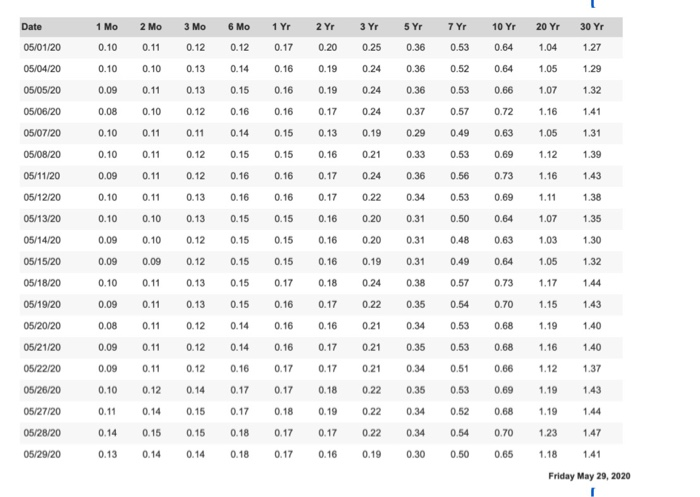

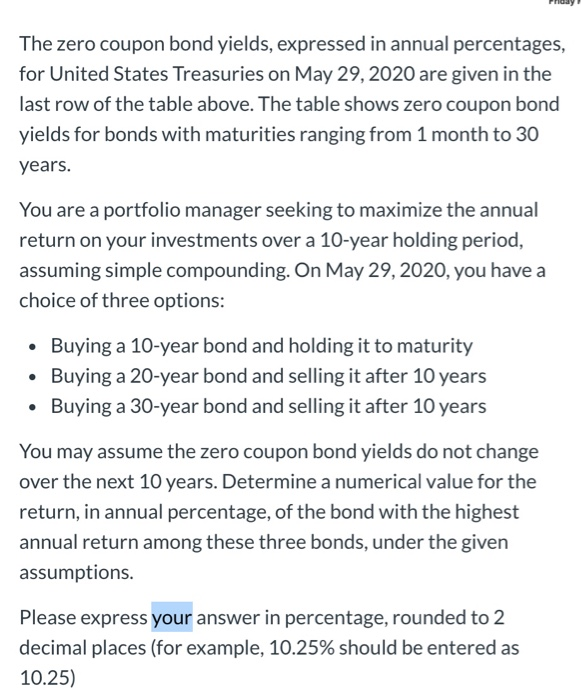

Date 1 Mo 2 Mo 3 Mo 6 Mo 1 Yr 2 Yr 3 Yr 5 Yr 7 Yr 10 Yr 20 Yr 30 Yr 05/01/20 0.10 0.11 0.12 0.12 0.17 0.20 0.25 0.36 0.53 0.64 1.04 1.27 05/04/20 0.10 0.10 0.13 0.14 0.16 0.19 0.24 0.36 0.52 0.64 1.05 1.29 05/05/20 0.09 0.11 0.13 0.15 0.16 0.19 0.24 0.36 0.53 0.66 1.07 1.32 05/06/20 0.08 0.10 0.12 0.16 0.16 0.17 0.24 0.37 0.57 0.72 1.16 1.41 05/07/20 0.10 0.11 0.11 0.14 0.15 0.13 0.19 0.29 0.49 0.63 1.05 1.31 05/08/20 0.10 0.11 0.12 0.15 0.15 0.16 0.21 0.33 0.53 0.69 1.12 1.39 05/11/20 0.09 0.11 0.12 0.16 0.16 0.17 0.24 0.36 0.56 0.73 1.16 1.43 05/12/20 0.10 0.11 0.13 0.16 0.16 0.17 0.22 0.34 0.53 0.69 1.11 1.38 05/13/20 0.10 0.10 0.13 0.15 0.15 0.16 0.20 0.31 0.50 0.64 1.07 1.35 05/14/20 0.09 0.10 0.12 0.15 0.15 0.16 0.20 0.31 0.48 0.63 1.03 1.30 05/15/20 0.09 0.09 0.12 0.15 0.15 0.16 0.19 0.31 0.49 0.64 1.05 1.32 05/18/20 0.10 0.11 0.13 0.15 0.17 0.18 0.24 0.38 0.57 0.73 1.17 1.44 05/19/20 0.09 0.11 0.13 0.15 0.16 0.17 0.22 0.35 0.54 0.70 1.15 1.43 05/20/20 0.08 0.11 0.12 0.14 0.16 0.16 0.21 0.34 0.53 0.68 1.19 1.40 05/21/20 0.09 0.11 0.12 0.14 0.16 0.17 0.21 0.35 0.53 0.68 1.16 1.40 05/22/20 0.09 0.11 0.12 0.16 0.17 0.17 0.21 0.34 0.51 0.66 1.12 1.37 05/26/20 0.10 0.12 0.14 0.17 0.17 0.18 0.22 0.35 0.53 0.69 1.19 1.43 05/27/20 0.11 0.14 0.15 0.17 0.18 0.19 0.22 0.34 0.52 0.68 1.19 1.44 05/28/20 0.14 0.15 0.15 0.18 0.17 0.17 0.22 0.34 0.54 0.70 1.23 1.47 05/29/20 0.13 0.14 0.14 0.18 0.17 0.16 0.19 0.30 0.50 0.65 1.18 1.41 Friday May 29, 2020 The zero coupon bond yields, expressed in annual percentages, for United States Treasuries on May 29, 2020 are given in the last row of the table above. The table shows zero coupon bond yields for bonds with maturities ranging from 1 month to 30 years. You are a portfolio manager seeking to maximize the annual return on your investments over a 10-year holding period, assuming simple compounding. On May 29, 2020, you have a choice of three options: Buying a 10-year bond and holding it to maturity Buying a 20-year bond and selling it after 10 years Buying a 30-year bond and selling it after 10 years You may assume the zero coupon bond yields do not change over the next 10 years. Determine a numerical value for the return, in annual percentage, of the bond with the highest annual return among these three bonds, under the given assumptions. Please express your answer in percentage, rounded to 2 decimal places (for example, 10.25% should be entered as 10.25)