Answered step by step

Verified Expert Solution

Question

1 Approved Answer

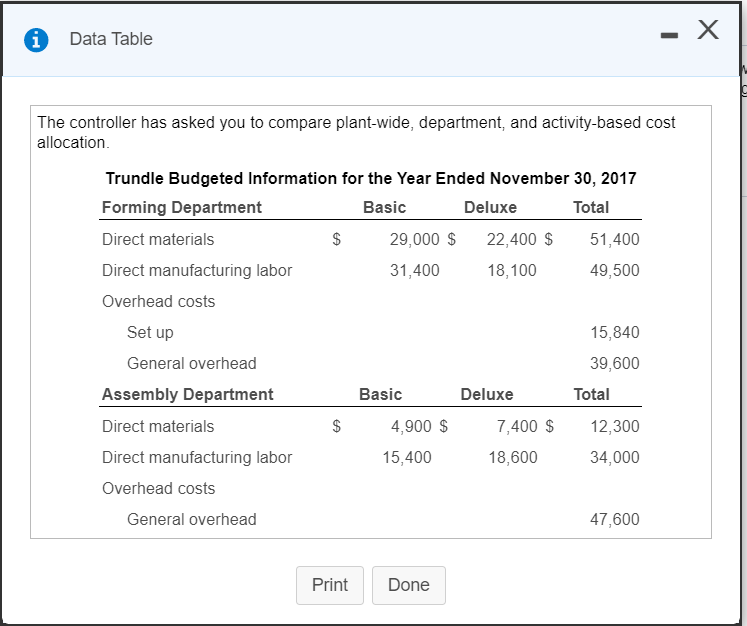

Data Table - - X The controller has asked you to compare plant-wide, department, and activity-based cost allocation. Trundle Budgeted Information for the Year

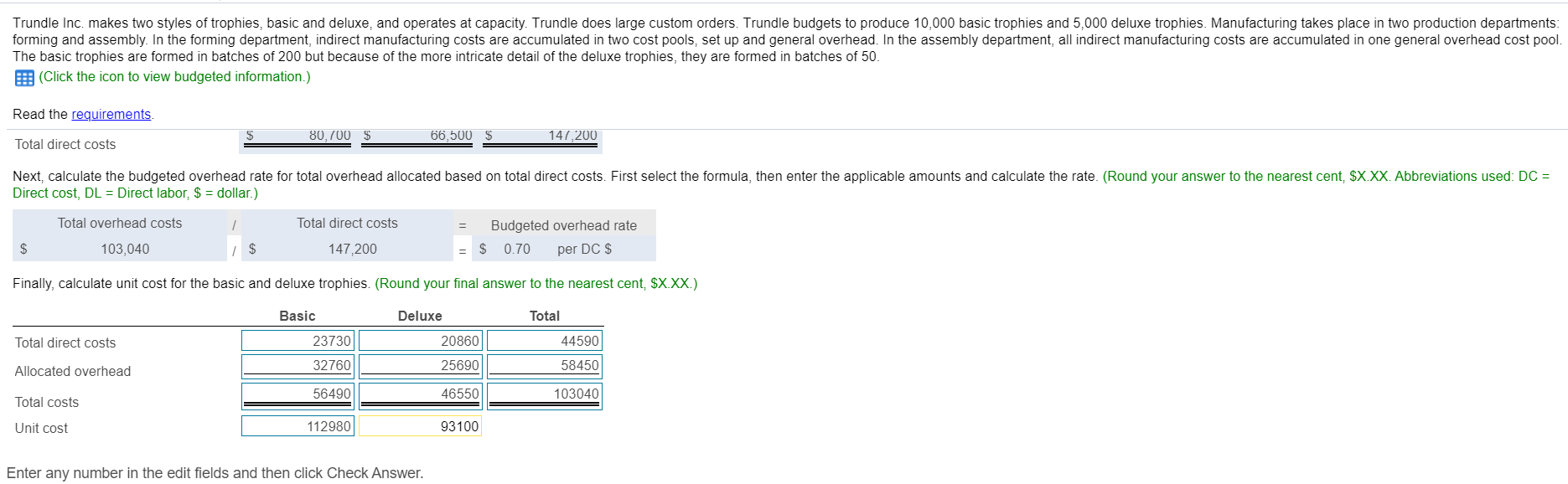

Data Table - - X The controller has asked you to compare plant-wide, department, and activity-based cost allocation. Trundle Budgeted Information for the Year Ended November 30, 2017 Forming Department Basic Deluxe Total Direct materials $ 29,000 $ 22,400 $ 51,400 Direct manufacturing labor 31,400 18,100 49,500 Overhead costs Set up General overhead Assembly Department Direct materials Direct manufacturing labor Overhead costs General overhead 15,840 39,600 Basic Deluxe Total $ 4,900 $ 7,400 $ 12,300 15,400 18,600 34,000 Print Done 47,600 Trundle Inc. makes two styles of trophies, basic and deluxe, and operates at capacity. Trundle does large custom orders. Trundle budgets to produce 10,000 basic trophies and 5,000 deluxe trophies. Manufacturing takes place in two production departments: forming and assembly. In the forming department, indirect manufacturing costs are accumulated in two cost pools, set up and general overhead. In the assembly department, all indirect manufacturing costs are accumulated in one general overhead cost pool. The basic trophies are formed in batches of 200 but because of the more intricate detail of the deluxe trophies, they are formed in batches of 50. (Click the icon to view budgeted information.) Read the requirements. Total direct costs 80,700 66,500 $ 147,200 Next, calculate the budgeted overhead rate for total overhead allocated based on total direct costs. First select the formula, then enter the applicable amounts and calculate the rate. (Round your answer to the nearest cent, $X.XX. Abbreviations used: DC = Direct cost, DL = Direct labor, $ = dollar.) Total overhead costs 103,040 / $ Total direct costs 147,200 Budgeted overhead rate = $ 0.70 per DC $ Finally, calculate unit cost for the basic and deluxe trophies. (Round your final answer to the nearest cent, $X.XX.) Total direct costs Allocated overhead Total costs Basic Deluxe Total 23730 20860 44590 32760 25690 58450 56490 46550 103040 112980 93100 Unit cost Enter any number in the edit fields and then click Check Answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started