Question

Date: 5/01/21 Instructions: Create a General Journal May 1. Paid $5,000 May 2. Sold Merchandise on account to Korman Co. Terms, n/15 FOB shipping point,

Date: 5/01/21

Instructions: Create a General Journal

May 1. Paid $5,000

May 2. Sold Merchandise on account to Korman Co. Terms, n/15 FOB shipping point, $68,500. The cost of the goods sold was $41,000.

May 3. Purchased Merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, $36,000

May 4. Paid freight on purchase of May 3, $600

May 7. Received $22,300 cash from Halstad Co. on account

May 10. Sold merchandise with a list price of $61,500 to customers who used visa and who redeemed $7,500 of point-of-sale coupons. The cost of goods sold was $32,000.

May 13. Paid for merchandise purchased on May 3.

May 15. Paid advertising expense for last half of May, $11,000.

May 17. Received cash from sale of May 2.

May 19. Purchased merchandise for cash, $18,700

May 19. Paid $33,450 to Buttons Co. on account.

May 20. Paid Korman Co. a cash refund of $13,230 for returned merchandise sale of May 2. the cost of returned merchandise was $8,000.

May 21. Sold merchandise on account to Crescent Co., terms n/eom, FOB shipping point, $110,000. The cost of the goods sold was $70,000.

May 21. For the convenience of Crescent Co., paid freight on sale May 21, $2,300.

May. 21 Received $42,900 cash from Gee Co. on account.

May 21. Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination, $88,000.

May 24. Returned damaged merchandise purchased on May 21, receiving a credit memo from the seller for $5,000.

May 26. Refunded cash on sales made for cash, $7,500. The cost of the merchandise returned was $4,800.

May 28. Paid sales salaries of $56,000 and office salaries of $29,000.

May 29. Purchased store supplies for cash, $2,400.

May 30. Sold merchandise on account to Turner Co., terms n/30, FOB shipping point, $78,750. The cost of the goods sold was $47,000.

May 31. Received cash from sale of May 21 plus freight.

May 31. Paid for purchase of May

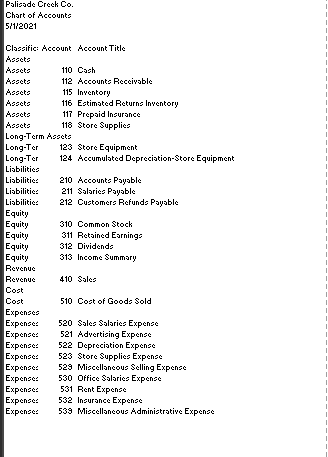

Palizade Creck Co. Chart of Accounte 5112021 Clagsific: Account Account Title Assets Asecte 110 Csin Asgetg 112 Accounte Reccivable Asecte 115 Inventory Assete 116 Egtimated Returne Inventory Asecte 11 Prepaid Inzurance Assets 118 Store Supplics Long-Term Assets Long-Ter 123 Store Equipment Long-Ter 124 Accumulated Depreciation-Store Equipment Lisbilities Lisbilitie: 210 Accounte Paysble Liabilitie: 211 Salarieg Paysble Lisbilities 212 Cugtomer Refunde Paysble Equity Equity 310 Common Stock Equity 311 Retained Earnings Equity 312 Dividends Equity 313 Income Summary Revenue Revenue 410 Soles Cogt Cogt 510 Coot of Good Sold Expenses Expenzes 520 Salez Salariez Expense Expenses 521 Advertising Expense Expenses 522 Depreciation Expense Expense: 523 Store Suppliez Expense Expenget 529 Mizcellaneoug Selling Expenge Expenses 530 Dffice Solaries Expense Expenget 531 Rent Expense Expenzes 532 Inzurance Expenge Expense 539 Mizcellaneouz Adminiztrtive Expenge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started