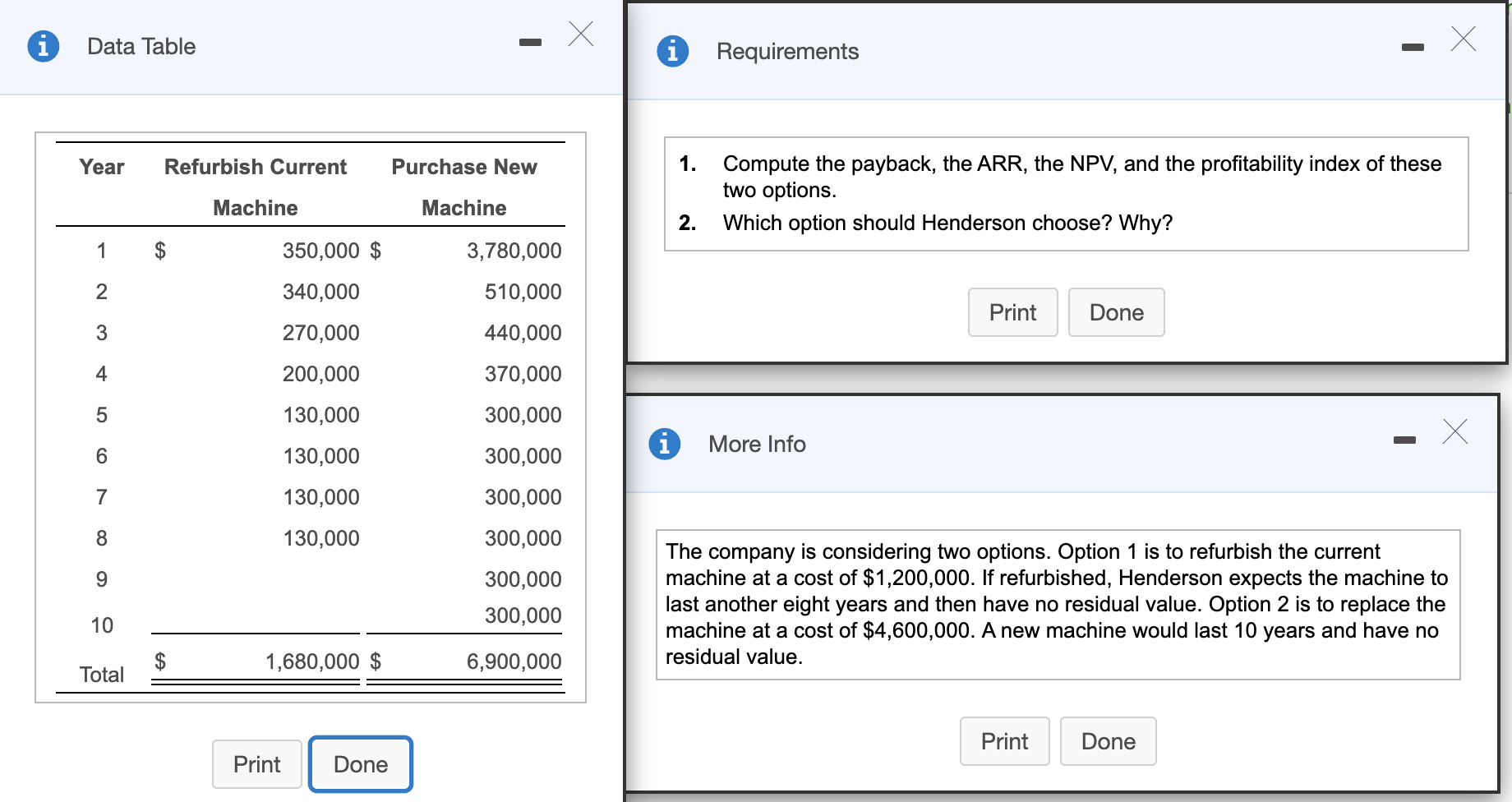

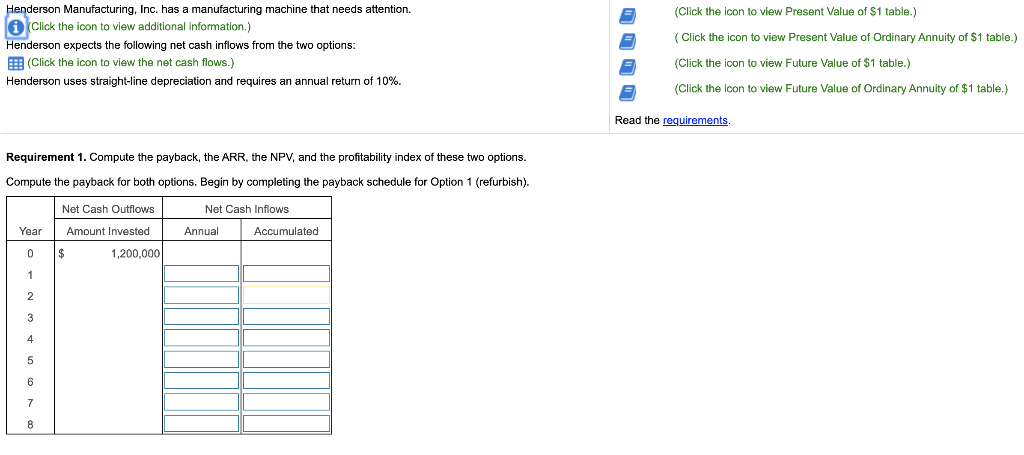

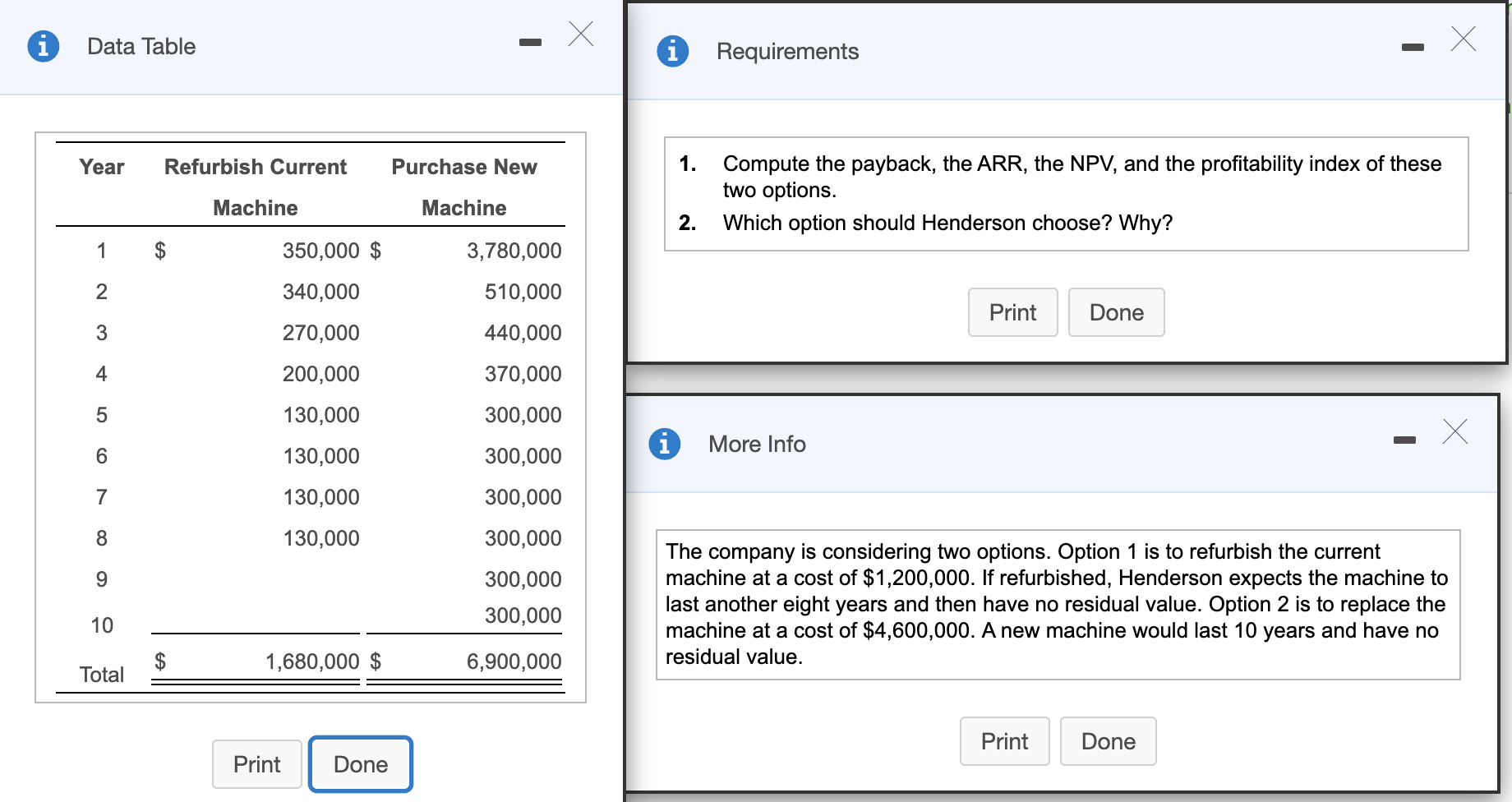

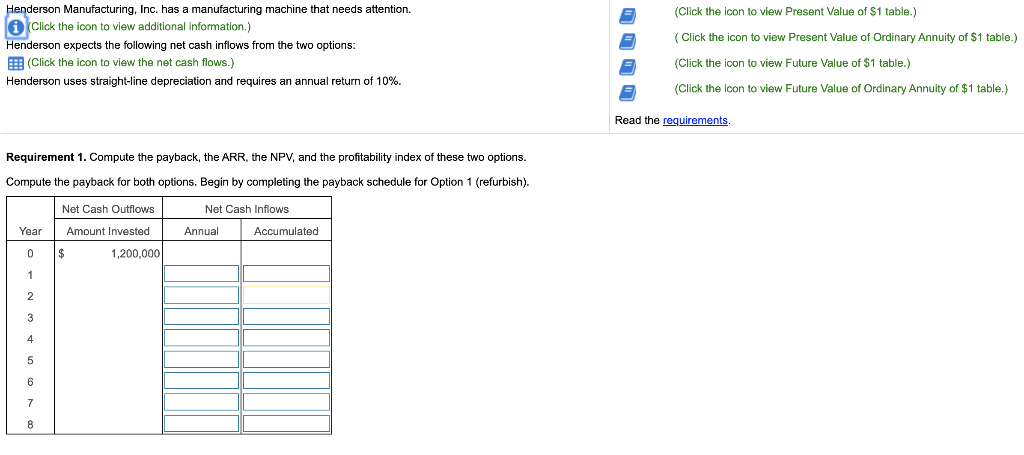

Data Table Requirements Year Refurbish Current 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. 2. Which option should Henderson choose? Why? Machine 1 $ 350,000 $ Purchase New Machine 3,780,000 510,000 440,000 340,000 Print Done 270,000 200,000 370,000 More Info 130,000 130,000 130,000 130,000 300,000 300,000 300,000 300,000 300,000 300,000 The company is considering two options. Option 1 is to refurbish the current machine at a cost of $1,200,000. If refurbished, Henderson expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,600,000. A new machine would last 10 years and have no residual value. 6,900,000 1,680,000 $ Total Print Done Print Done 0 (Click the icon to view Present Value of $1 table.) Henderson Manufacturing, Inc. has a manufacturing machine that needs attention. Click the icon to view additional information.) Henderson expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Henderson uses straight-line depreciation and requires an annual return of 10%. (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). Net Cash Outflows Amount Invested 1,200,000 Net Cash Inflows Annual Accumulated Year Data Table Requirements Year Refurbish Current 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. 2. Which option should Henderson choose? Why? Machine 1 $ 350,000 $ Purchase New Machine 3,780,000 510,000 440,000 340,000 Print Done 270,000 200,000 370,000 More Info 130,000 130,000 130,000 130,000 300,000 300,000 300,000 300,000 300,000 300,000 The company is considering two options. Option 1 is to refurbish the current machine at a cost of $1,200,000. If refurbished, Henderson expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,600,000. A new machine would last 10 years and have no residual value. 6,900,000 1,680,000 $ Total Print Done Print Done 0 (Click the icon to view Present Value of $1 table.) Henderson Manufacturing, Inc. has a manufacturing machine that needs attention. Click the icon to view additional information.) Henderson expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Henderson uses straight-line depreciation and requires an annual return of 10%. (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). Net Cash Outflows Amount Invested 1,200,000 Net Cash Inflows Annual Accumulated Year