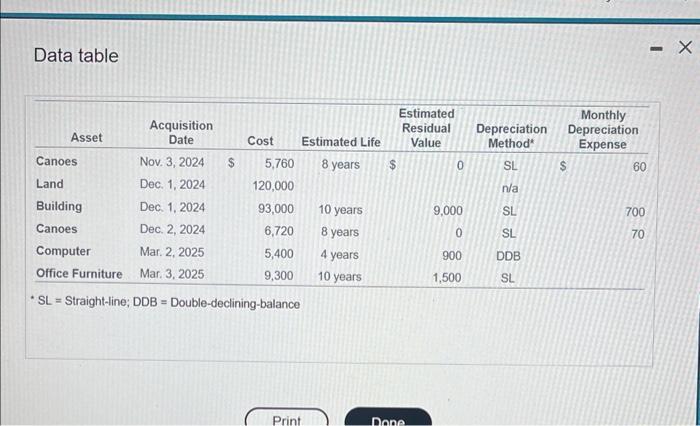

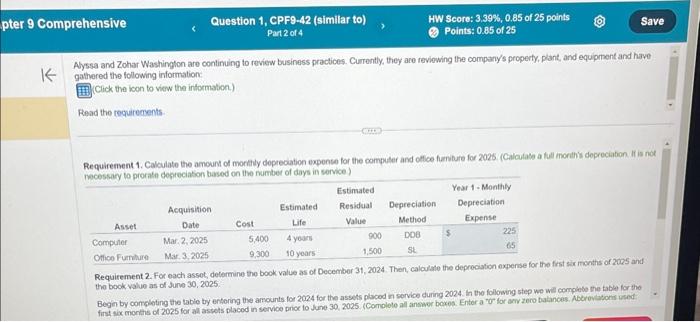

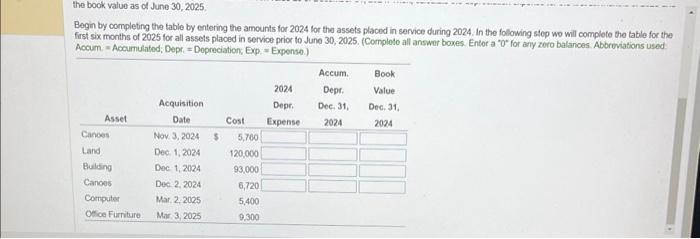

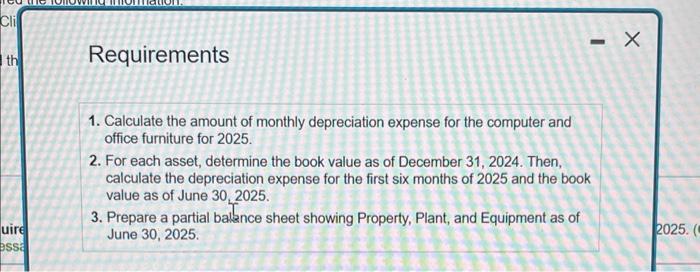

Data table - SL = Straight-line; DDB = Double-declining-balance Alyssa and Zohar Washingfon are continuing to review business proctices. Currently, they are reviowing the compary/s property, plant, and equipment and have gathered the tollowing information: Click the icon to view the intormation.) Read the tequirectents necessacy to prorate degreciason basod on the rumber of days in service) Requirement 2. For each asset, determine the book vilue as of Decembor 31, 2024. Then, calculate the depreciaton experne uri the frist sir months of 2025 and the book valuo as of Juno 30,2025 Begin by completing the tabie by entoring the amounts for 2024 for the assets placod ni service during 2024 . in the following step we will complete the table for the the book value as of June 30,2025 , Begin by completing the table by entering the amounts for 2024 lor the assets placed in service during 2024 , In the following step wo will complete the table for the first six months of 2025 for all assets placed in service prior to June 30, 2025. (Complote all answer boxes. Entor a "0" for any zero balances Abbreviations used Accum = Acournulatod; Depr, = Depreciation, Exp = Expense.) Requirements 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2025. 2. For each asset, determine the book value as of December 31,2024 . Then, calculate the depreciation expense for the first six months of 2025 and the book value as of June 30,2025. 3. Prepare a partial balsnce sheet showing Property, Plant, and Equipment as of June 30,2025. Data table - SL = Straight-line; DDB = Double-declining-balance Alyssa and Zohar Washingfon are continuing to review business proctices. Currently, they are reviowing the compary/s property, plant, and equipment and have gathered the tollowing information: Click the icon to view the intormation.) Read the tequirectents necessacy to prorate degreciason basod on the rumber of days in service) Requirement 2. For each asset, determine the book vilue as of Decembor 31, 2024. Then, calculate the depreciaton experne uri the frist sir months of 2025 and the book valuo as of Juno 30,2025 Begin by completing the tabie by entoring the amounts for 2024 for the assets placod ni service during 2024 . in the following step we will complete the table for the the book value as of June 30,2025 , Begin by completing the table by entering the amounts for 2024 lor the assets placed in service during 2024 , In the following step wo will complete the table for the first six months of 2025 for all assets placed in service prior to June 30, 2025. (Complote all answer boxes. Entor a "0" for any zero balances Abbreviations used Accum = Acournulatod; Depr, = Depreciation, Exp = Expense.) Requirements 1. Calculate the amount of monthly depreciation expense for the computer and office furniture for 2025. 2. For each asset, determine the book value as of December 31,2024 . Then, calculate the depreciation expense for the first six months of 2025 and the book value as of June 30,2025. 3. Prepare a partial balsnce sheet showing Property, Plant, and Equipment as of June 30,2025