Answered step by step

Verified Expert Solution

Question

1 Approved Answer

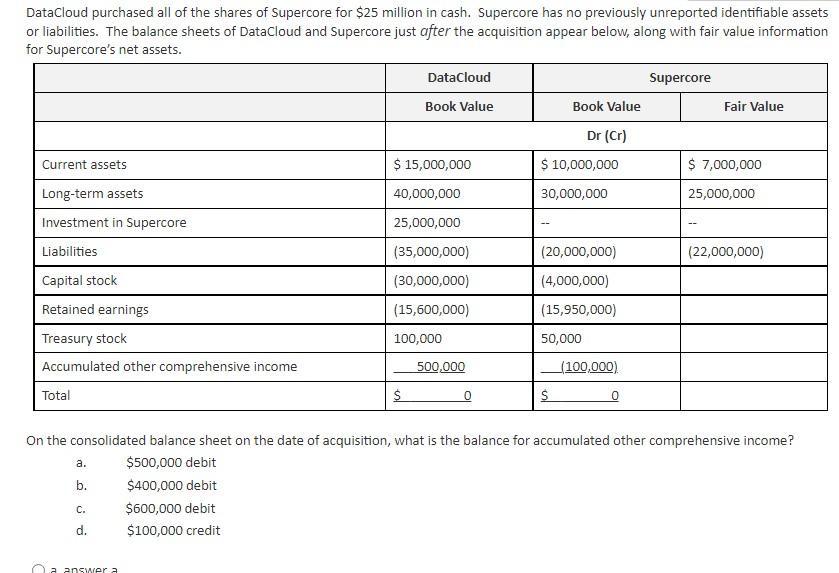

DataCloud purchased all of the shares of Supercore for $25 million in cash. Supercore has no previously unreported identifiable assets or liabilities. The balance

DataCloud purchased all of the shares of Supercore for $25 million in cash. Supercore has no previously unreported identifiable assets or liabilities. The balance sheets of DataCloud and Supercore just after the acquisition appear below, along with fair value information for Supercore's net assets. Current assets Long-term assets Investment in Supercore Liabilities Capital stock Retained earnings Treasury stock Accumulated other comprehensive income Total n a. b. C. d. a answer a $600,000 debit $100,000 credit DataCloud Book Value $ 15,000,000 40,000,000 25,000,000 (35,000,000) (30,000,000) (15,600,000) $ 100,000 500,000 Book Value Dr (Cr) $ 10,000,000 30,000,000 (20,000,000) (4,000,000) (15,950,000) 50,000 (100,000) Supercore On the consolidated balance sheet on the date of acquisition, what is the balance for accumulated other comprehensive income? $500,000 debit $400,000 debit Fair Value $ 7,000,000 25,000,000 (22,000,000)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The balance for accumulated other comprehensive income on the consolidated balance sheet on the date ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started