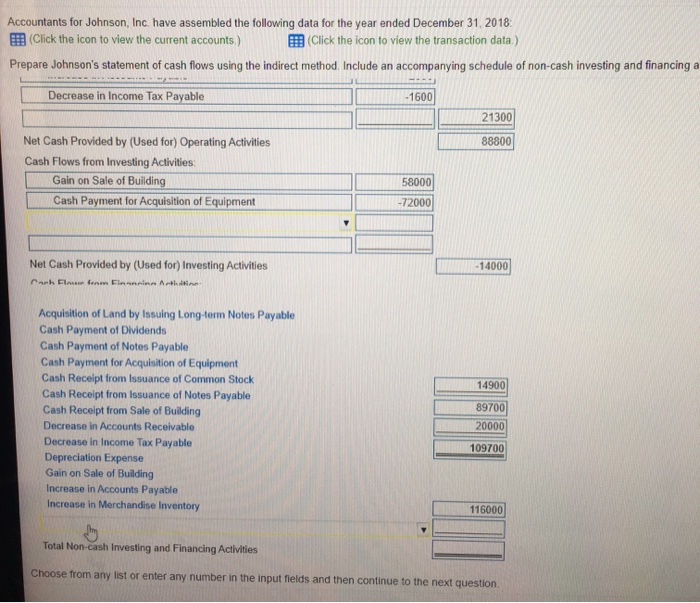

| Data Table Accountants for John Click the icon to Prepare Johnson's s Decrease in Net Cash Provided Cash Flows from Transaction Data for 2018: Issuance of common stock for cash Depreciation expense Purchase of equipment with cash Acquisition of land by issuing long-term notes payable Book value of building sold $ 37,000 Payment of notes payable 21,000 Payment of cash dividends 72,000 Issuance of notes payable to borrow cash 116,000 Gain on sale of building 55000 Net income $ 42.100 48.000 58.000 3.000 67500 Gain on Sale Cash Paym Print Done Data Table 2018 2017 Net Cash Provided by (Used for) inver Cash Flows from Financing Activities Cash Receipt from Issuance of Cash Payment of Notes Payable Cash Payment of Dividends Cash Receipt from Issuance of N Net Cash Provided by (Used for) Finan Net Increase (Decrease) in Cash Cash Balance, December 31, 2017 Cash Balance, December 31, 2018 $ Current Assets Cash Accounts Receivable Merchandise Inventory Current Labines Accounts Payable Income Tax Payable 109,700 $ 63.900 82,000 20.000 69200 79.000 57.900 14,600 55.300 16.200 Non-cash Investing and Financing Act Acquisition of Land by issuing LG Print Done Total Non-cash Investing and Financing Activities Choose from any list or enter any number in the input fields and then continue to the next question Accountants for Johnson, Inc. have assembled the following data for the year ended December 31, 2018 Click the icon to view the current accounts.) Click the icon to view the transaction data) Prepare Johnson's statement of cash flows using the indirect method. Include an accompanying schedule of non-cash investing and financing activities. Complete the statement one section at a time, beginning with the cash flows from operating activities (Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box is not used in the statement, leave the box empty do not select a label or enter a zero) 67500 Johnson, Inc. Statement of Cash Flows Year Ended December 31, 2018 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Depreciation Expense Gain on Sale of Building Decrease in Accounts Receivable 21000 -3000 5300 Increase in Merchandise Inventory Increase in Accounts Payable Decrease in Income Tax Payable -3000 2500 1600 88800 Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities Gain on Sale of Building 58000 Cash Payment for Acquisition of Equipment 72000 - 14000 Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Question Help Accountants for Johnson, Inc. have assembled the following data for the year ended December 31, 2018 (Click the icon to view the current accounts.) Click the icon to view the transaction data.) Prepare Johnson's statement of cash flows using the indirect method. Include an accompanying schedule of non-cash investing and financing activities Decrease in Income Tax Payable -1600 21300 88800 Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Gain on Sale of Building Cash Payment for Acquisition of Equipment 58000 -72000 - 14000 Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities Cash Receipt from Issuance of Common Stock Cash Payment of Notes Payable Cash Payment of Dividends Cash Receipt from Issuance of Notes Payable Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2017 Cash Balance, December 31, 2018 37000 -42100 48000 68000 14900 89700 20000 109700 Non-cash Investing and Financing Activities Acquisition of Land by Issuing Long-term Notes Payable 116000 Total Non-cash Investing and Financing Activities Choose from any list or enter any number in the input fields and then continue to the next question Accountants for Johnson, Inc. have assembled the following data for the year ended December 31, 2018 (Click the icon to view the current accounts.) (Click the icon to view the transaction data) Prepare Johnson's statement of cash flows using the indirect method. Include an accompanying schedule of non-cash investing and financing a Decrease in Income Tax Payable -1600 21300 88800 Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Gain on Sale of Building Cash Payment for Acquisition of Equipment 58000 -72000 Net Cash Provided by (Used for) Investing Activities arh El fram - 14000 Acquisition of Land by Issuing Long-term Notes Payable Cash Payment of Dividends Cash Payment of Notes Payable Cash Payment for Acquisition of Equipment Cash Receipt from Issuance of Common Stock Cash Receipt from Issuance of Notes Payable Cash Receipt from Sale of Building Decrease in Accounts Receivable Decrease in Income Tax Payable Depreciation Expense Gain on Sale of Building Increase in Accounts Payable Increase in Merchandise Inventory 14900 89700 20000 109700 116000 long Total Non-cash Investing and Financing Activities Choose from any list or enter any number in the input fields and then continue to the next