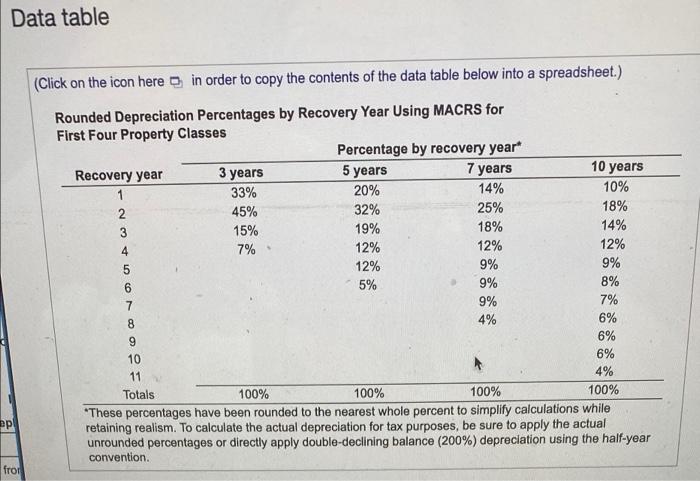

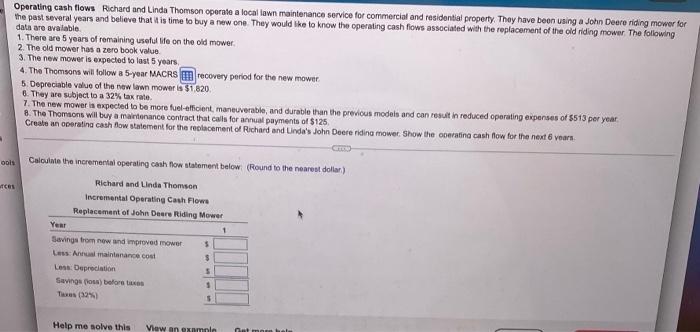

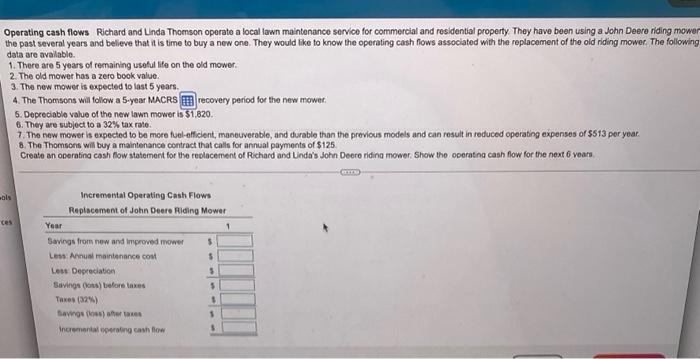

Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year 3 years Recovery year 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. fror Operating cash flows Richard and Linda Thomson operate a local lawn maintenance service for commercial and residential property. They have been using a John Deere riding mower for the past several years and believe that it is time to buy a new one. They would like to know the operating cash flows associated with the replacement of the old riding mower The following data are avalable 1. There are 5 years of remaining useful ife on the old mower, 2. The old mower has a zero book value 3. The new mower is expected to last 5 years, 4. The Thomsons will follow a 5-year MACRS recovery period for the new mower 5.Depreciable value of the new lawn mower is $1.620 8. They are subject to a 32% tax rate. 7. The new mower is expected to be more fuel-efficient, maneuverable, and durable than the previous models and can result in reduced operating expenses of $513 per year 8. The Thomsons wil buy a maintenance contract that calls for annual payments of $125 Create an operating cash flow statement for the replacement of Richard and Linda's John Deere riding mower, Show the coating cash flow for the next 6 years Opis Calculate the incremental operating cash flow statement below (Round to the nearest dollar) Richard and Linda Thomson Incremental Operating Cash Flows Replacement of John Deere Riding Mower Year Savings from now and improved mower $ Less Annual maintenance cost $ Less Depreciation 5 Savings poss) before 1 Tas (293 5 Help mo solve this View on gamle ut mou Operating cash flows Richard and Linda Thomson operate a local lawn maintenance service for commercial and residential property. They have been using a John Deere riding mower the past several years and believe that it is time to buy a new one. They would like to know the operating cash flows associated with the replacement of the old riding mower. The following data are available 1. There are 5 years of remaining useful life on the old mower. 2. The old mower has a zero book value 3. The new mower is expected to last 5 years. 4. The Thomsons will follow a 5-year MACRS recovery period for the new mowet. 5. Depreciablo value of the new lawn mower is $1.820. 6. They are subject to a 32% tax rato. 7. The new mower is expected to be more fuel-efficient, maneuverable, and durable than the previous models and can result in reduced operating expenses of $513 per year. 8. The Thomsons will buy a maintenance contract that calls for annual payments of $125. Create an operatina cash flow statement for the replacement of Richard and Linda's John Deere riding mower, Show the operating cash flow for the next 6 years als ces Incremental Operating Cash Flows Replacement of John Deere Riding Mower Year Savings from now and improved mower 5 Less Annual maintenance com $ Lou Depreciation $ Savings (ous) before taxe 5 Taxes (329) $ Bags low as Incrementing cash flow $