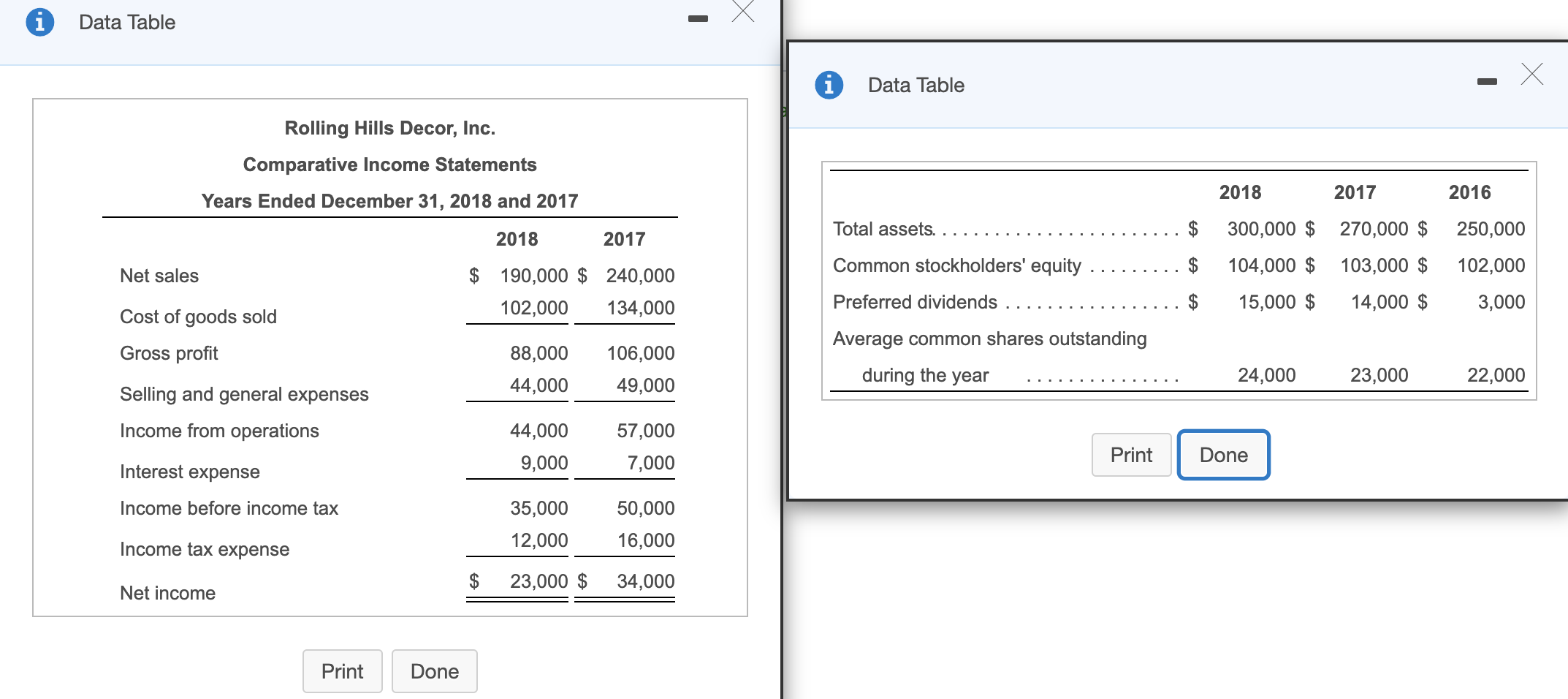

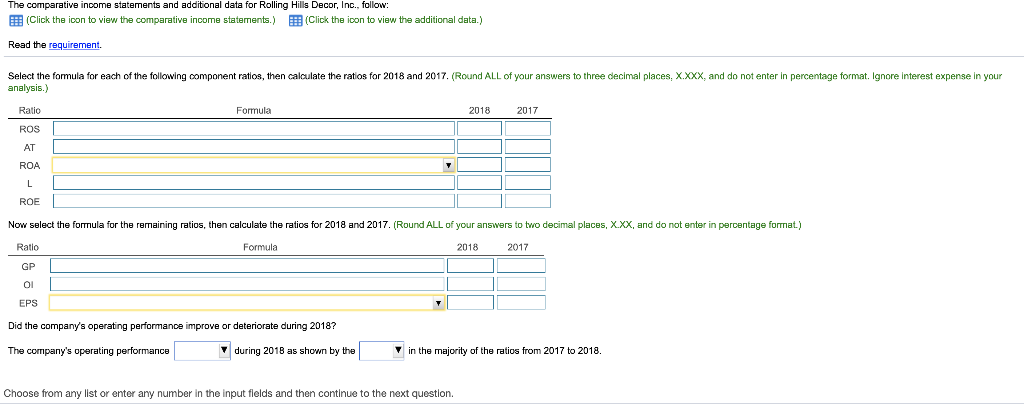

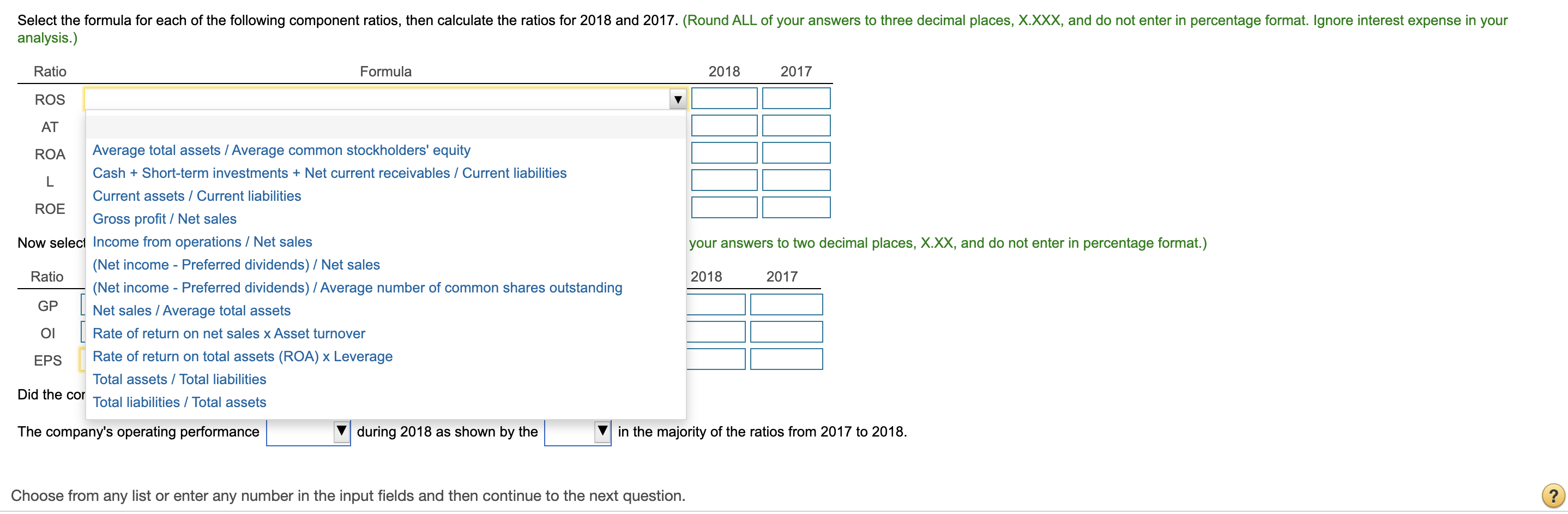

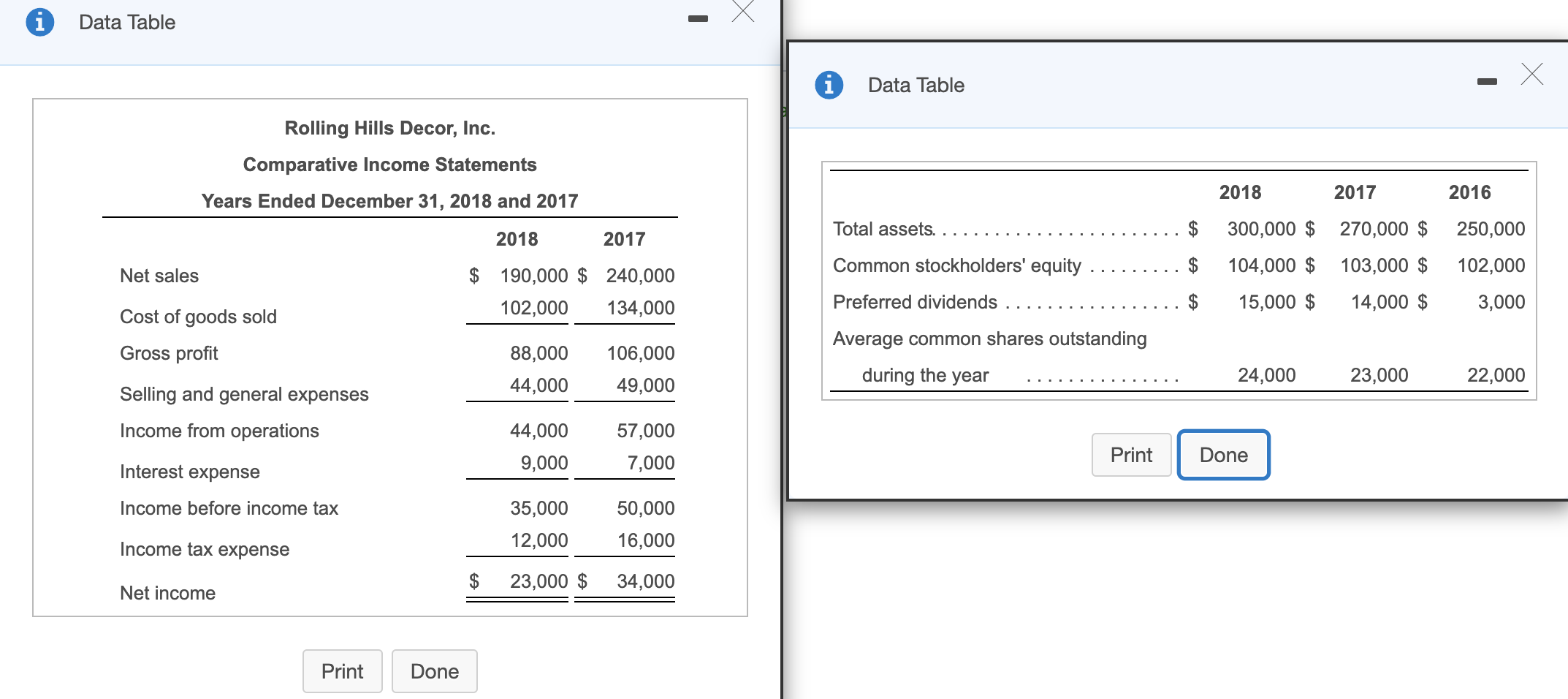

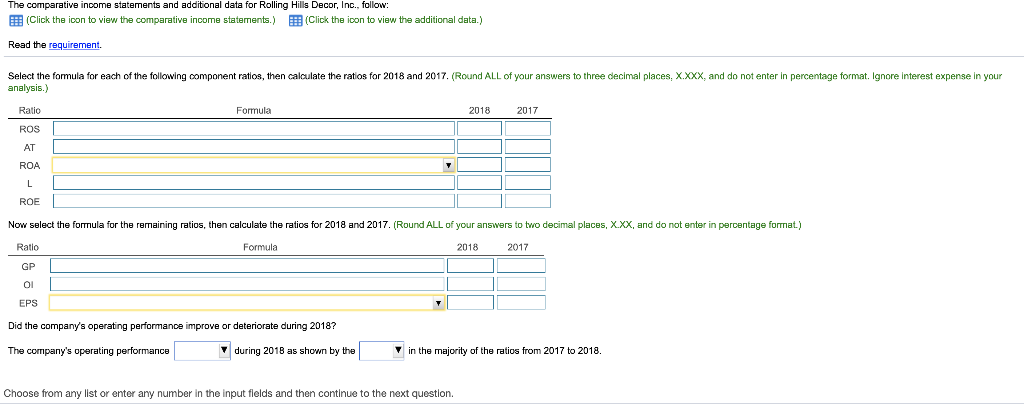

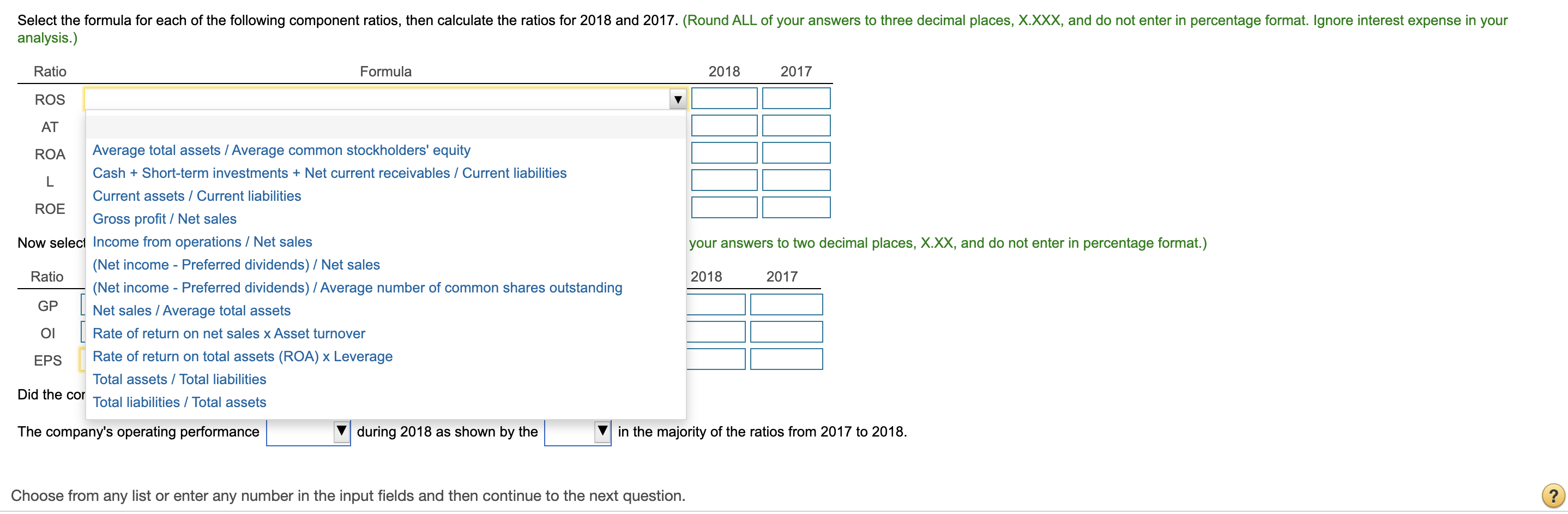

Data Table Data Table 2018 2017 2016 Rolling Hills Decor, Inc. Comparative Income Statements Years Ended December 31, 2018 and 2017 2018 2017 Net sales $ 190,000 $ 240,000 Cost of goods sold 102,000 134,000 Total assets. .... ........$ Common stockholders' equity .........$ Preferred dividends ..................$ Average common shares outstanding 300,000 $ 104,000 $ 15,000 $ 270,000 $ 103,000 $ 14,000 $ 250,000 102,000 3,000 Gross profit 88,000 106,000 during the year . . . . . . . . . . . . ... 24,000 23,000 22,000 44,000 49,000 Selling and general expenses Income from operations 57,000 44,000 9,000 Print 7.000 Done Interest expense Income before income tax 35,000 12,000 50,000 16,000 Income tax expense $ 23,000 $ 34,000 Net income Print Done The comparative income statements and additional data for Rolling Hills Decor, Inc., follow (Click the icon to view the comparative income statements.) (Click the icon to view the additional data.) Read the requirement. Select the formula for each of the following component ratios, then calculate the ratios for 2018 and 2017. (Round ALL of your answers to three decimal places, X.XXX, and do not enter in percentage format. Ignore Interest expense in your analysis.) Formula 2018 2017 Ratio ROS AT ROA ROE Now select the formula for the remaining ratios, then calculate the ratios for 2018 and 2017. (Round ALL of your answers to two decimal places, X.XX, and do not enter in percentage format.) Formula 2018 2017 Ratio GP OI EPS Did the company's operating performance improve or deteriorate during 2018? The company's operating performance during 2018 as shown by the in the majority of the ratios from 2017 to 2018. Choose from any list or enter any number in the input fields and then continue to the next question. Select the formula for each of the following component ratios, then calculate the ratios for 2018 and 2017. (Round ALL of your answers to three decimal places, X.XXX, and do not enter in percentage format. Ignore interest expense in your analysis.) Ratio Formula 2018 2017 ROS ROA Average total assets / Average common stockholders' equity Cash + Short-term investments + Net current receivables / Current liabilities Current assets / Current liabilities ROE Gross profit / Net sales Now select Income from operations / Net sales your answers to two decimal places, X.XX, and do not enter in percentage format.) (Net income - Preferred dividends) / Net sales Ratio 2018 2017 (Net income - Preferred dividends) / Average number of common shares outstanding | Net sales / Average total assets Rate of return on net sales x Asset turnover Rate of return on total assets (ROA) x Leverage Total assets / Total liabilities Did the cor Total liabilities / Total assets The company's operating performance V during 2018 as shown by the in the majority of the ratios from 2017 to 2018. GP EPS Choose from any list or enter any number in the input fields and then continue to the next