Answered step by step

Verified Expert Solution

Question

1 Approved Answer

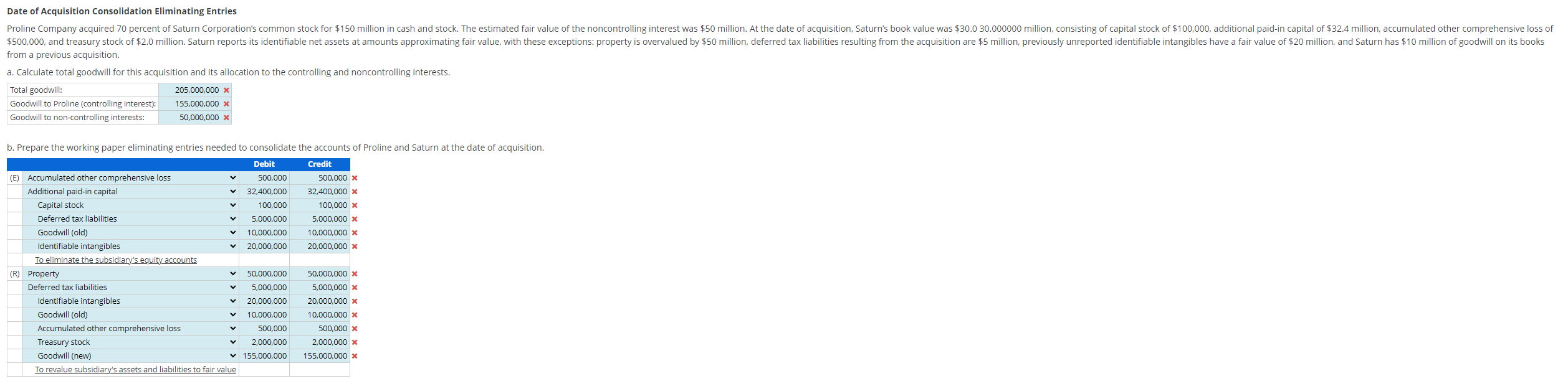

Date of Acquisition Consolidation Eliminating Entries Proline Company acquired 70 percent of Saturn Corporation's common stock for $150 million in cash and stock. The

Date of Acquisition Consolidation Eliminating Entries Proline Company acquired 70 percent of Saturn Corporation's common stock for $150 million in cash and stock. The estimated fair value of the noncontrolling interest was $50 million. At the date of acquisition, Saturn's book value was $30.0 30.000000 million, consisting of capital stock of $100,000, additional paid-in capital of $32.4 million, accumulated other comprehensive loss of $500,000, and treasury stock of $2.0 million. Saturn reports its identifiable net assets at amounts approximating fair value, with these exceptions: property is overvalued by $50 million, deferred tax liabilities resulting from the acquisition are $5 million, previously unreported identifiable intangibles have a fair value of $20 million, and Saturn has $10 million of goodwill on its books from a previous acquisition. a. Calculate total goodwill for this acquisition and its allocation to the controlling and noncontrolling interests. Total goodwill: 205,000,000 Goodwill to Proline (controlling interest): Goodwill to non-controlling interests: 155,000,000 50,000,000 x b. Prepare the working paper eliminating entries needed to consolidate the accounts of Proline and Saturn at the date of acquisition. Debit Credit (E) Accumulated other comprehensive loss 500,000 500,000 x Additional paid-in capital Capital stock Deferred tax liabilities Goodwill (old) Identifiable intangibles To eliminate the subsidiary's equity accounts (R) Property Deferred tax liabilities 32,400,000 32,400,000 x 100,000 100,000 x 5,000,000 5,000,000 x 10,000,000 20,000,000 10,000,000 x 20,000,000 x Identifiable intangibles Goodwill (old) 50,000,000 50,000,000 x 5,000,000 20,000,000 5,000,000 x 20,000,000 x 10,000,000 10,000,000 x 500,000 2,000,000 500,000 x 2,000,000 x 155,000,000 155,000,000 x Accumulated other comprehensive loss Treasury stock Goodwill (new) To revalue subsidiary's assets and liabilities to fair value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started