Question

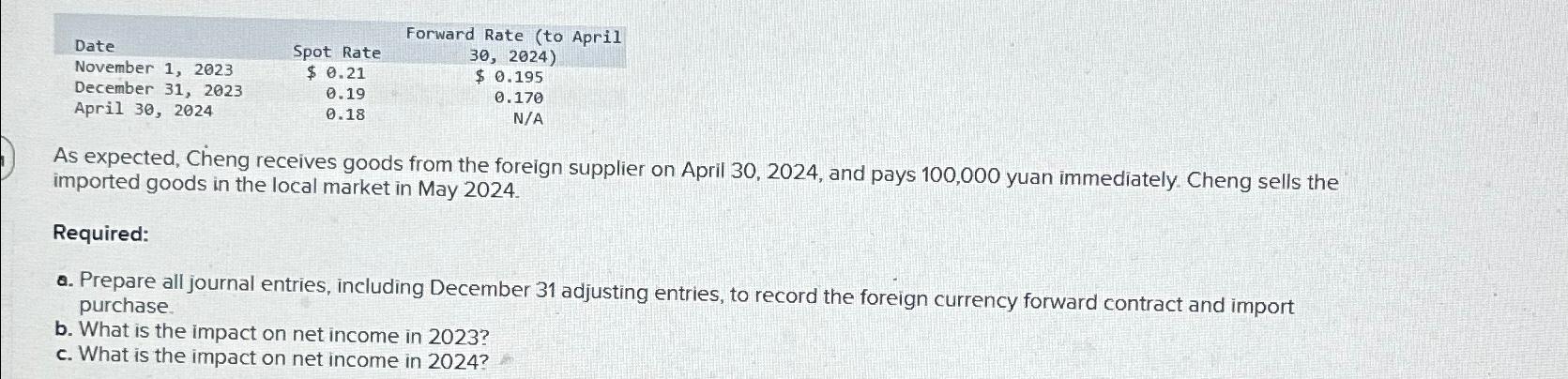

Date November 1, 2023 December 31, 2023 April 30, 2024 Spot Rate $ 0.21 0.19 0.18 Forward Rate (to April 30, 2024) $ 0.195

Date November 1, 2023 December 31, 2023 April 30, 2024 Spot Rate $ 0.21 0.19 0.18 Forward Rate (to April 30, 2024) $ 0.195 0.170 N/A As expected, Cheng receives goods from the foreign supplier on April 30, 2024, and pays 100,000 yuan immediately. Cheng sells the imported goods in the local market in May 2024. Required: a. Prepare all journal entries, including December 31 adjusting entries, to record the foreign currency forward contract and import purchase. b. What is the impact on net income in 2023? c. What is the impact on net income in 2024?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The image shows an accounting question related to a foreign currency transaction and a forward contract To answer the question appropriately we need to make some assumptions as not all details are pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Advanced Accounting

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

9th International Edition

1266268537, 9781266268533

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App