Answered step by step

Verified Expert Solution

Question

1 Approved Answer

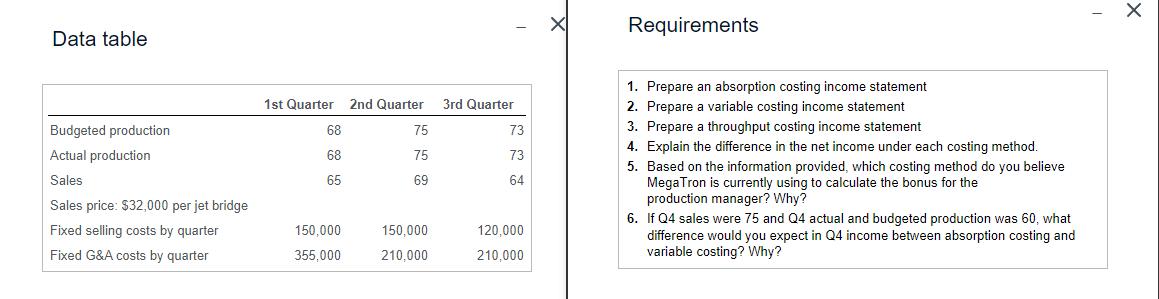

Data table Requirements 1st Quarter 2nd Quarter 3rd Quarter Budgeted production 68 75 73 3. Prepare a throughput costing income statement Actual production 68

Data table Requirements 1st Quarter 2nd Quarter 3rd Quarter Budgeted production 68 75 73 3. Prepare a throughput costing income statement Actual production 68 75 73 Sales 65 69 64 Sales price: $32,000 per jet bridge Fixed selling costs by quarter 150,000 150,000 120,000 Fixed G&A costs by quarter 355,000 210,000 210,000 1. Prepare an absorption costing income statement 2. Prepare a variable costing income statement 4. Explain the difference in the net income under each costing method. 5. Based on the information provided, which costing method do you believe Mega Tron is currently using to calculate the bonus for the production manager? Why? 6. If Q4 sales were 75 and Q4 actual and budgeted production was 60, what difference would you expect in Q4 income between absorption costing and variable costing? Why? -

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started