Question

Date Duma Bookstore had the following beginning inventory and purchases of accounting textbooks during June. On Jun 30, 20Duma Bookstore sold 240 textbooks. Required:

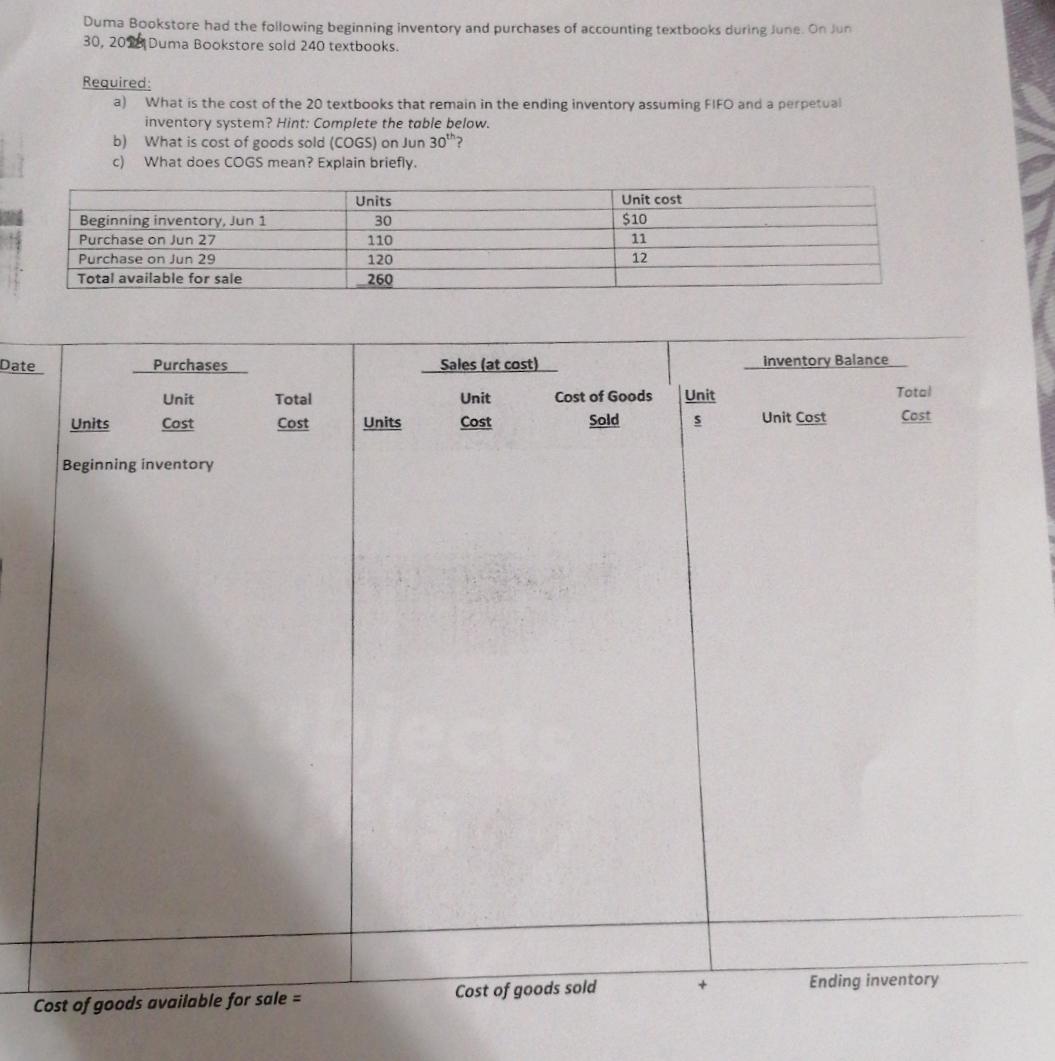

Date Duma Bookstore had the following beginning inventory and purchases of accounting textbooks during June. On Jun 30, 20Duma Bookstore sold 240 textbooks. Required: a) What is the cost of the 20 textbooks that remain in the ending inventory assuming FIFO and a perpetual inventory system? Hint: Complete the table below. b) What is cost of goods sold (COGS) on Jun 30th? c) What does COGS mean? Explain briefly. Units Beginning inventory, Jun 1 30 Purchase on Jun 27 110 Purchase on Jun 29 120 Total available for sale 260 Unit cost $10 11 12 Purchases Sales (at cost) Inventory Balance Unit Total Unit Units Cost Cost Units Cost Cost of Goods Sold Unit S Unit Cost Total Cost Beginning inventory Cost of goods available for sale = Cost of goods sold Ending inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: Larson Kermit, Tilly Jensen

Volume I, 14th Canadian Edition

71051503, 978-1259066511, 1259066517, 978-0071051507

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App