Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Date Account Titles and Explanation Debit Credit Mar. 2 Accounts payable 13000 Notes payable 13000 (To record note issued) Mar. 3 Cash 45200 Sales 40000

| Date | Account Titles and Explanation | Debit | Credit |

| Mar. 2 | Accounts payable | 13000 | |

| Notes payable | 13000 | ||

| (To record note issued) | |||

| Mar. 3 | Cash | 45200 | |

| Sales | 40000 | ||

| Sales tax payable (13% x $40000) | 5200 | ||

| (To record sales) | |||

| Mar. 3 | Cost of goods sold | 24000 | |

| Inventory | 24000 | ||

| (To record cost of goods sold) | |||

| Mar. 4 | Property tax expense ($16000 x 3/12) | 4000 | |

| Property tax payable | 4000 | ||

| (To record property tax expense) | |||

| Mar. 12 | Cash | 11300 | |

| Service revenue | 10000 | ||

| Sales tax payable (13% x $10000) | 1300 | ||

| (To record services provided for cash) | |||

| Mar. 16 | CPP Payable ($1540 + $1540) | 3080 | |

| EI Payable ($470+ $658) | 1128 | ||

| Employee income tax payable | 5540 | ||

| Cash | 9748 | ||

| (To record remittances to government) | |||

| Mar. 27 | Accounts payable | 30000 | |

| Cash | 30000 | ||

| (To record payments to trade creditors on account) | |||

| Mar. 30 | Salaries expense | 19000 | |

| CPP Payable | 803 | ||

| EI Payable | 259 | ||

| Employee income tax payable | 5850 | ||

| Cash | 12088 | ||

| (To record payroll and employee deductions) | |||

| Mar. 31 | Employee benefits expense | 1166 | |

| CPP Payable | 803 | ||

| EI Payable | 363 | ||

| (To record employee benefits) | |||

| Mar. 31 | Sales tax payable | 6200 | |

| Cash | 6200 | ||

| (To record remittance of sales tax payable) |

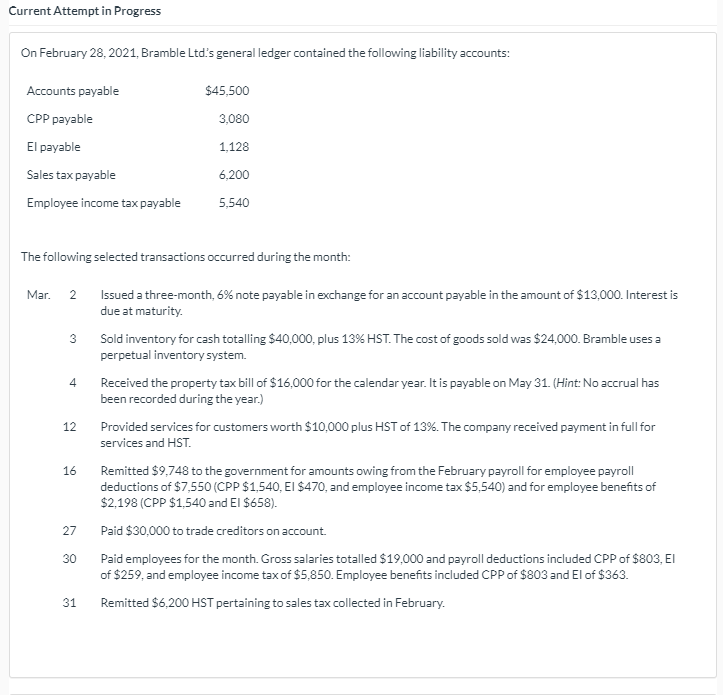

Current Attempt in Progress On February 28, 2021, Bramble Ltd's general ledger contained the following liability accounts: $45,500 3,080 Accounts payable CPP payable El payable Sales tax payable Employee income tax payable 1.128 6,200 5,540 The following selected transactions occurred during the month: Mar. 2 3 4 12 Issued a three-month, 6% note payable in exchange for an account payable in the amount of $13,000. Interest is due at maturity. Sold inventory for cash totalling $40,000, plus 13% HST. The cost of goods sold was $24,000. Bramble uses a perpetual inventory system. Received the property tax bill of $16,000 for the calendar year. It is payable on May 31. (Hint: No accrual has been recorded during the year.) Provided services for customers worth $10,000 plus HST of 13%. The company received payment in full for services and HST. Remitted $9,748 to the government for amounts owing from the February payroll for employee payroll deductions of $7,550 (CPP $1,540, El $470, and employee income tax $5.540) and for employee benefits of $2,198 (CPP $1,540 and El $658). Paid $30,000 to trade creditors on account Paid employees for the month. Gross salaries totalled $19,000 and payroll deductions included CPP of $803, EI of $259, and employee income tax of $5,850. Employee benefits included CPP of $803 and El of $363. Remitted $6,200 HST pertaining to sales tax collected in February 16 27 30 31 (b) Record any required adjusting entries at March 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Round answers to decimal places, eg. 5,275.) Date Account Titles and Explanation Debit Credit Mar. 31 eTextbook and Media List of Accounts Save for Later Attempts: 0 of 1 used Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started