Answered step by step

Verified Expert Solution

Question

1 Approved Answer

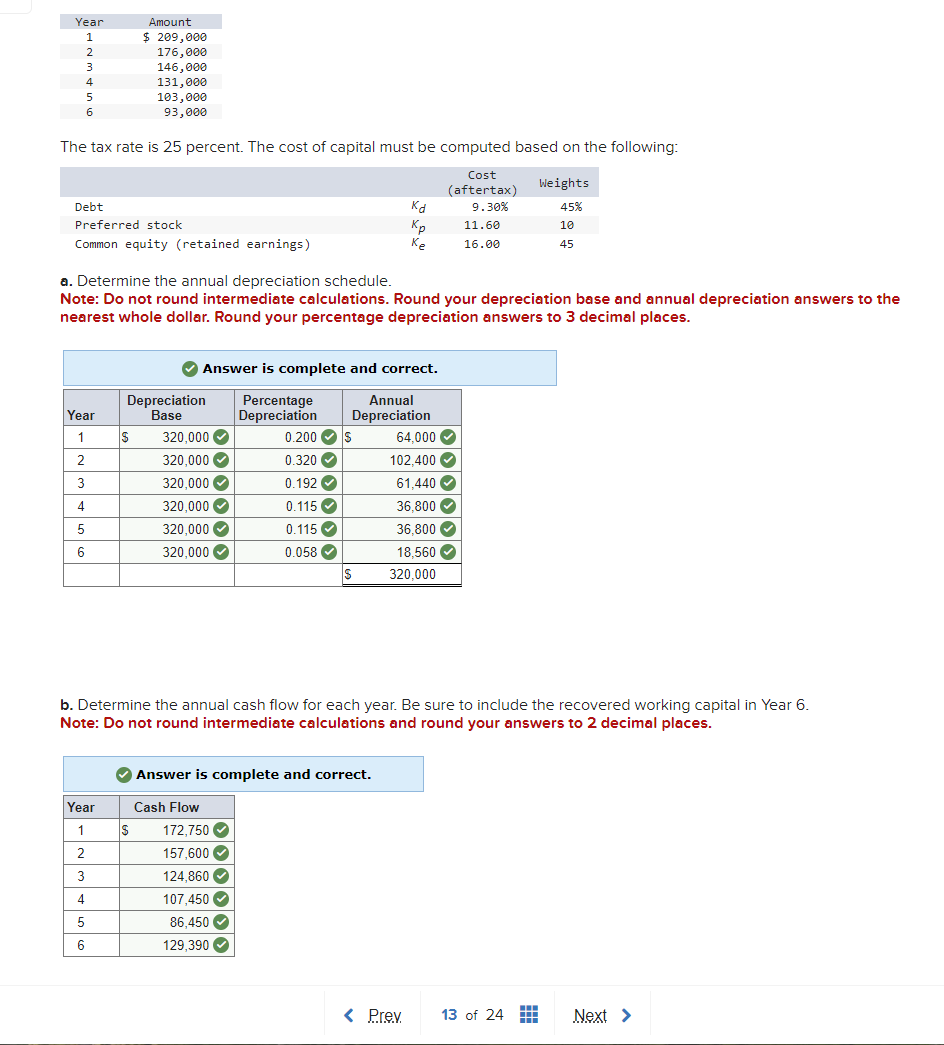

DataPoint Engineering is considering the purchase of a new piece of equipment for $ 3 2 0 , 0 0 0 . It has an

DataPoint Engineering is considering the purchase of a new piece of equipment for $ It has an eightyear midpoint of its asset depreciation range ADR It will require an additional initial investment of $ in nondepreciable working capital. $ of this investment will be recovered after the sixth year and will provide additional cash flow for that year. With the weighted average cost of capital being what is the net present avlaue. The answer must use the WACC rounded to decimal places a percent as the cost of capital. Do not round intermediate calculations and round your final answer to deciimals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started