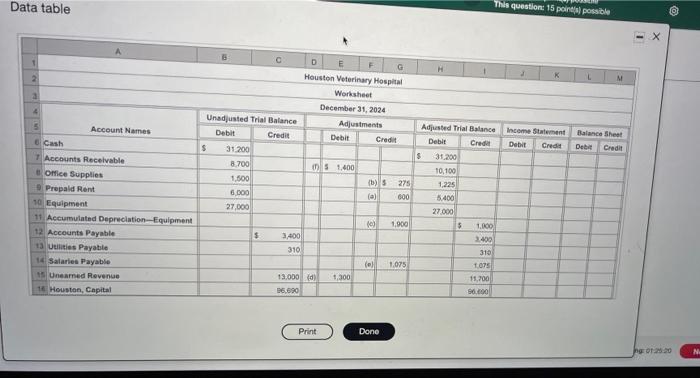

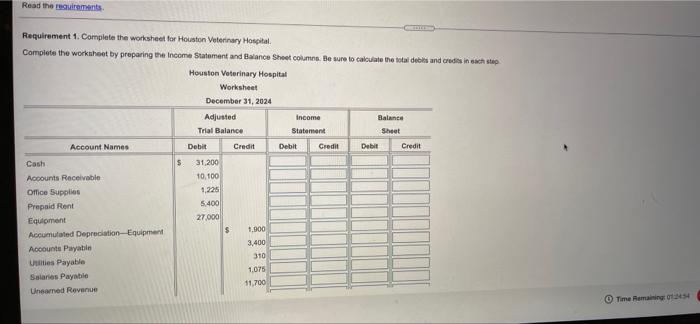

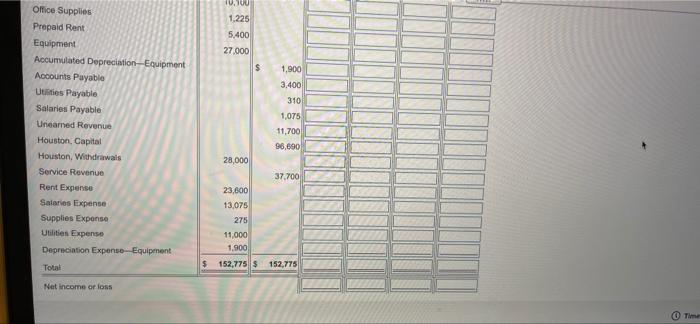

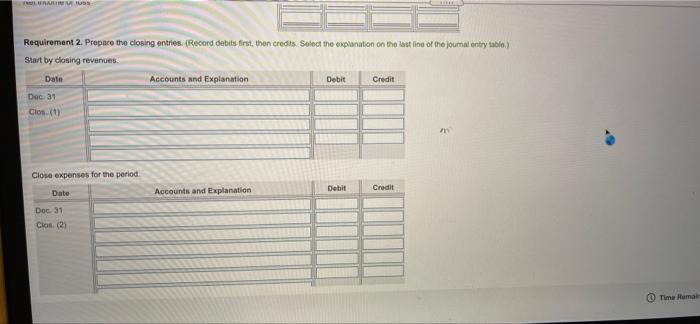

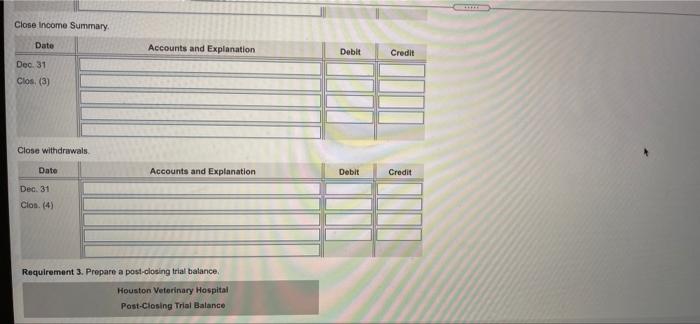

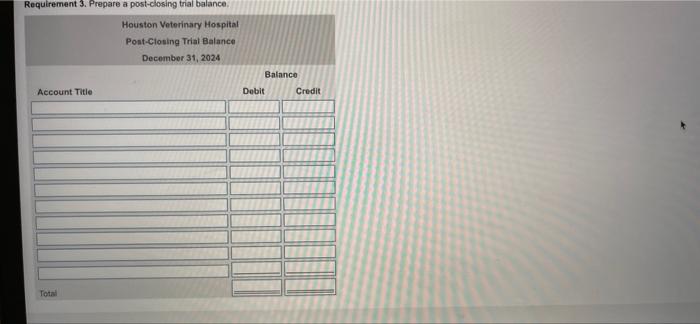

Data table This question: 15 point possible 1 2 M a D E G Houston Veterinary Hospital Worksheet December 31, 2024 Adjustments Debit Credit 4 Unadjusted Trial Balance Debit Credit Income Statement Debit Cred Balance Sheet Debe Credit $ Adjusted Trial Balance Debit Cred $ 31.200 10.100 1,225 S 1.400 31.200 8.700 1.500 6 000 27,000 3 Account Names Cash 7 Accounts Receivable Office Supplies Prepaid Rent 10 Equipment 11 Accumulated Depreciation ---Equipment Accounts Payable 13 Utilities Payable 14 Salaries Payable 15 Uneamed Revenue 16 Houston, Capital (5) 5 275 (a) 600 5.400 27.000 5 1.900 1.000 $ 3,400 310 3400 (e 1.075 1,300 13.000 de 36.690 310 1075 11,700 90.000 Print Done ng 20 N. Read the requirements Requirement 1. Complete the worksheet for Houston Veterinary Hospital Complete the worksheet by preparing the Income Statement and Balance Sheet columns. Be sure to calculate the total debitis and credits in sach step Houston Veterinary Hospital Worksheet December 31, 2024 Adjusted Income Balance Trial Balance Statement Sheet Account Names Debit Credit Debit Credit Debit Credit Cash $ 31,200 Accounts Receivable 10.100 Office Supplies 1,225 Prepaid Rent 5.400 Equipment 27.000 Accumulated Depreciation Equipment $ 1,000 3,400 Accounts Payable 310 Units Payable 1,075 Salones Payable Uneared Revenue 11,700 Time Remaining 10,00 1.225 5.400 27.000 $ Office Supplies Prepaid Rent Equipment Accumulated Depreciation-Equipment Accounts Payable Uuties Payable Salaries Payable Uneamed Revenue Houston, Capital Houston, Withdrawals Service Revenue Rent Expense Salaries Expense Supplies Exponse Utilities Expense Depreciation Expense-Equipment 1,900 3.400 310 1,075 11,700 96,690 28,000 37.700 23,600 13.075 275 11,000 1.900 Total 152,775 $ 152,775 Net income or loss Time FRAU Requirement 2. Prepare the closing entries (Record debits first, then credits. Select the explanation on the last line of the journal entry table) Start by closing revenues Date Accounts and Explanation Debit Credit Dec. 31 Clos) Close expenses for the period Date Accounts and explanation Debit Credit Doc 31 Clos (2) Time Hamar Close Income Summary Dato Accounts and Explanation Debit Credit Dec 31 Clos (3) Close withdrawals Date Accounts and Explanation Debit Credit Dec 31 Clon. (4) Requirement 3. Prepare a post-closing trial balance Houston Veterinary Hospital Post-Closing Trial Balance Requirement 3. Prepare a post-closing trial balance Houston Veterinary Hospital Pont-Closing Trial Balance December 31, 2024 Balance Debit Credit Account Title Total