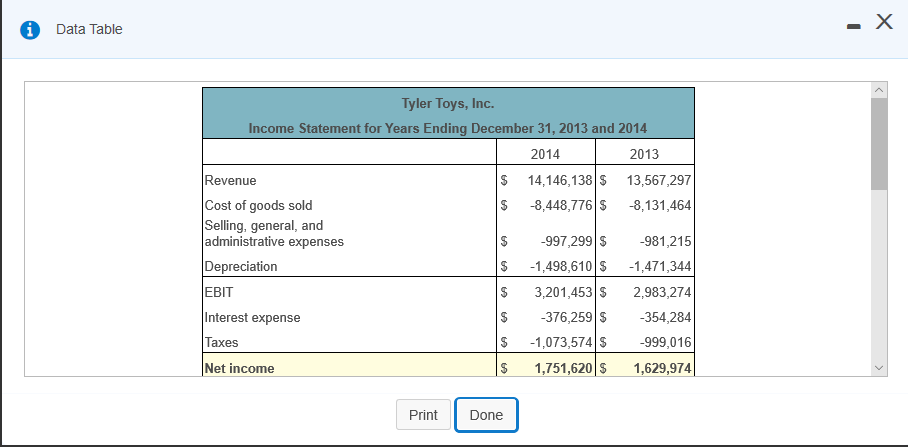

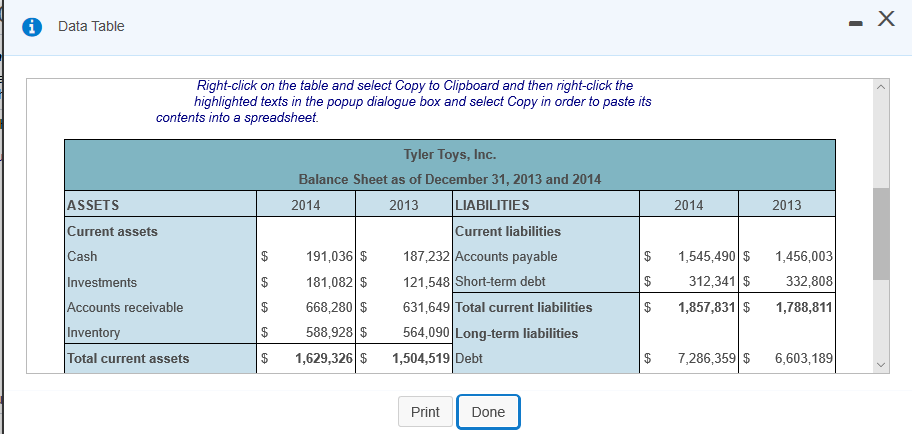

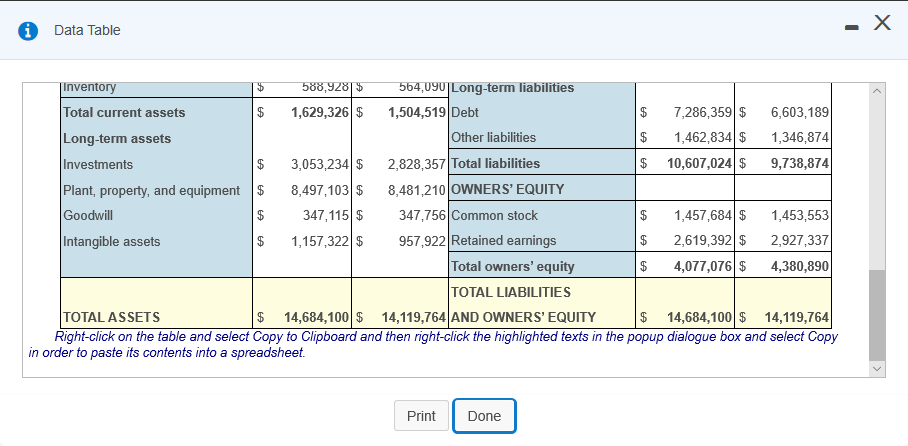

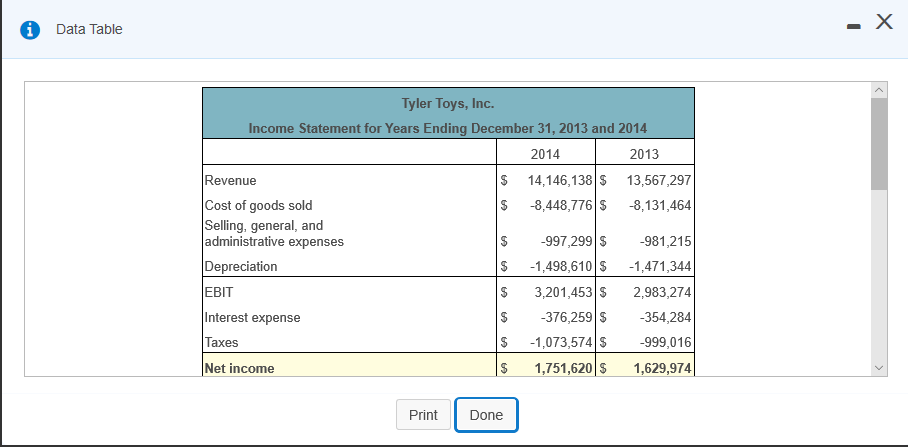

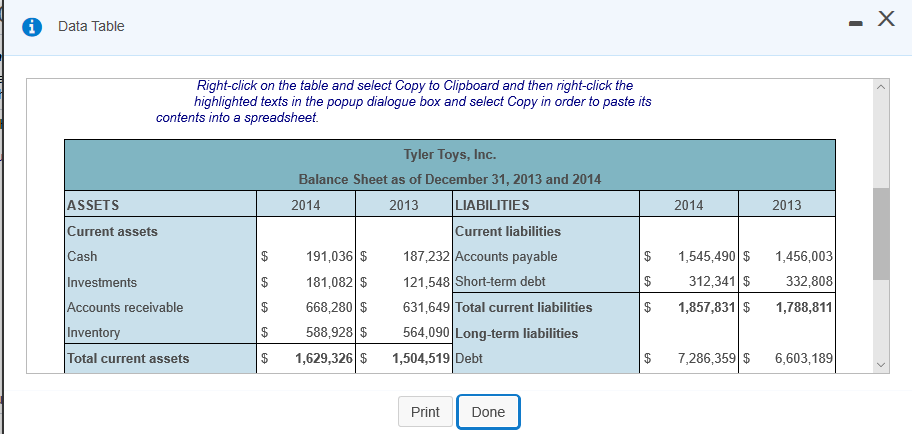

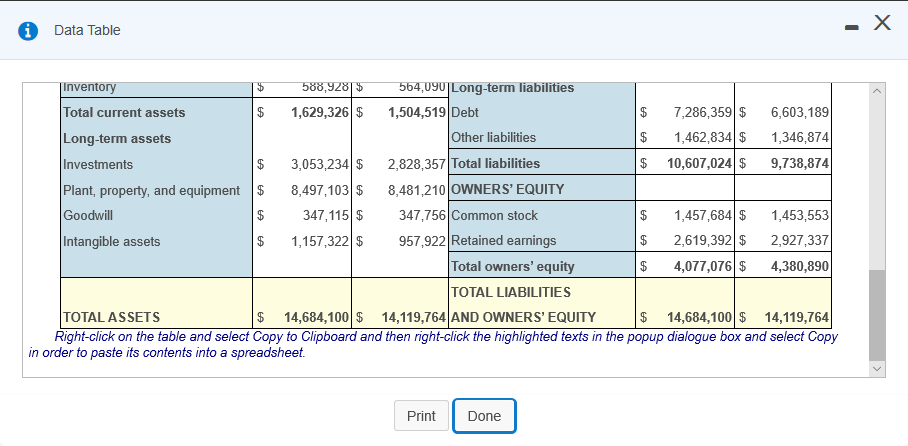

Data Table Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $ 14,146,138 $ 13,567,297 Cost of goods sold $ 8,448,776 $ -8,131,464 Selling, general, and administrative expenses $ -997,299 S - 981,215 Depreciation $ -1,498,610 $ -1,471,344 EBIT $ 3,201,453 S 2,983,274 Interest expense $ -376,259 $ -354,284 Taxes $ -1,073,574 $ -999,016 Net income $ 1,751,620s 1,629,974|| Print Done 0 Data Table Right click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet. Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES 2014 2013 ASSETS Current assets A Cash A Investments Current liabilities 187,232 Accounts payable 121,548 Short-term debt 631,649 Total current liabilities 564,090 Long-term liabilities 1,504,519 Debt 191,036 $ 181,082 $ 668,280 $ 588,928 $ 1,629,326 $ $ $ $ 1,545,490 $ 312,341 $ 1,857,831 $ 1,456,003 332,808 1,788,811 A Accounts receivable A Inventory Total current assets $ $ 7,286,359 $ 6,603,189 [Print Print Done Done] 0 Data Table - X Inventory $ 588,928 $ 564,090|Long-term liabilities Total current assets $ 1,629,326 $ 1,504,519 Debt $ 7,286,359 $ 6,603,189 Long-term assets Other liabilities $ 1,462,834 $ 1,346,874 Investments $ 3,053,234 $ 2,828,357 Total liabilities $ 10,607,024 $ 9,738,874 Plant, property, and equipment $ 8,497,103 $ 8,481,210 OWNERS' EQUITY Goodwill $ 347,115 $ 347,756 Common stock $ 1,457,684 $ 1,453,553 Intangible assets 1,157,322 $ 957,922 Retained earnings $ 2,619,392 $ 2,927,337 Total owners' equity $ 4,077,076 $ 4,380,890 TOTAL LIABILITIES TOTAL ASSETS $ 14,684,100 $ 14,119,764 AND OWNERS' EQUITY $ 14,684,100 $ 14,119,764 Right click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet. Print Done Financial ratios: Financial leverage. The financial statements for Tyler Toys, Inc. are shown in the popup window: 2. Calculate the debt ratio, times interest earned ratio, and cash coverage ratio for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the debt ratio for 2014? (Round to four decimal places.)