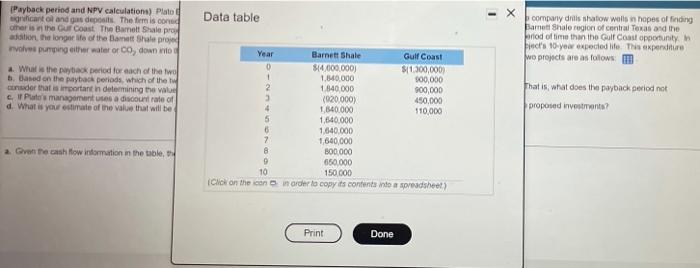

Data table Payback period and NPV calculation) Plato cartol and gas deposits. The fire is con other is in the Guf Coast The Barnett Shale pro addition the longest of the Banat Shale proje vorespurning either water or Co, down to company distow wells in hopes of finding Baret Shale region of Central Texas and the period of time than the Gulf Coast opportunity Fred's 10-year expected life. This expenditure wo projects are as follows Wulis the back period for each of the two h. Based on the payback periods, which of the under that is important in determining the value c. Pater management to a discount rate of d. What is your state of the value that will be That is what does the payback seriod not proposed investments? Year Barnett Shale Gulf Coast 0 844.000.000) $11.300,000 1 1.140.000 000.000 2 1 840 000 900,000 3 (020.000) 450,000 4 1.540.000 110,000 5 1,640,000 1.640.000 7 1 640,000 8 800.000 9 650.000 10 150.000 Chok on the icon on order to copy its contents into a spreadsheet) a Gentech tow information in the table, Print Done (Payback period and NPV calculations) Plato Energy is an oil and gas exploration and development company located in Farmington, New Mexico. The company drills shallow wels in hopes of finding significant ol and gas deposits. The firm is considering two different ring opportunities that have very different production potentials. The first is in the Barnett Shale region of contral Texas and the other is in the Gulf Coast. The Bamel Shale project requires a much larger til investment but provides cash flows successful) over a much longer period of time than the Gulf Coast opportunity in addition, the forger life of the Bame Shale project also results in additional expenditures in year 3 of the project to enhance production throughout the projects 10-year expected. This expenditure involves purring their water or co, down into the wes in order to increase the flow of oil and gas from the structure. The expected cash flows for the two projects are as follows: a. What is the payback period for each of the two projects? b. Based on the payback periods, which of the two projects appears to be the best alternativo? What are the limitations of the payback period ranking? That is what does the payback period not consider that is important in determining the value creation potential of these two projects? c. Plato's management uses a discount rate of 196 percent to evaluate the present values of ts energy investment projects, what is the NPV of the two proposed investments? d. What is your estimate of the value that wil be created for Plato by the acceptance of each of these two investments? a. Given the cash flow information in the table, the payback period of the Bamott Shale project is years (Round to two decimal places