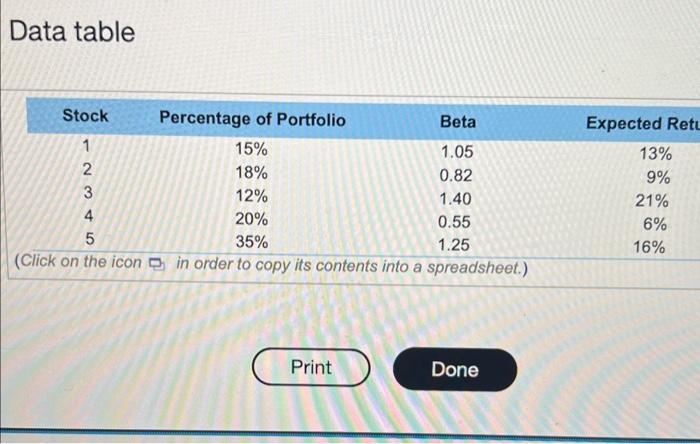

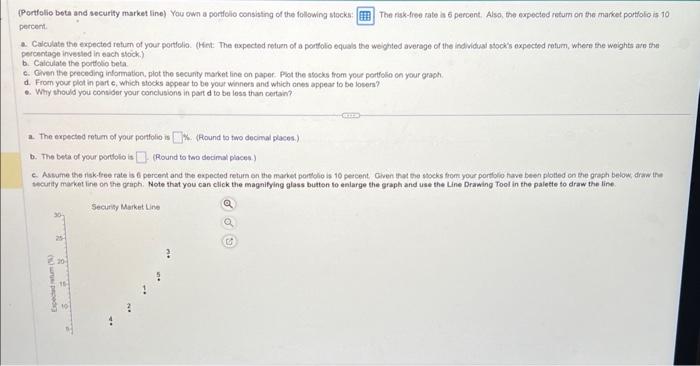

Data table (Portfolio beta and security market line) You own a porfclo consisting of the following stocks: The risk-free rate ia 6 percont. Alsa, the expected raturn on the manket portfolo is 10 percent a. Calculate the expected return of your portlolia. (Hent. The expectod refuen of a portfolo equals the weighted average of the individual asock's expected rofum, whers the woights arn the percentage invested in wach stock. b. Calculate the porttolio beta. c. Given the preceding information, plot the secunty maket line on paper. Prot the atocks from your portfolio on your graph. d. From your plot in part c, which stocks appeat to be your winners and which ones appear to be losers? -. Why should you consider your conclusions in part d to be less than certain? a. The expected retum of your pertfolio is k. (Hound to two decimal places.) b. The teta of your portlolo is (Round to two docimal phaces.) c. Aswume the risk.teee rate is 6 percent and the expected return on the market portolio is 10 percent Clven that the socks trom your portlolo five been plotied on the graph below, draw ine twcurly mecket line on the oraph. Note that you can click the magnifying glass butten to enlarge the graph and use the Line Drawing Tool in the palette to draw the line. d. From your plot in part c, which stocks appear to be your winners and which ones appear to be losers? Stock 1 is a (Select from the drop-down menu.) Stock 2 is a (Select from the drop-down menu.) Stock 3 is a (Select from the drop-down menu.) Stock 4 is a (Select from the drop-down menu.) Stock 5 is a (Select from the drop-down menu.) e. Why should you consider your conclusions in part d to be less than certain? (Select the best choice below.) A. The conclusions are less than certain because it is possible to to draw an incorrect security market line by using bad estimates in the data B. The conclusions are less than certain because the capital asset pricing model is based on some unrealistic assumptions. C. The conclusions are less than certain because the investor's preference toward risk is hard to estimate. D. The conclusions are less than certain because the market data is not possble to obtain