Answered step by step

Verified Expert Solution

Question

1 Approved Answer

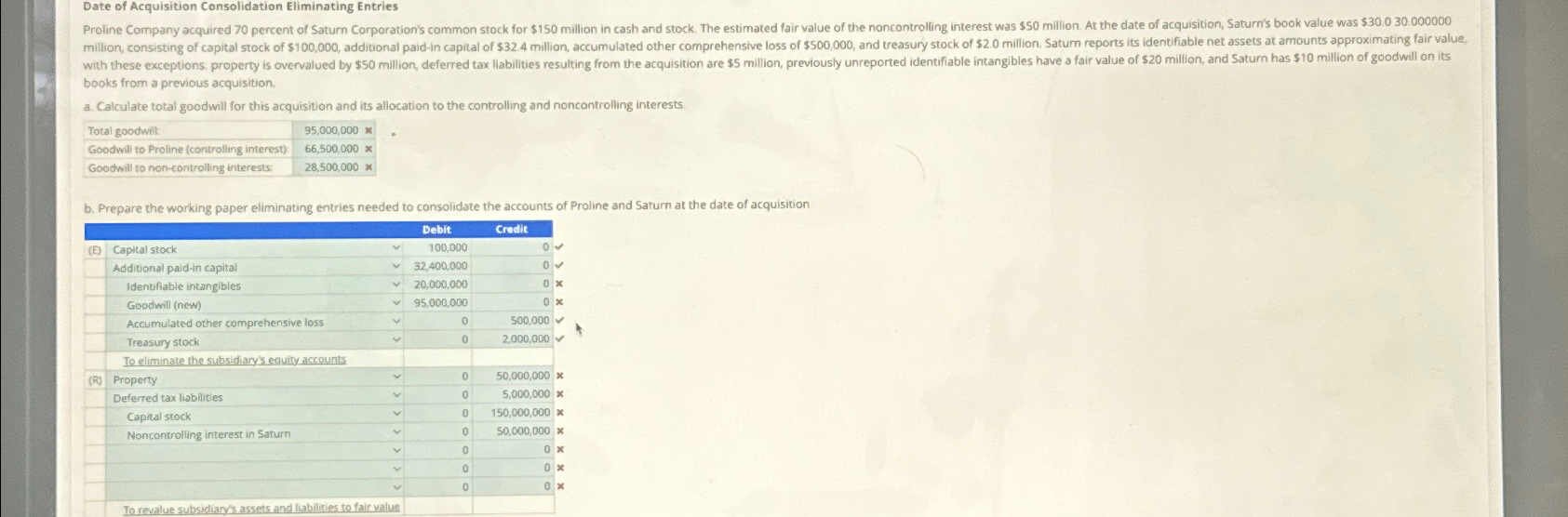

Date of Acquisition Consolidation Eliminating Entries Proline Company acquired 70 percent of Saturn Corporation's common stock for $150 million in cash and stock. The

Date of Acquisition Consolidation Eliminating Entries Proline Company acquired 70 percent of Saturn Corporation's common stock for $150 million in cash and stock. The estimated fair value of the noncontrolling interest was $50 million. At the date of acquisition, Saturn's book value was $30.0 30.000000 million, consisting of capital stock of $100,000, additional paid-in capital of $32.4 million, accumulated other comprehensive loss of $500,000, and treasury stock of $2.0 million. Saturn reports its identifiable net assets at amounts approximating fair value, with these exceptions property is overvalued by $50 million, deferred tax liabilities resulting from the acquisition are $5 million, previously unreported identifiable intangibles have a fair value of $20 million, and Saturn has $10 million of goodwill on its books from a previous acquisition. a. Calculate total goodwill for this acquisition and its allocation to the controlling and noncontrolling interests. Total goodwill: 95,000,000 x Goodwill to Proline (controlling interest): Goodwill to non-controlling interests: 66,500,000 x 28,500,000 x b. Prepare the working paper eliminating entries needed to consolidate the accounts of Proline and Saturn at the date of acquisition (E) Capital stock Additional paid-in capital Identifiable intangibles Goodwill (new) Accumulated other comprehensive loss Treasury stock To eliminate the subsidiary's equity accounts (R) Property Deferred tax liabilities Capital stock Noncontrolling interest in Saturn Debit 100,000 32,400,000 Credit 20,000,000 0x v 95,000,000 0% 0 500,000 0 2,000,000 0 50,000,000 x 0 5,000,000 x 0 150,000,000 x 0 50,000,000 x 0 0 x 0 0x 0 0 % To revalue subsidiary's assets and liabilities to fair value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started