Answered step by step

Verified Expert Solution

Question

1 Approved Answer

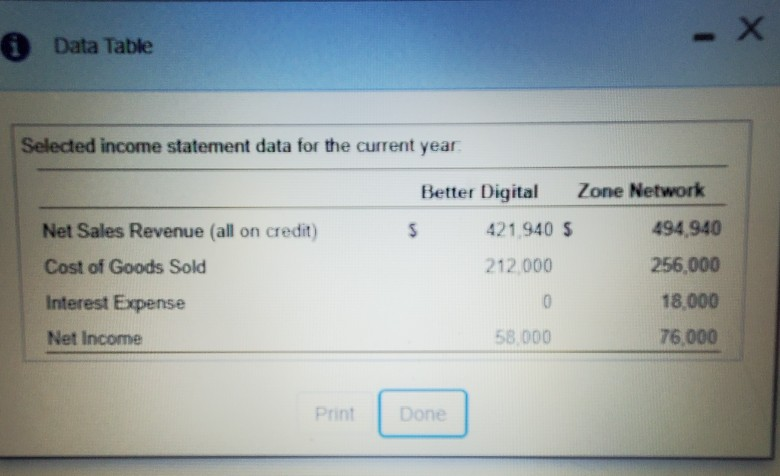

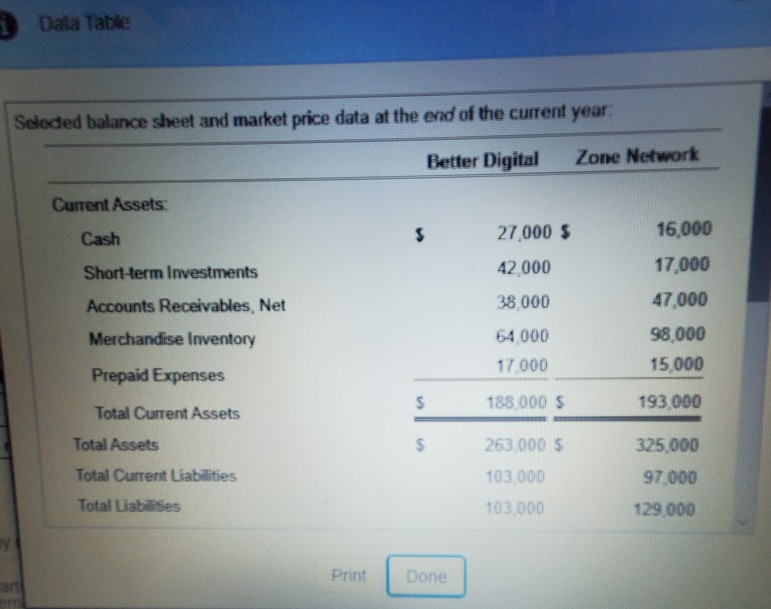

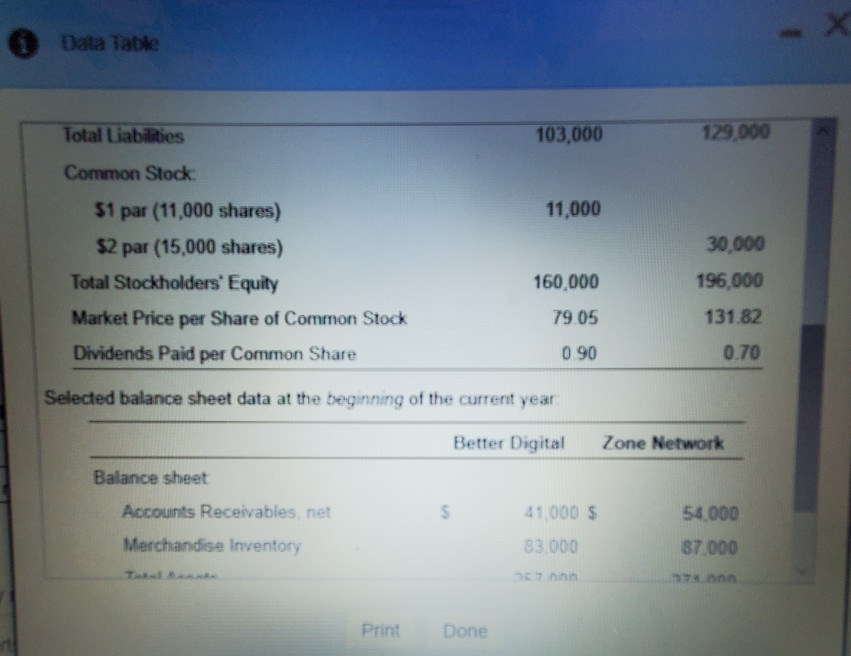

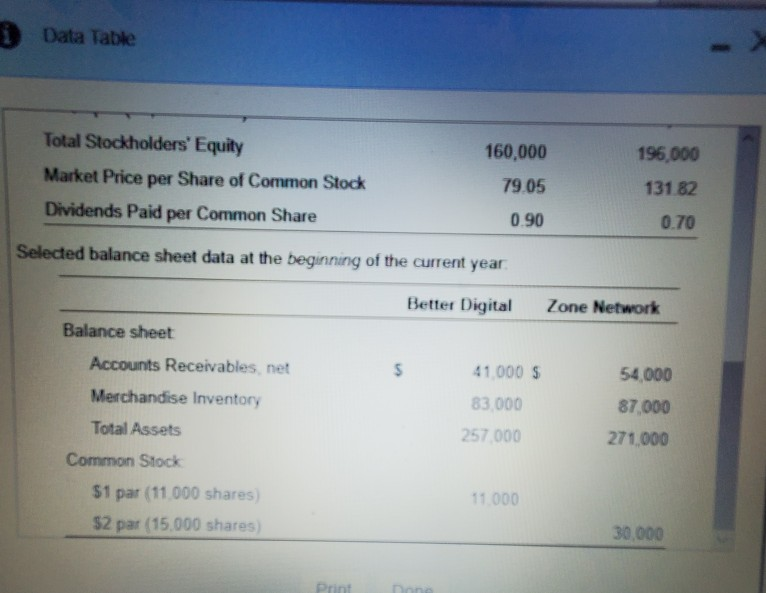

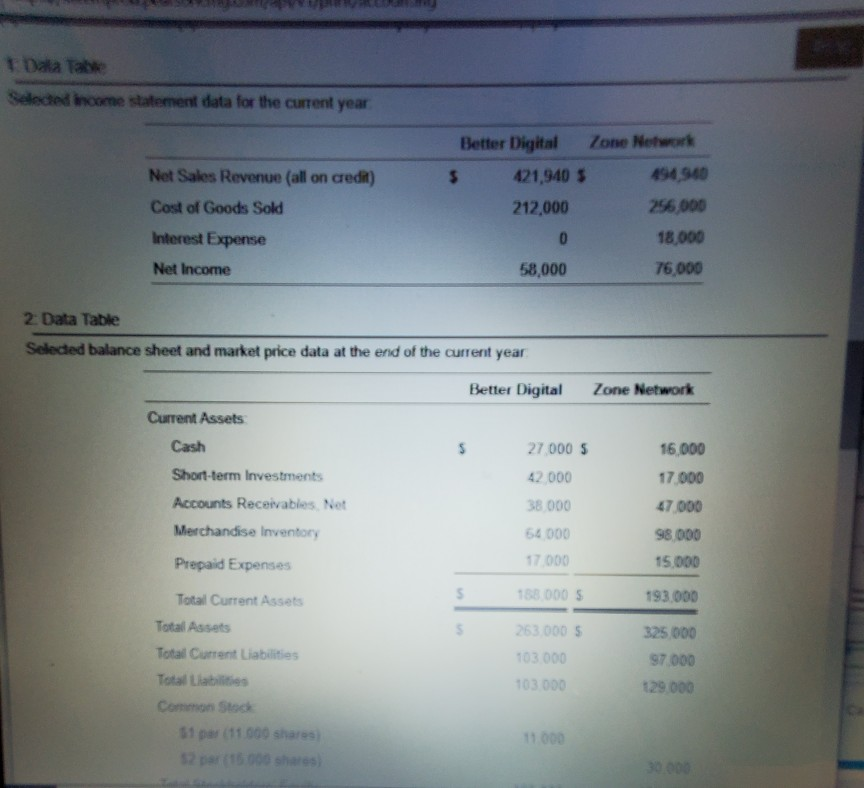

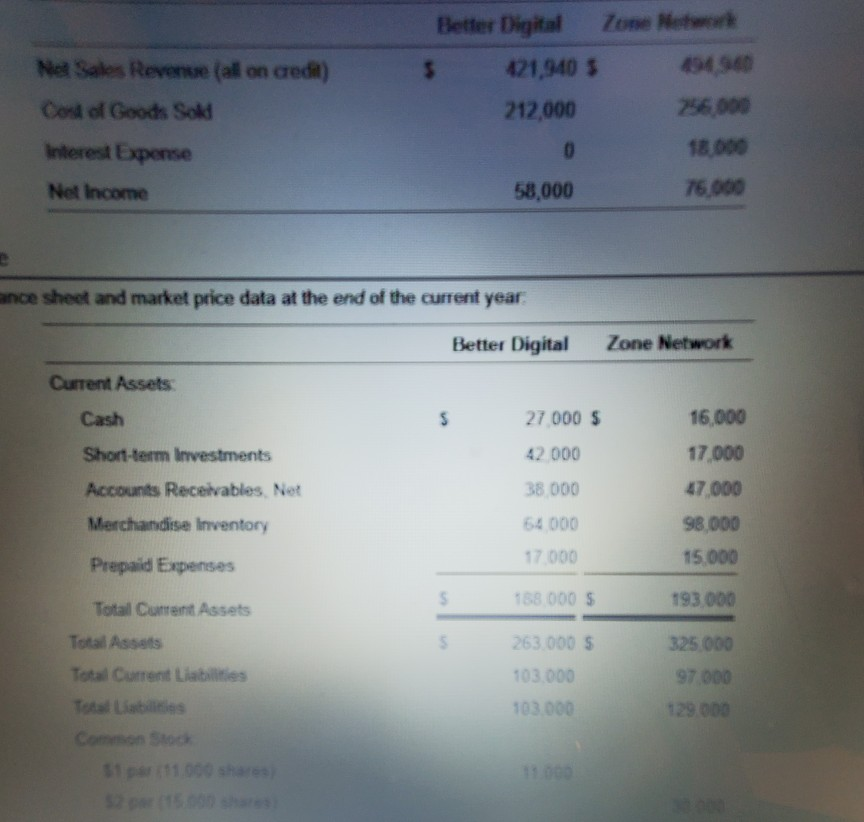

- Data Table Selected income statement data for the current year Better Digital Zone Network $ 421.940 S 494 940 Net Sales Revenue (all on

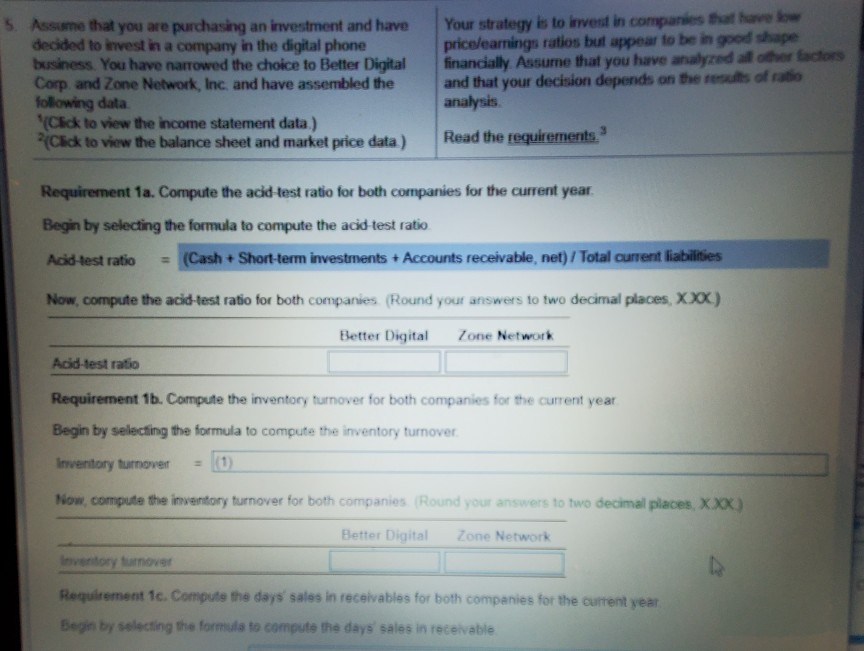

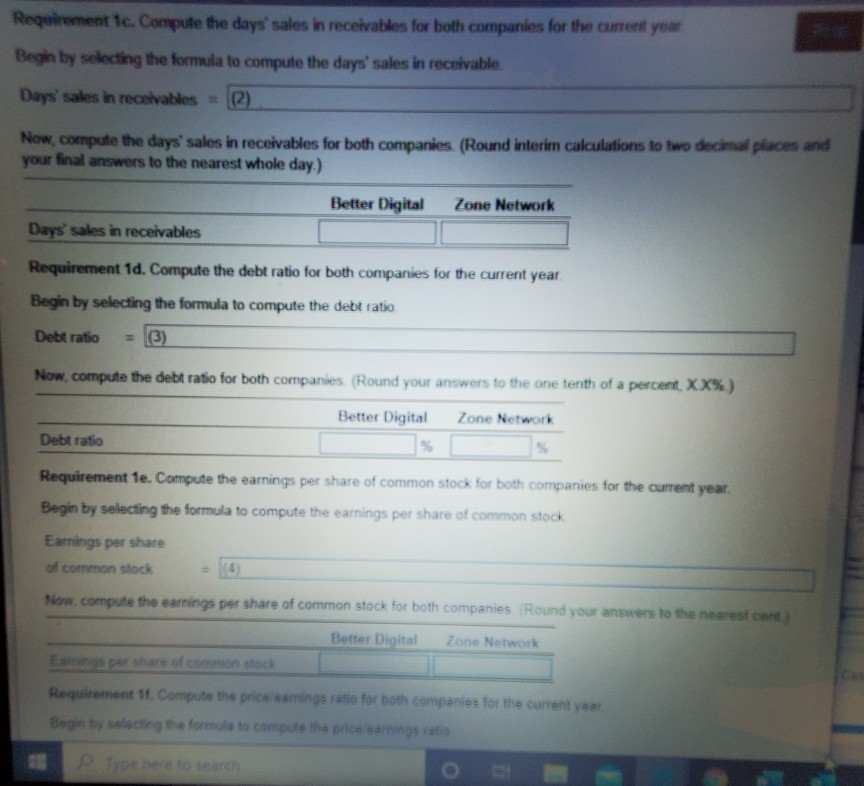

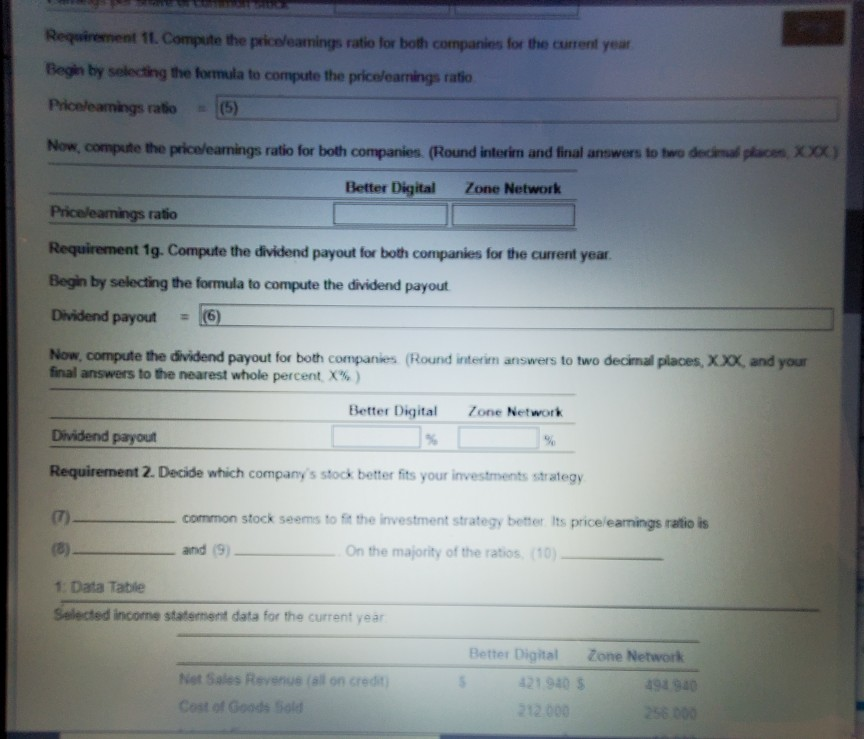

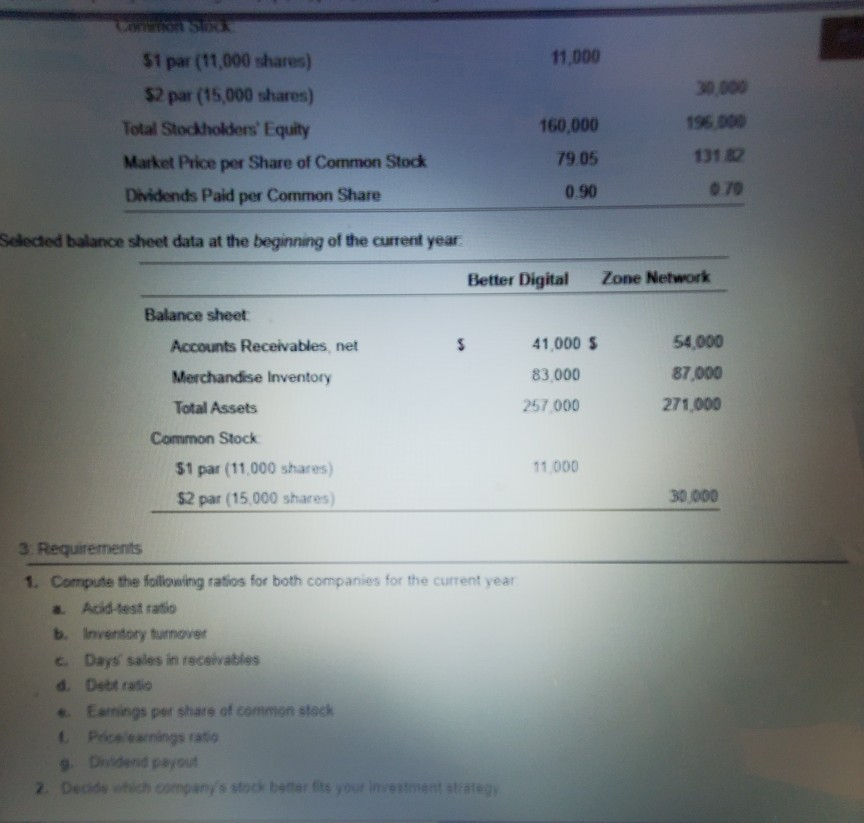

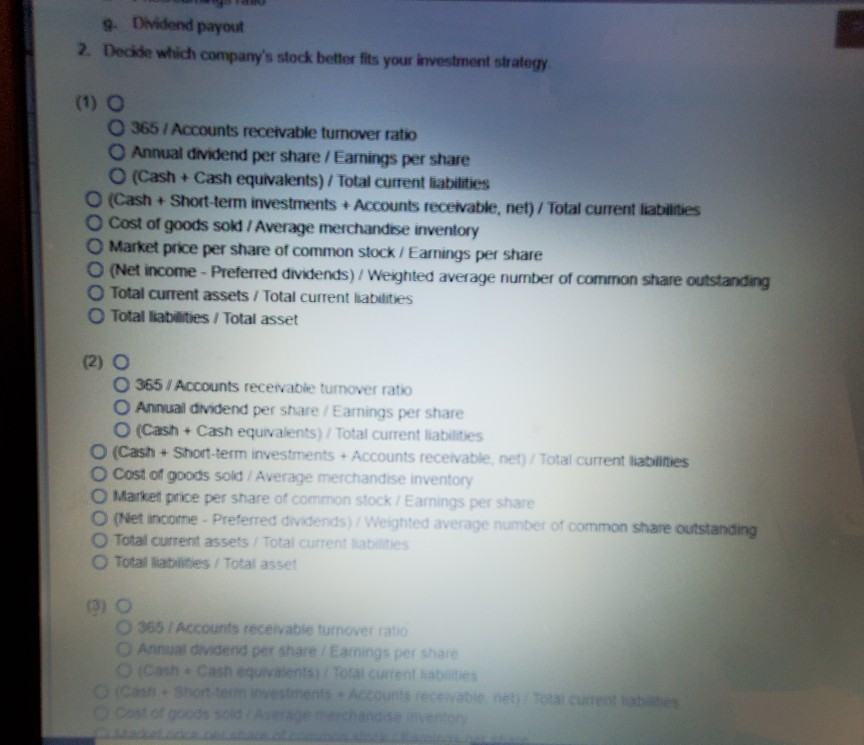

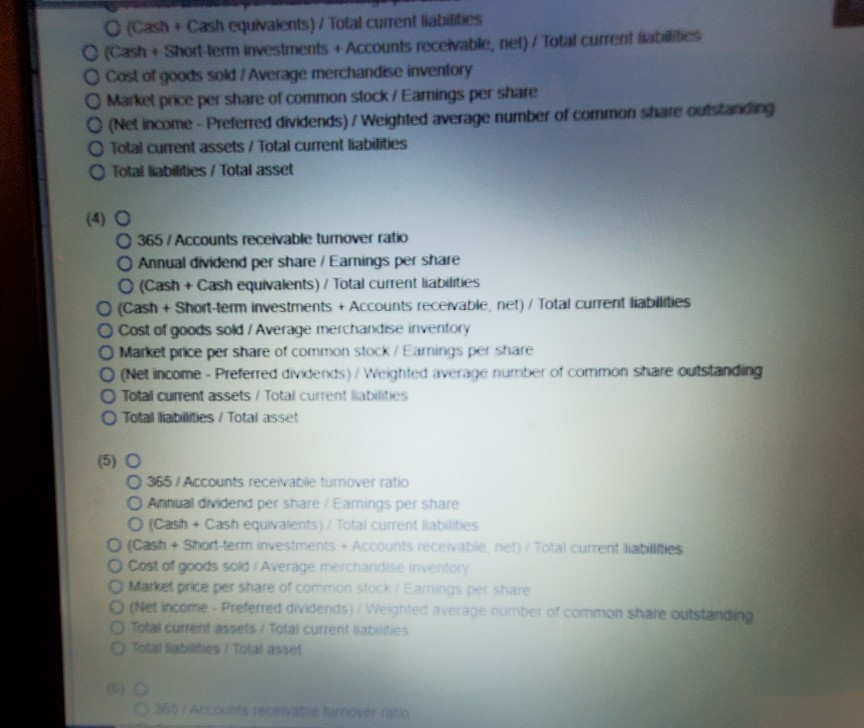

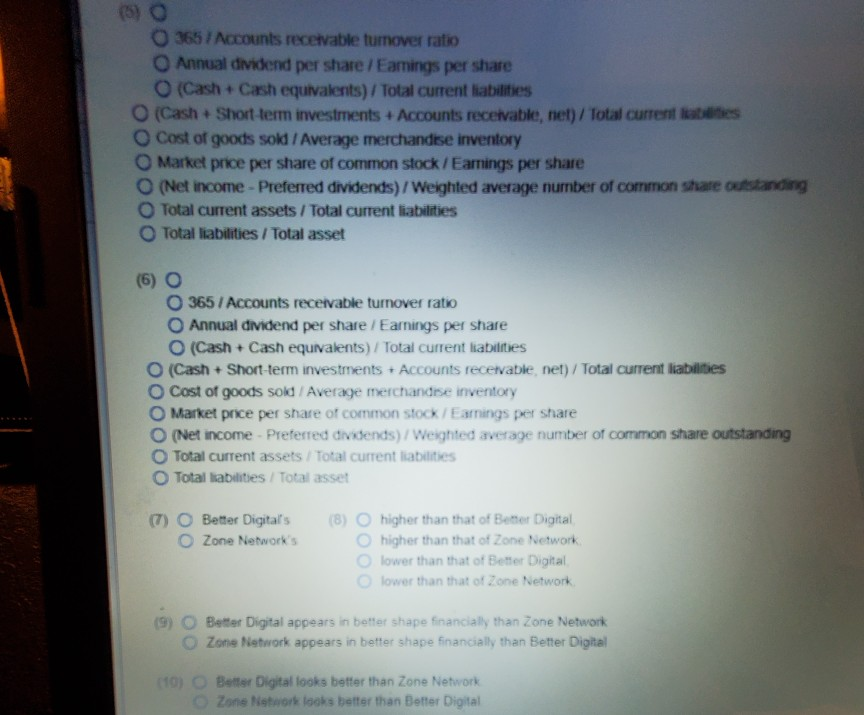

- Data Table Selected income statement data for the current year Better Digital Zone Network $ 421.940 S 494 940 Net Sales Revenue (all on credit) Cost of Goods Sold 212.000 256,000 0 18.000 Interest Expense Net Income 58.000 76,000 Print Done Data Table Seleded balance sheet and market price data at the end of the current year Better Digital Zone Network Current Assets Cash 27,000 $ 16,000 Short-term Investments 42,000 17,000 47,000 Accounts Receivables, Net Merchandise Inventory Prepaid Expenses 38 000 64 000 17.000 98,000 15,000 $ 188 000 $ 193.000 Total Current Assets Total Assets Total Current Liabilities $ 263 000 $ 103.000 103.000 325.000 97.000 129 000 Total Liabilities ay Print Done Data Table Total Liabilities 103,000 129.000 Common Stock 11,000 30,000 $1 par (11,000 shares) $2 par (15,000 shares) Total Stockholders' Equity Market Price per Share of Common Stock Dividends Paid per Common Share 160,000 196.000 79.05 131.82 0.90 0.70 Selected balance sheet data at the beginning of the current year Better Digital Zone Network Balance sheet Accounts Receivables, net Merchandise Inventory S 41.000 $ 54,000 83.000 87.000 Print Done D Data Table 196,000 Total Stockholders' Equity Market Price per Share of Common Stock Dividends Paid per Common Share 160,000 79.05 131 82 0.90 0.70 Selected balance sheet data at the beginning of the current year Better Digital Zone Network 41.000 $ 83.000 Balance sheet Accounts Receivables.net Merchandise Inventory Total Assets Common Stock $1 par (11.000 shares) $2 par (15.000 shares) 54,000 87,000 271,000 257000 11 000 30,000 Print none 5. Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Better Digital Corp. and Zone Network, Inc. and have assembled the following data Click to view the income statement data) (Click to view the balance sheet and market price data) Your strategy is to invest in companies that have pricelearnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis Read the requirements Requirement 1a. Compute the acid-test ratio for both companies for the current year. Begin by selecting the formula to compute the acid-test ratio Adid test ratio = (Cash + Short-term investments + Accounts receivable net) / Total current liabilities Now.compute the acid-test ratio for both companies (Round your answers to two decimal places, XXX) Better Digital Zone Network Acid-test ratio Requirement 1b. Compute the inventory turnover for both companies for the current year Begin by selecting the formula to compute the inventory turnover. Inventory turnover = 1 Now, compute the inventory turnover for both companies Round your answers to two decimal places, XXX) Better Digital Zone Network Inventory tumover Requirement te. Compute the days sales in receivables for both companies for the current year Begin by selecting the formula to compute the days sales in receivable Requirement 1c. Compute the days' sales in receivables for both companies for the current year Begin by selecting the formula to compute the days' sales in receivable Days' sales in receivables = (2) Now, compute the days' sales in receivables for both companies. (Round interim calculations to two decimal places and your final answers to the nearest whole day.) Better Digital Zone Network Days' sales in receivables Requirement 1d. Compute the debt ratio for both companies for the current year Begin by selecting the formula to compute the debt ratio Debt ratio = (3) Now, compute the debt ratio for both companies (Round your answers to the one tenth of a percent, XX%) Better Digital Zone Network Debt ratio Requirement 1e. Compute the earnings per share of common stock for both companies for the current year. Begin by selecting the formula to compute the earnings per share of common stock Earnings per share of common stock Now.compute the earnings per share of common stock for both companies Round your answers to the nearest cent Better Digital Zone Network E posh of common stock Requirement 11. Compute the pricelearnings ratio for both companies for the current year Begin by cing the formula to compute the price aming tao Type here to read Requirement i Compute the pricelearnings ratio for both companies for the current year Begin by selecting the formula to compute the pricelearnings ratio Pricelearnings rabio (5) Now, compute the price/earnings ratio for both companies. (Round interim and final answers to two decimal places XD) Better Digital Zone Network Priceleamings ratio Requirement 19. Compute the dividend payout for both companies for the current year Begin by selecting the formula to compute the dividend payout Dividend payout = (6) Now, compute the dividend payout for both companies (Round interim answers to two decimal places, XXX, and your final answers to the nearest whole percent X%) Better Digital Zone Network Dividend payout Requirement 2. Decide which company's stock better fits your investments strategy common stock seems to fit the investment strategy better Its pricelearnings ratio is and 9 On the majority of the ratios (10) (8) 1. Data Table Selected income statement data for the current year Net Sales Revenue (all on credit Cost of Goods Sold Better Digital Zone Network 421 980 $ 212.000 Data Tab Selected income statement data for the current year Net Sales Revenue (all on credit) Cost of Goods Sold Better Digital Zone Network 421,940 5 494,940 212,000 256 000 0 18,000 58,000 76,000 Interest Expense Net Income 2 Data Table Selected balance sheet and market price data at the end of the current year Better Digital Zone Network 27 000 $ 42.000 Current Assets Cash Short-term Investments Accounts Receivables Net Merchandise Inventory Prepaid Expenses 16 000 17.000 47.000 38 000 54 000 98 000 15,000 17 000 5 158.000 S 193.000 Total Current Assets Total Assets 253 000 $ 103000 103000 Total Current Liabilities Total Liabilities Common Sted 51 par (11 000 shares) 325 000 97.000 129.000 Net Sales Revenue (all on credit) Cost of Goods Sold Better Digital 421,940 5 212,000 0 Interest Expense Net Income 58,000 76.000 ance sheet and market price data at the end of the current year Better Digital Zone Network Current Assets Cash $ 27 000 $ 16,000 42 000 17.000 Short-term Investments Accounts Receivables Net 38 000 Merchandise Inventory 64 000 17 000 47.000 98,000 15.000 Prepaid Expenses 158 000 $ 193 000 Total Current Assets Total Assets Total Current Liabilities $ 325.000 263.000 $ 103.000 97.000 103.000 129.000 Common Stoc 11,000 51 par (11,000 shares) 52 par (15,000 shares) Total Stockholders' Equity Market Price per Share of Common Stock Dividends Paid per Common Share 160,000 79 05 0.90 Selected balance sheet data at the beginning of the current year. Better Digital Zone Network $ 41,000 $ Balance sheet Accounts Receivables net Merchandise Inventory Total Assets Common Stock $1 par (11.000 shares) $2 par (15.000 shares) 83.000 257 000 54,000 87.000 271.000 11 000 30 000 3 Requirements 1. Compute the following ratios for both companies for the current year Acid-test ratio b. Inventory turnover cDays' sales in receivables d Debt ratio Earnings per share of common stock Pecelearnings ratio 9. Dividend payout 2. Decide which company's stock better fits your investment strategy - Dividend payout 2. Decide which company's stock better fits your investment strategy (1) O 0 365 / Accounts receivable turnover ratio Annual dividend per share / Earnings per share O (Cash Cash equivalents) / Total current liabilities O (Cash Short-term investments + Accounts receivable, net) / Total current liabilities Cost of goods sold / Average merchandise inventory Market price per share of common stock/Earnings per share O (Net income - Preferred dividends) / Weighted average number of common share outstanding Total current assets/Total current liabilities Total liabilities / Total asset 0 365 / Accounts receivable turnover ratio O Annual dividend per share / Earnings per share O (Cash + Cash equivalents) / Total current liabilities O (Cash + Short-term investments + Accounts receivable, net/ Total current liabilities Cost of goods sold / Average merchandise inventory Market price per share of common stock / Earnings per share (Net income - Preferred dividends) Weighted average number of common share outstanding Total current assets/Total current abates Total liabilities / Total asset 365 I Accounts receivable turnover ratio Annual dividend per share / Earnings per share Cash Cash equivalents/Total current abates O Cash Short term investments Accounts receivable et Total currenties (Cash Cash equivalents) / Total current liabilities (Cash Short-term investments Accounts receivable, net) / Total current sites Cost of goods sold / Average merchandise inventory Market price per share of common stock/Earnings per share (Net Income - Preferred dividends) / Weighted average number of common share outstanding Total current assets / Total current liabilities Total abilities/ Total asset 0 365 / Accounts receivable turnover ratio Annual dividend per share / Earnings per share O (Cash + Cash equivalents) / Total current liabilities (Cash + Short-term investments + Accounts receivable net)/Total current liabilities Cost of goods sold / Average merchandise inventory Market price per share of common stock/ Earnings per share (Net income - Preferred dividends) / Weighted average number of common share outstanding Total current assets / Total current abilities Total liabilities / Total asset (5) O 0 365 / Accounts receivable turnover ratio O Annual dividend per share 'Earnings per share O Cash Cash equivalents) Total current liabilities O (Cash + Short-term investments Accounts receivable net) Total current liabilities Cost of goods sold / Average merchandise inventory Market price per share of common stock Eam nos per share (Net income - Preferred dividends) Weighted average number of common share outstanding Total current assets / Total current liabilities Total Babies / Total asset 0 365 / Accounts receivable turnover ratio Annual dividend per share/Eamings per share (Cash + Cash equivalents) / Total current liabilities (Cash + Short-term investments + Accounts receivable, net) / Total current les Cost of goods sold / Average merchandise inventory Market price per share of common stock /Earnings per share O (Net income - Preferred dividends) / Weighted average number of common share outstanding Total current assets / Total current liabilities Total liabilities / Total asset (6) O 365 / Accounts receivable turnover ratio Annual dividend per share / Earnings per share O (Cash + Cash equivalents) / Total current liabilities (Cash + Short-term investments + Accounts receivable net) / Total current liabilities Cost of goods sold / Average merchandise inventory Market price per share of common stock /Earnings per share (Net income - Preferred dividends) / Weighted average number of common share outstanding Total current assets/Total current liabilities Total liabilities / Total asset Better Digital's O Zone Network's (8) higher than that of Bener Digital higher than that of Zone Network lower than that of Better Digital lower than that of Zone Network Better Digital appears in better shape fnancially than Zone Network Zone Network appears in better shape financially than Better Digital (10) Better Digital looks better than Zone Network Zone Network looks better than Better Digital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started