Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Date of Acquisition Consolidation Eliminating Entries Proline Company acquired 7 0 percent of Saturn Corporation s common stock for $ 1 5 0 million in

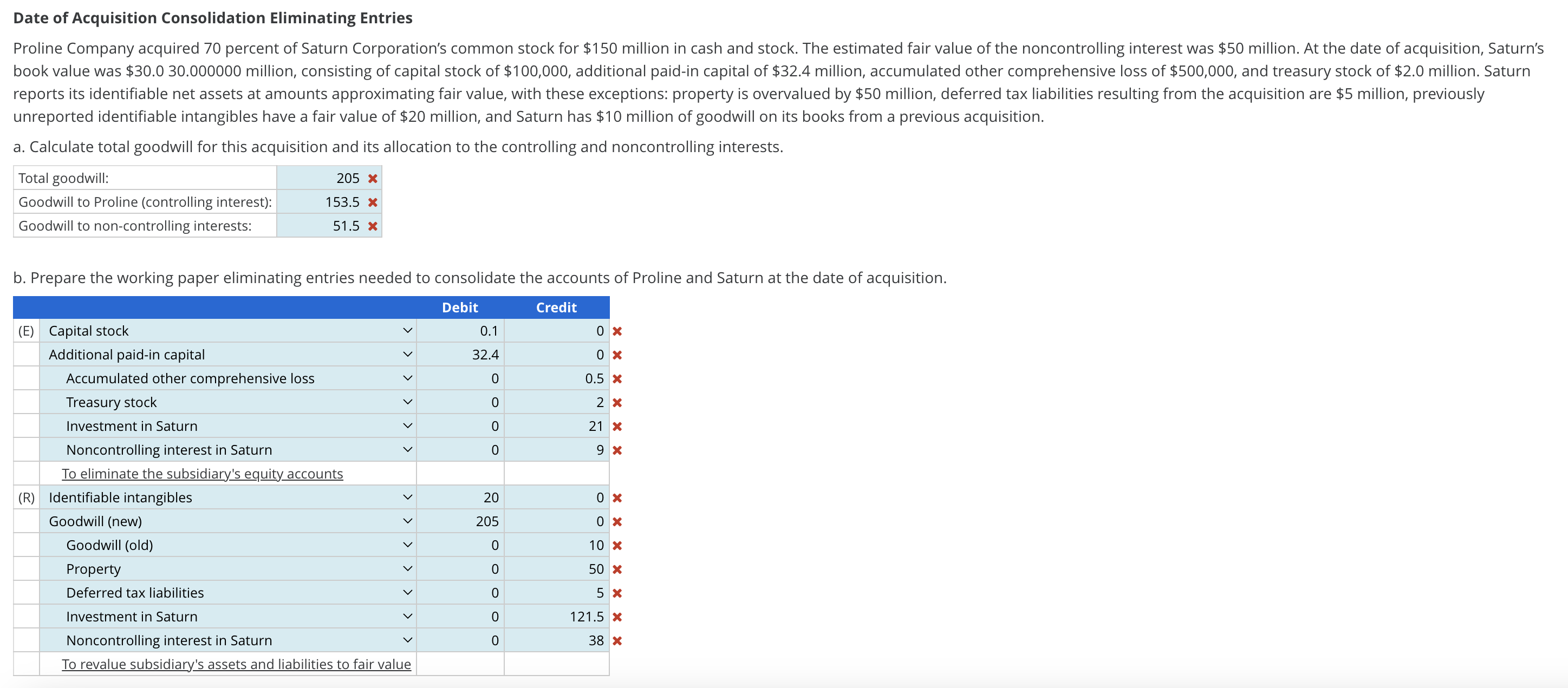

Date of Acquisition Consolidation Eliminating Entries

Proline Company acquired percent of Saturn Corporations common stock for $ million in cash and stock. The estimated fair value of the noncontrolling interest was $ million. At the date of acquisition, Saturns book value was $ million, consisting of capital stock of $ additional paidin capital of $ million, accumulated other comprehensive loss of $ and treasury stock of $ million. Saturn reports its identifiable net assets at amounts approximating fair value, with these exceptions: property is overvalued by $ million, deferred tax liabilities resulting from the acquisition are $ million, previously unreported identifiable intangibles have a fair value of $ million, and Saturn has $ million of goodwill on its books from a previous acquisition.

a Calculate total goodwill for this acquisition and its allocation to the controlling and noncontrolling interests. PLEASE HELP ME SOLVE THIS!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started