Answered step by step

Verified Expert Solution

Question

1 Approved Answer

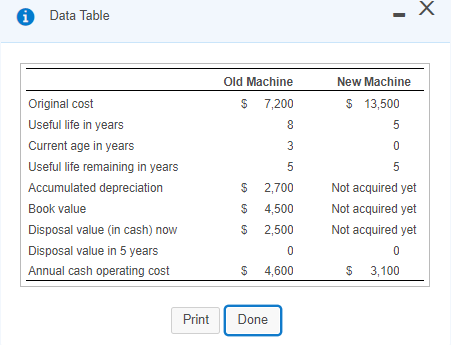

Data Table x Old Machine $ 7,200 8 New Machine $ 13,500 5 0 5 3 5 5 Original cost Useful life in years Current

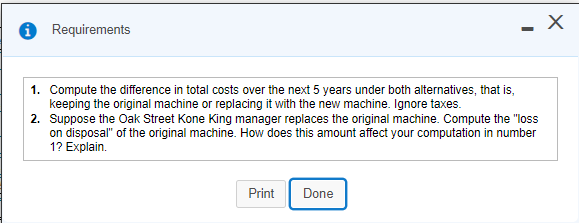

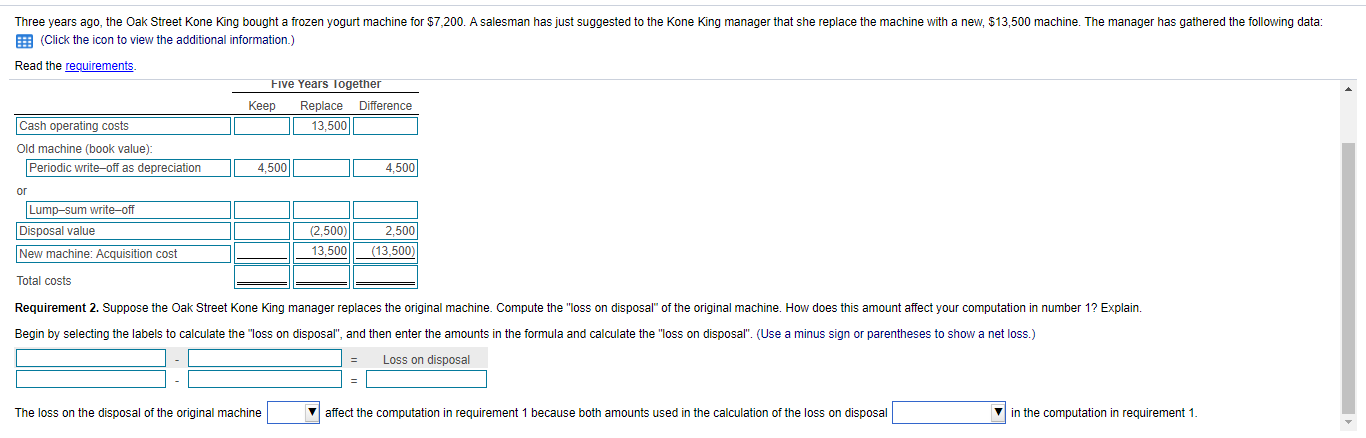

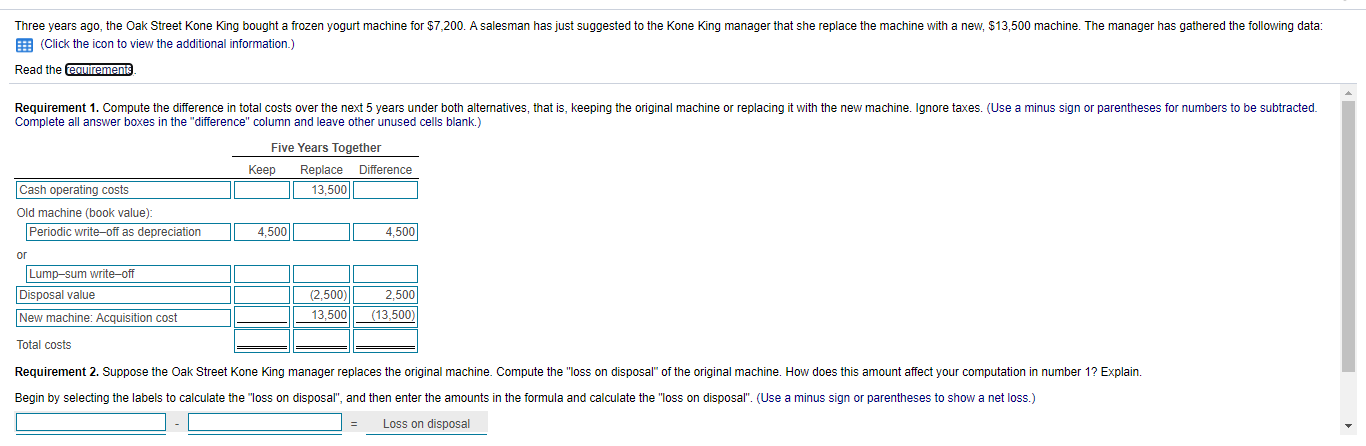

Data Table x Old Machine $ 7,200 8 New Machine $ 13,500 5 0 5 3 5 5 Original cost Useful life in years Current age in years Useful life remaining in years Accumulated depreciation Book value Disposal value in cash) now Disposal value in 5 years Annual cash operating cost $ 2,700 $ 4,500 $ 2,500 0 $ 4,600 Not acquired yet Not acquired yet Not acquired yet 0 $ 3,100 Print Done The Question: 25 pm This Quie: 100 proc. Threeya Sepete At Teen the cheese of Man . Requirements - X 1. Compute the difference in total costs over the next 5 years under both alternatives, that is, keeping the original machine or replacing it with the new machine. Ignore taxes. 2. Suppose the Oak Street Kone King manager replaces the original machine. Compute the "loss on disposal of the original machine. How does this amount affect your computation in number 1? Explain Print Done Three years ago, the Oak Street Kone King bought a frozen yogurt machine for $7,200. A salesman has just suggested to the Kone King manager that she replace the machine with a new, $13,500 machine. The manager has gathered the following data: E (Click the icon to view the additional information.) Read the requirements Requirement 1. Compute the difference in total costs over the next 5 years under both alternatives, that is, keeping the original machine or replacing it with the new machine. Ignore taxes. (Use a minus sign or parentheses for numbers to be subtracted. Complete all answer boxes in the "difference" column and leave other unused cells blank.) Five Years Together Keep Replace Difference Cash operating costs 13,500 Old machine (book value) Periodic write-off as depreciation 4,500 4,500 or Lump-sum write-off Disposal value New machine: Acquisition cost (2,500) 13,500 2.500 (13.500 Total costs Requirement 2. Suppose the Oak Street Kone King manager replaces the original machine. Compute the "loss on disposal of the original machine. How does this amount affect your computation in number 1? Explain. Begin by selecting the labels to calculate the loss on disposal", and then enter the amounts in the formula and calculate the "loss on disposal". (Use a minus sign or parentheses to show a net loss.) Loss on disposal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started