Answered step by step

Verified Expert Solution

Question

1 Approved Answer

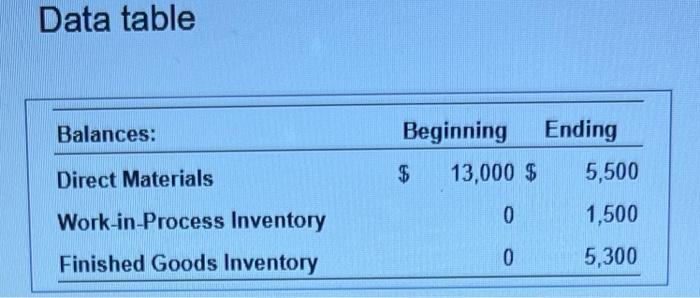

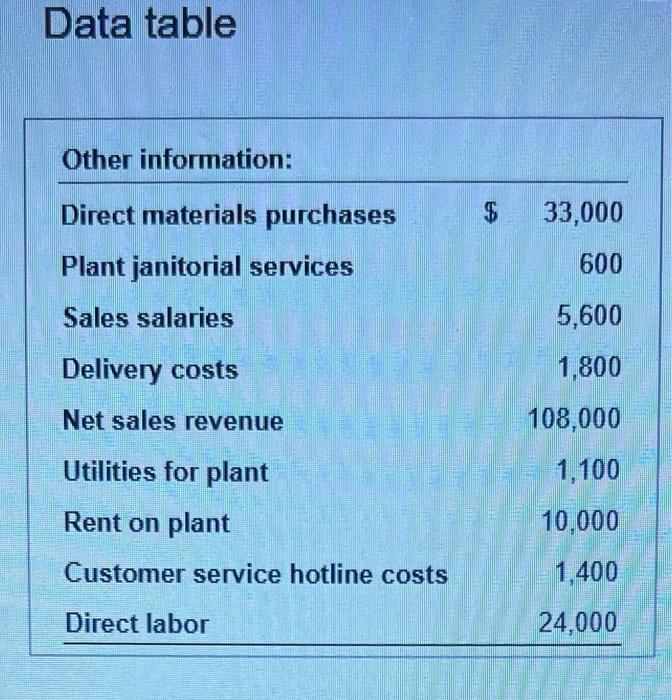

Data table Balances: Direct Materials Work-in-Process Inventory Finished Goods Inventory Beginning Ending $ 13,000 $ 5,500 0 1,500 0 5,300 Data table Other information:

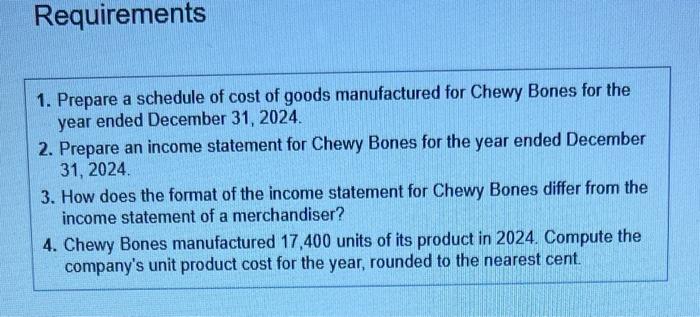

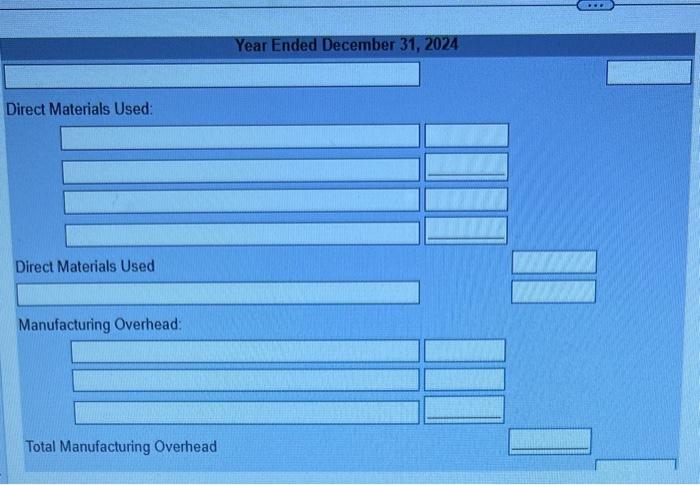

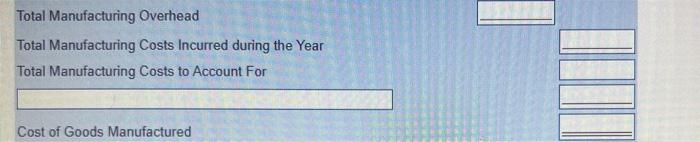

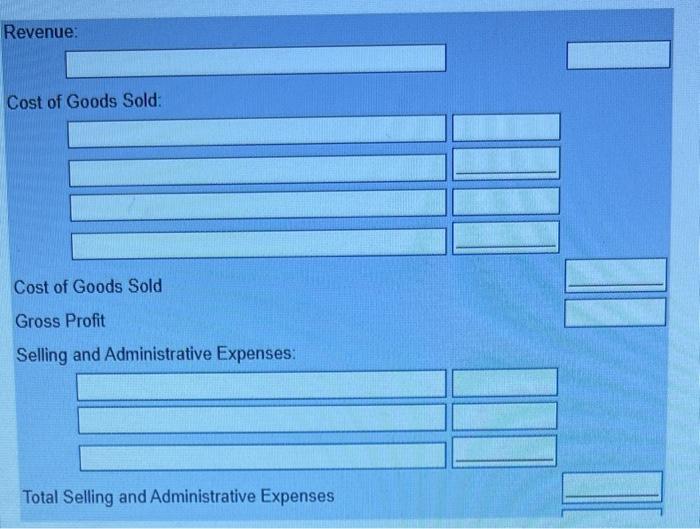

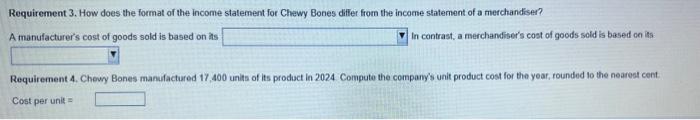

Data table Balances: Direct Materials Work-in-Process Inventory Finished Goods Inventory Beginning Ending $ 13,000 $ 5,500 0 1,500 0 5,300 Data table Other information: Direct materials purchases $ 33,000 Plant janitorial services 600 Sales salaries Delivery costs 5,600 1,800 Net sales revenue 108,000 Utilities for plant 1,100 Rent on plant 10,000 Customer service hotline costs 1,400 Direct labor 24,000 Requirements 1. Prepare a schedule of cost of goods manufactured for Chewy Bones for the year ended December 31, 2024. 2. Prepare an income statement for Chewy Bones for the year ended December 31, 2024. 3. How does the format of the income statement for Chewy Bones differ from the income statement of a merchandiser? 4. Chewy Bones manufactured 17,400 units of its product in 2024. Compute the company's unit product cost for the year, rounded to the nearest cent. Direct Materials Used: Direct Materials Used Manufacturing Overhead: Total Manufacturing Overhead Year Ended December 31, 2024 Total Manufacturing Overhead Total Manufacturing Costs Incurred during the Year Total Manufacturing Costs to Account For Cost of Goods Manufactured Revenue: Cost of Goods Sold: Cost of Goods Sold Gross Profit Selling and Administrative Expenses: Total Selling and Administrative Expenses Requirement 3. How does the format of the income statement for Chewy Bones differ from the income statement of a merchandiser? A manufacturer's cost of goods sold is based on its In contrast, a merchandiser's cost of goods sold is based on its Requirement 4. Chewy Bones manufactured 17,400 units of its product in 2024 Compute the company's unit product cost for the year, rounded to the nearest cent Cost per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started