Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Datadog (Ticker: DDOG) underwent an initial public offering (IPO) in 2019 by issuing 24 million shares of common stock at $27.00 per share. The

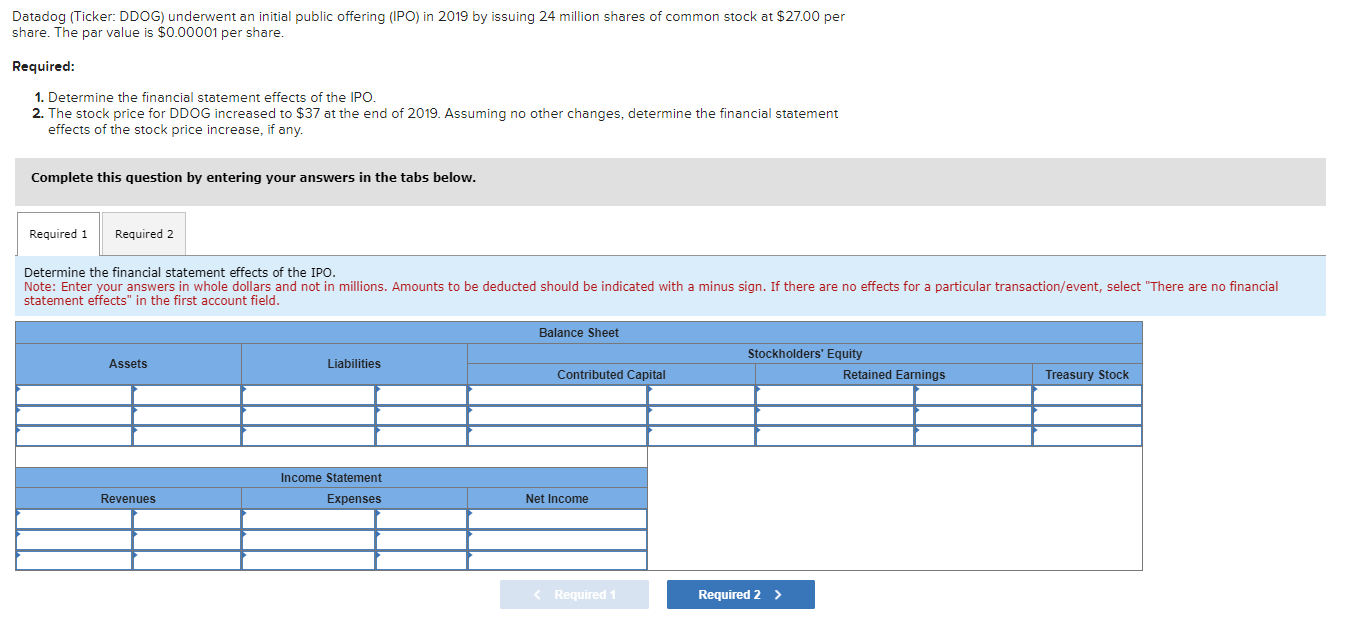

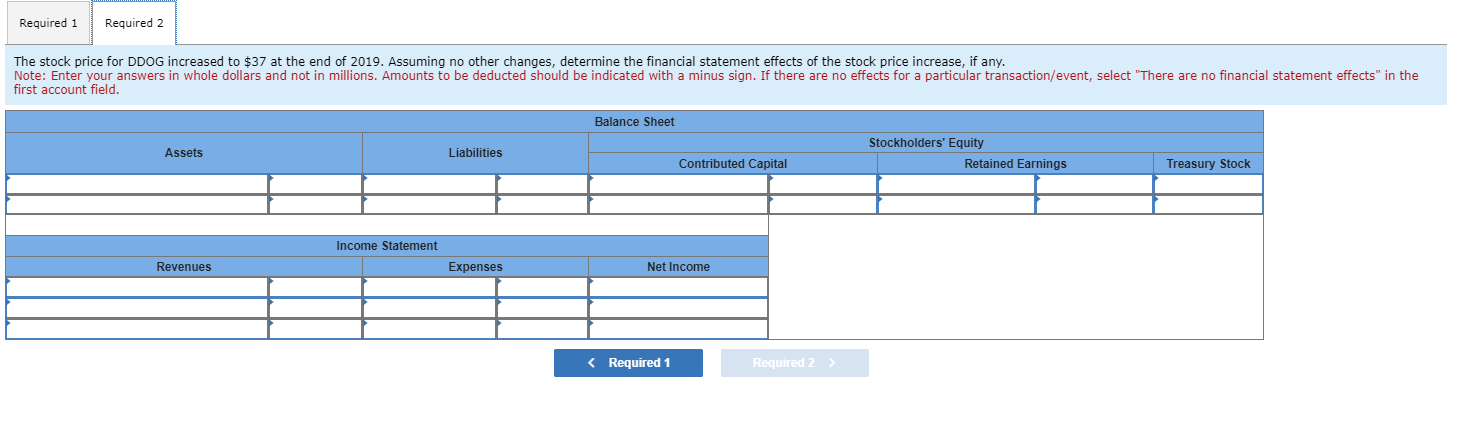

Datadog (Ticker: DDOG) underwent an initial public offering (IPO) in 2019 by issuing 24 million shares of common stock at $27.00 per share. The par value is $0.00001 per share. Required: 1. Determine the financial statement effects of the IPO. 2. The stock price for DDOG increased to $37 at the end of 2019. Assuming no other changes, determine the financial statement effects of the stock price increase, if any. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the financial statement effects of the IPO. Note: Enter your answers in whole dollars and not in millions. Amounts to be deducted should be indicated with a minus sign. If there are no effects for a particular transaction/event, select "There are no financial statement effects" in the first account field. Assets Revenues Liabilities Income Statement Expenses Balance Sheet Contributed Capital Net Income < Required 1 Stockholders' Equity Required 2 > Retained Earnings Treasury Stock Required 1 Required 2 The stock price for DDOG increased to $37 at the end of 2019. Assuming no other changes, determine the financial statement effects of the stock price increase, if any. Note: Enter your answers in whole dollars and not in millions. Amounts to be deducted should be indicated with a minus sign. If there are no effects for a particular transaction/event, select "There are no financial statement effects" in the first account field. Assets Revenues Income Statement Liabilities Expenses Balance Sheet Contributed Capital Net Income < Required 1 Required 2 > Stockholders' Equity Retained Earnings Treasury Stock Datadog (Ticker: DDOG) underwent an initial public offering (IPO) in 2019 by issuing 24 million shares of common stock at $27.00 per share. The par value is $0.00001 per share. Required: 1. Determine the financial statement effects of the IPO. 2. The stock price for DDOG increased to $37 at the end of 2019. Assuming no other changes, determine the financial statement effects of the stock price increase, if any. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the financial statement effects of the IPO. Note: Enter your answers in whole dollars and not in millions. Amounts to be deducted should be indicated with a minus sign. If there are no effects for a particular transaction/event, select "There are no financial statement effects" in the first account field. Assets Revenues Liabilities Income Statement Expenses Balance Sheet Contributed Capital Net Income < Required 1 Stockholders' Equity Required 2 > Retained Earnings Treasury Stock Required 1 Required 2 The stock price for DDOG increased to $37 at the end of 2019. Assuming no other changes, determine the financial statement effects of the stock price increase, if any. Note: Enter your answers in whole dollars and not in millions. Amounts to be deducted should be indicated with a minus sign. If there are no effects for a particular transaction/event, select "There are no financial statement effects" in the first account field. Assets Revenues Income Statement Liabilities Expenses Balance Sheet Contributed Capital Net Income < Required 1 Required 2 > Stockholders' Equity Retained Earnings Treasury Stock

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 Assets Liabilities Stockholders Equity Cash 648000000 Contributed Capital 648000000 Retained Earnings Explanation Assets The IPO res...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started