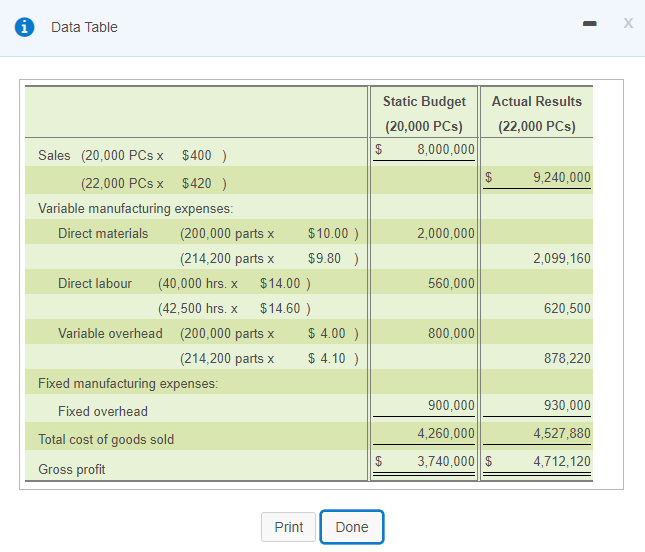

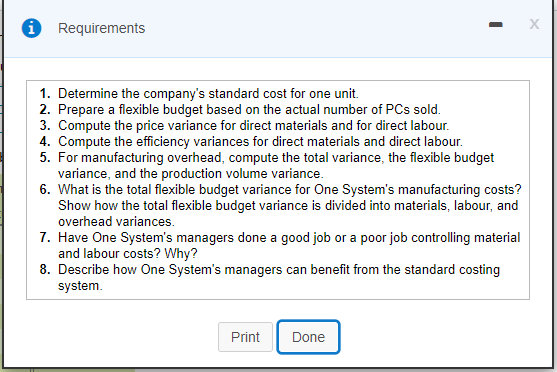

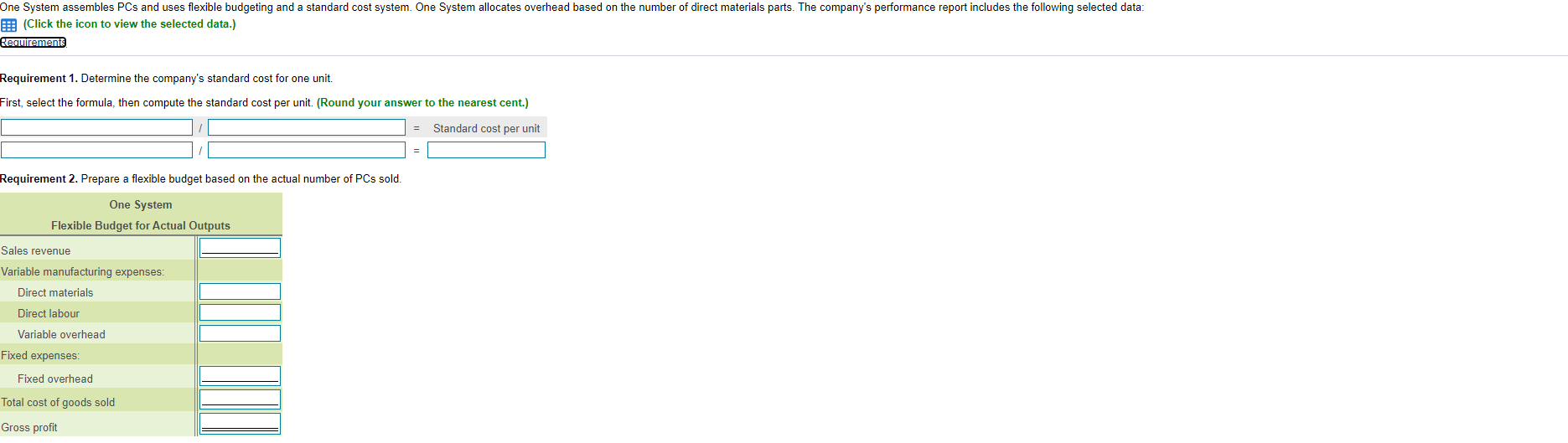

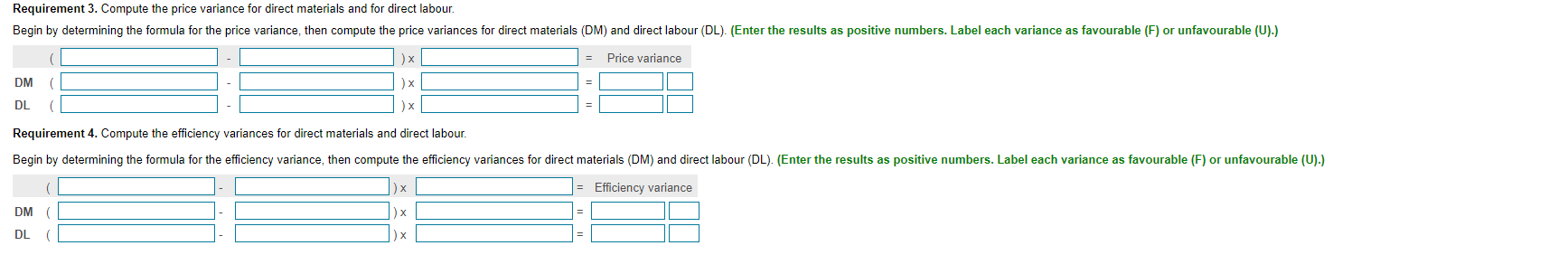

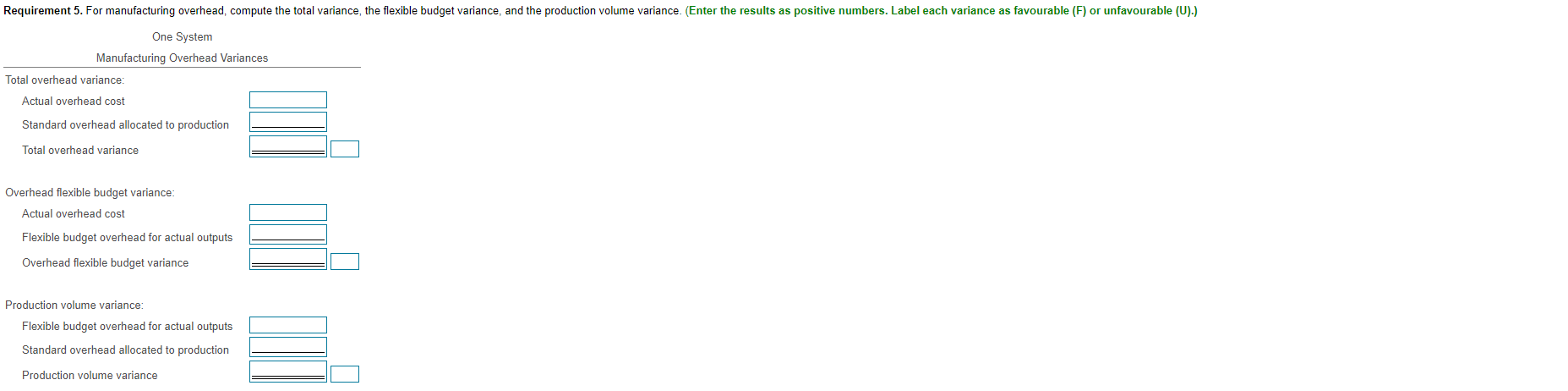

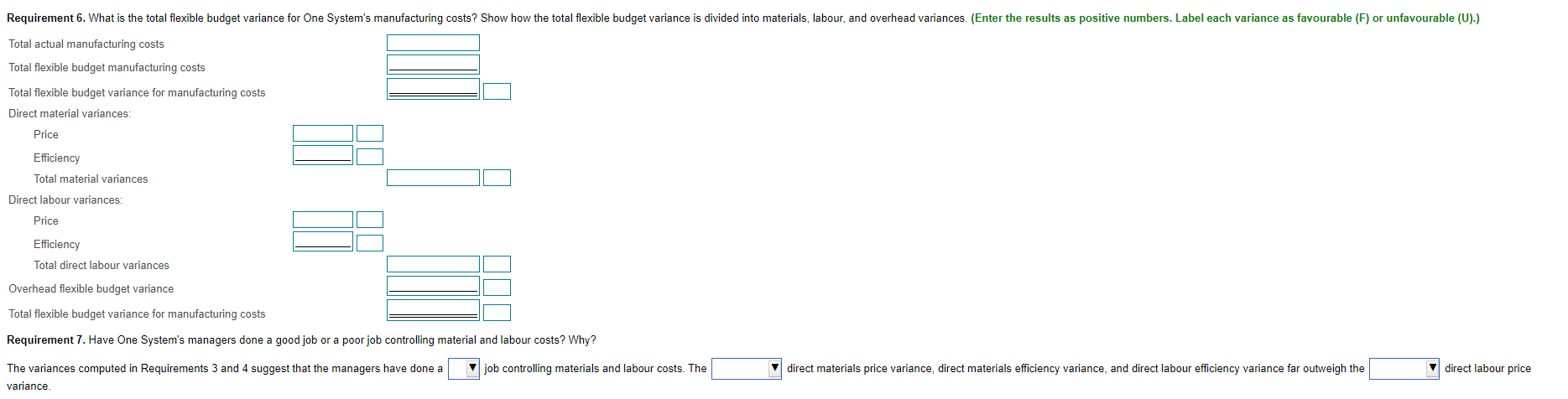

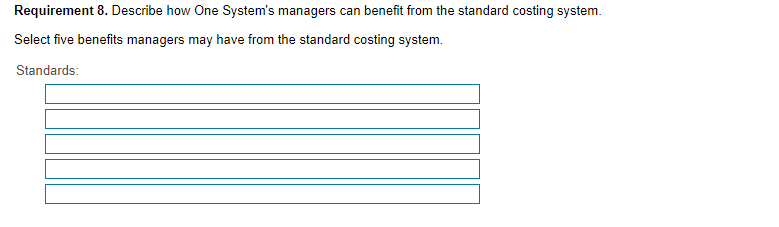

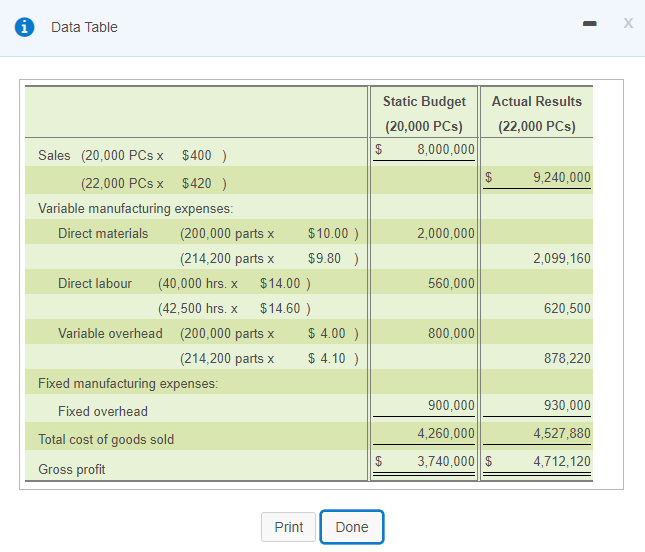

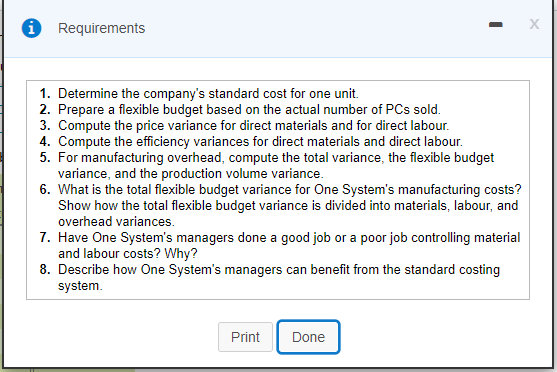

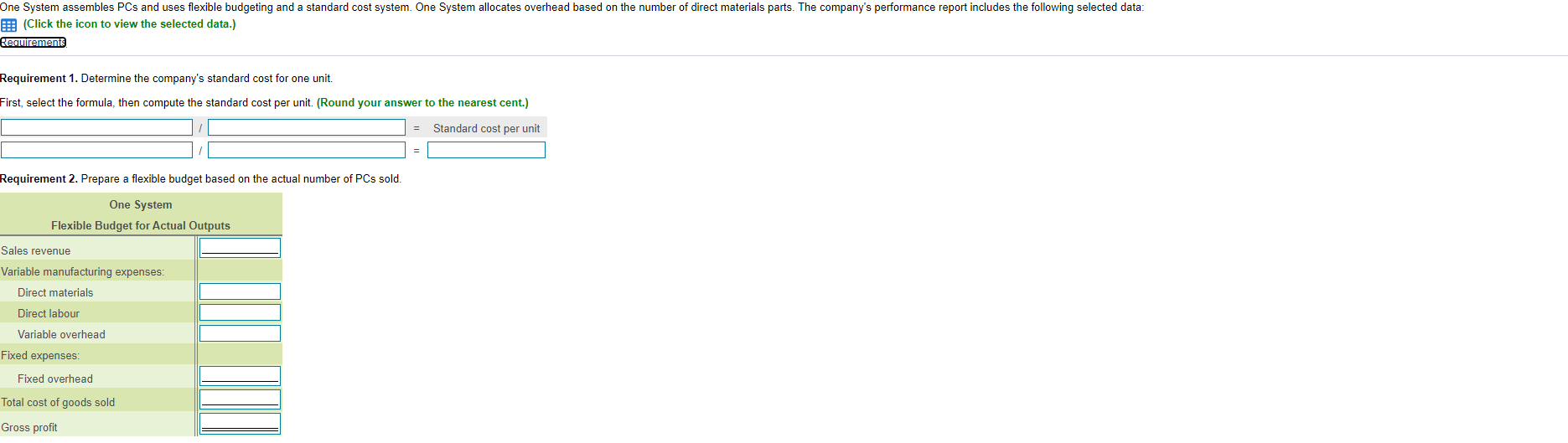

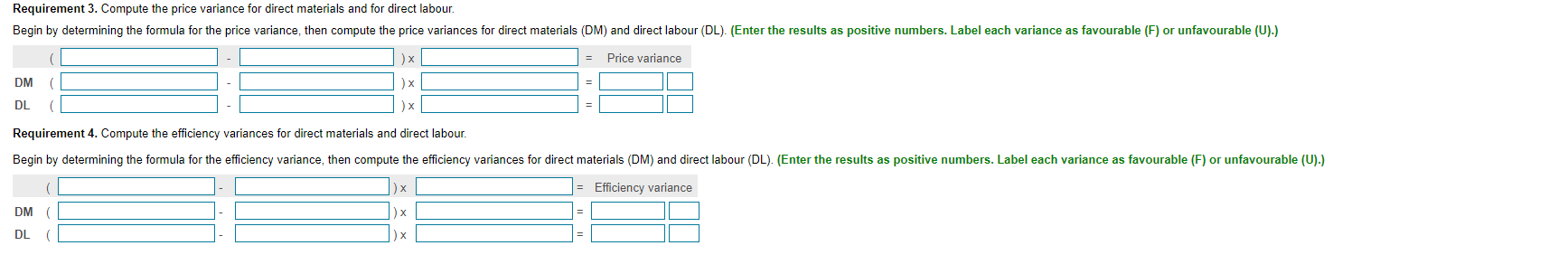

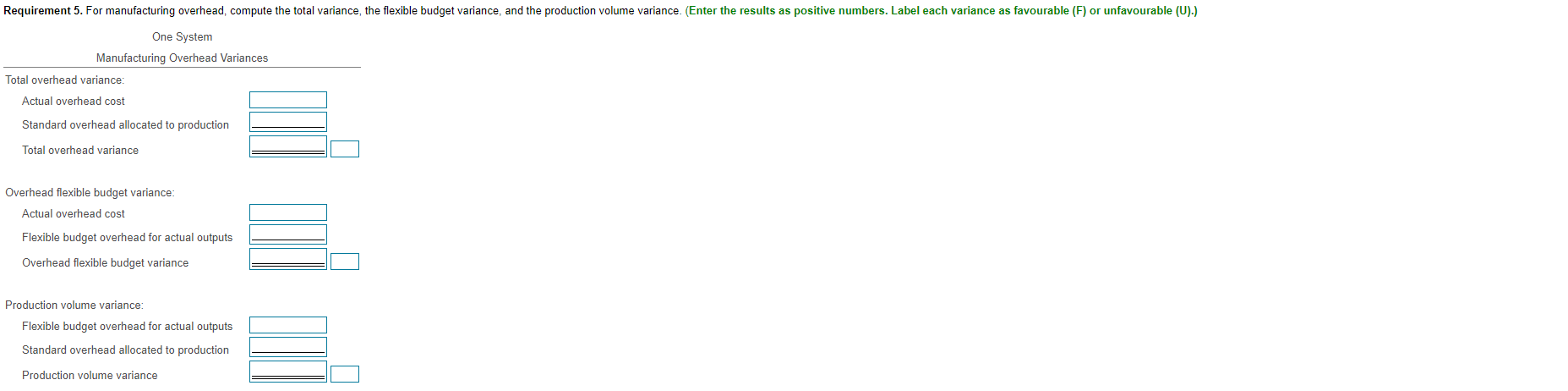

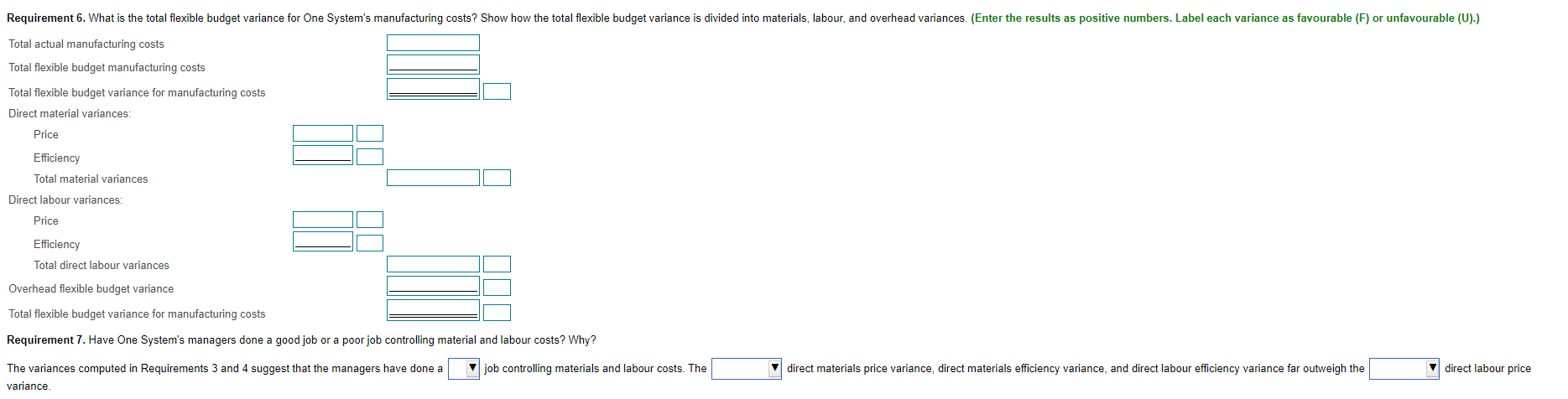

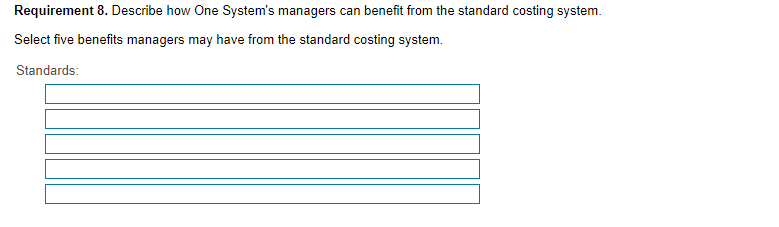

Data Table X Static Budget (20,000 PCs) $ 8,000,000 Actual Results (22,000 PCs) $ 9,240,000 2,000,000 2,099,160 560,000 Sales (20,000 PCs x $400 ) (22,000 PCs x $420 ) Variable manufacturing expenses: Direct materials (200,000 parts x $10.00 ) (214,200 parts x $9.80) Direct labour (40,000 hrs. * $14.00 ) (42,500 hrs. x $14.60 ) Variable overhead (200,000 parts x $ 4.00) (214,200 parts $ 4.10 ) Fixed manufacturing expenses: Fixed overhead Total cost of goods sold Gross profit 620,500 800,000 878,220 930,000 900,000 4,260,000 3,740,000 $ 4,527,880 4,712,120 $ Print Done i Requirements 1. Determine the company's standard cost for one unit. 2. Prepare a flexible budget based on the actual number of PCs sold. 3. Compute the price variance for direct materials and for direct labour. 4. Compute the efficiency variances for direct materials and direct labour. 5. For manufacturing overhead, compute the total variance, the flexible budget variance, and the production volume variance. 6. What is the total flexible budget variance for One System's manufacturing costs? Show how the total flexible budget variance is divided into materials, labour, and overhead variances. 7. Have One System's managers done a good job or a poor job controlling material and labour costs? Why? 8. Describe how One System's managers can benefit from the standard costing system Print Done One System assembles PCs and uses flexible budgeting and a standard cost system. One System allocates overhead based on the number of direct materials parts. The company's performance report includes the following selected data: : (Click the icon to view the selected data.) Requirements Requirement 1. Determine the company's standard cost for one unit. First, select the formula, then compute the standard cost per unit. (Round your answer to the nearest cent.) Standard cost per unit Requirement 2. Prepare a flexible budget based on the actual number of PCs sold. One System Flexible Budget for Actual Outputs Sales revenue Variable manufacturing expenses: Direct materials Direct labour Variable overhead Fixed expenses Fixed overhead Total cost of goods sold Gross profit Requirement 3. Compute the price variance for direct materials and for direct labour. Begin by determining the formula for the price variance, then compute the price variances for direct materials (DM) and direct labour (DL). (Enter the results as positive numbers. Label each variance as favourable (F) or unfavourable (U).) Price variance DM DL ( )x Requirement 4. Compute the efficiency variances for direct materials and direct labour. Begin by determining the formula for the efficiency variance, then compute the efficiency variances for direct materials (DM) and direct labour (DL). (Enter the results as positive numbers. Label each variance as favourable (F) or unfavourable (U).) )x Efficiency variance J) x DM ( DL ) x Requirement 5. For manufacturing overhead, compute the total variance, the flexible budget variance, and the production volume variance. (Enter the results as positive numbers. Label each variance as favourable (F) or unfavourable (U).) One System Manufacturing Overhead Variances Total overhead variance: Actual overhead cost Standard overhead allocated to production Total overhead variance Overhead flexible budget variance: Actual overhead cost Flexible budget overhead for actual outputs Overhead flexible budget variance Production volume variance: Flexible budget overhead for actual outputs Standard overhead allocated to production Production volume variance Requirement 6. What is the total flexible budget variance for One System's manufacturing costs? Show how the total flexible budget variance is divided into materials, labour, and overhead variances. (Enter the results as positive numbers. Label each variance as favourable (F) or unfavourable (U).) Total actual manufacturing costs Total flexible budget manufacturing costs Total flexible budget variance for manufacturing costs Direct material variances: Price Efficiency Total material variances Direct labour variances: Price Efficiency Total direct labour variances Overhead flexible budget variance Total flexible budget variance for manufacturing costs Requirement 7. Have One System's managers done a good job or a poor job controlling material and labour costs? Why? job controlling materials and labour costs. The The variances computed in Requirements 3 and 4 suggest that the managers have done a variance direct materials price variance, direct materials efficiency variance, and direct labour efficiency variance far outweigh the direct labour price Requirement 8. Describe how One System's managers can benefit from the standard costing system. Select five benefits managers may have from the standard costing system. Standards