Answered step by step

Verified Expert Solution

Question

1 Approved Answer

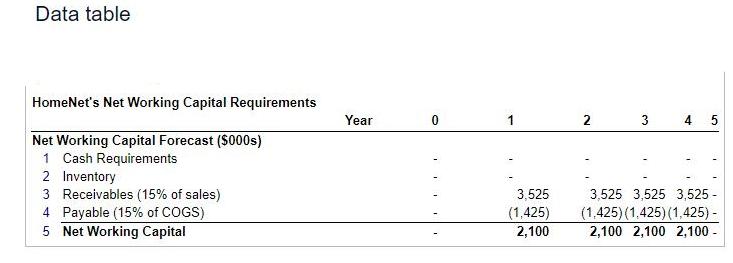

Data table HomeNet's Net Working Capital Requirements Net Working Capital Forecast ($000s) 1 Cash Requirements 2 Inventory 3 Receivables (15% of sales) 4 Payable

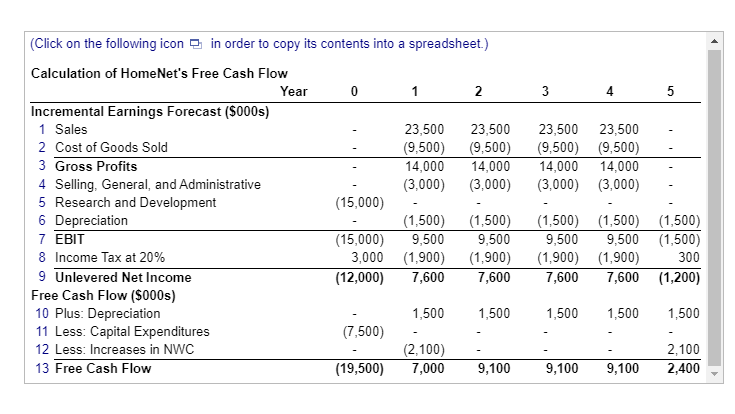

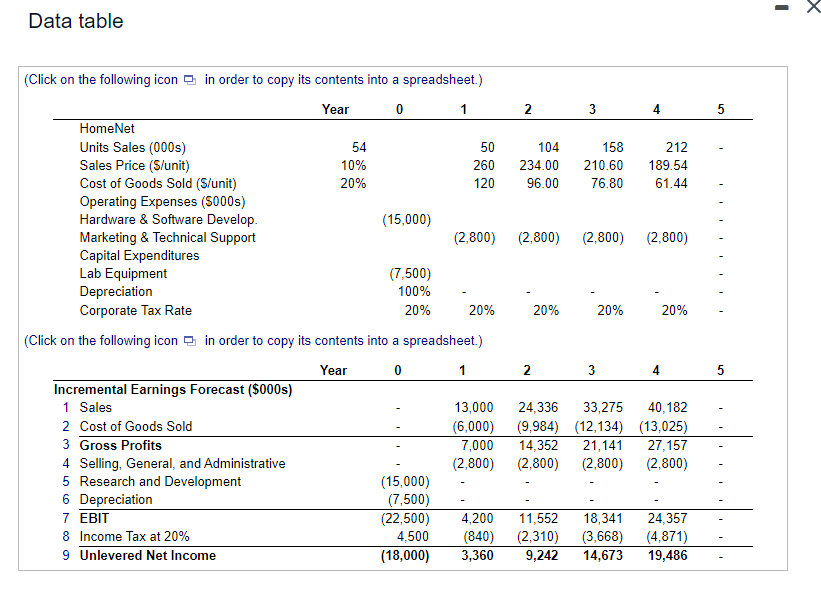

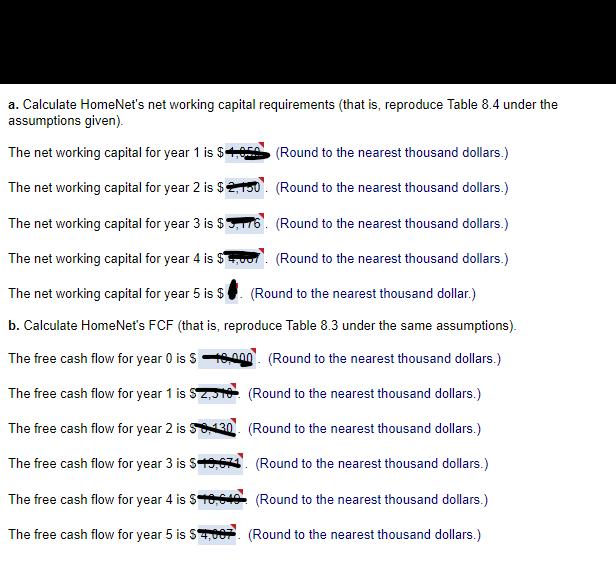

Data table HomeNet's Net Working Capital Requirements Net Working Capital Forecast ($000s) 1 Cash Requirements 2 Inventory 3 Receivables (15% of sales) 4 Payable (15% of COGS) 5 Net Working Capital Year 0 1 2 3 4 5 3,525 (1,425) 2,100 3,525 3,525 3,525- (1,425) (1.425) (1,425) - 2,100 2,100 2,100 - (Click on the following icon in order to copy its contents into a spreadsheet.) Calculation of Home Net's Free Cash Flow Year 0 1 2 3 4 5 Incremental Earnings Forecast ($000s) 1 Sales 2 Cost of Goods Sold 23,500 (9,500) (9,500) 23,500 23,500 23,500 3 Gross Profits 14,000 (9,500) (9,500) 14,000 14,000 14,000 4 Selling, General, and Administrative (3,000) (3,000) (3,000) (3,000) 5 Research and Development (15,000) 6 Depreciation (1,500) (1,500) (1,500) (1,500) (1,500) 7 EBIT (15,000) 9,500 9,500 9,500 9,500 (1,500) 8 Income Tax at 20% 3,000 (1,900) (1,900) (1,900) (1,900) 300 9 Unlevered Net Income (12,000) 7,600 7,600 7,600 7,600 (1,200) Free Cash Flow ($000s) 10 Plus: Depreciation 1,500 1,500 1,500 1,500 1,500 11 Less: Capital Expenditures (7,500) 12 Less: Increases in NWC (2,100) 2,100 13 Free Cash Flow (19,500) 7,000 9,100 9,100 9,100 2,400 Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 0 1 2 3 4 5 HomeNet Units Sales (000s) 54 Sales Price ($/unit) 10% Cost of Goods Sold (S/unit) 20% 50 104 158 212 260 234.00 210.60 189.54 120 96.00 76.80 61.44 Operating Expenses ($000s) Hardware & Software Develop. (15,000) Marketing & Technical Support (2,800) (2,800) (2,800) (2,800) Capital Expenditures Lab Equipment (7,500) Depreciation 100% Corporate Tax Rate 20% 20% 20% 20% 20% (Click on the following icon in order to copy its contents into a spreadsheet.) Incremental Earnings Forecast ($000s) Year 0 1 2 3 4 5 1 Sales 2 Cost of Goods Sold 3 Gross Profits 4 Selling, General, and Administrative 13,000 24,336 33,275 40,182 (6,000) (9,984) (12,134) (13,025) 7,000 14,352 21,141 27,157 (2,800) (2,800) (2,800) (2,800) 5 Research and Development (15,000) 6 Depreciation (7,500) 7 EBIT (22,500) 4,200 11,552 18,341 24,357 8 Income Tax at 20% 4,500 (840) (2,310) (3,668) (4,871) 9 Unlevered Net Income (18,000) 3,360 9,242 14,673 19,486 a. Calculate HomeNet's net working capital requirements (that is, reproduce Table 8.4 under the assumptions given). The net working capital for year 1 is $4,05 (Round to the nearest thousand dollars.) The net working capital for year 2 is $2,150. (Round to the nearest thousand dollars.) The net working capital for year 3 is $5,176. (Round to the nearest thousand dollars.) The net working capital for year 4 is $ (Round to the nearest thousand dollars.) The net working capital for year 5 is $ (Round to the nearest thousand dollar.) b. Calculate Home Net's FCF (that is, reproduce Table 8.3 under the same assumptions). The free cash flow for year 0 is $18,000. (Round to the nearest thousand dollars.) The free cash flow for year 1 is $ 2,516. (Round to the nearest thousand dollars.) The free cash flow for year 2 is $8,130 (Round to the nearest thousand dollars.) The free cash flow for year 3 is $ 19,671. (Round to the nearest thousand dollars.) The free cash flow for year 4 is $10,649 (Round to the nearest thousand dollars.) The free cash flow for year 5 is $4,007. (Round to the nearest thousand dollars.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started