Answered step by step

Verified Expert Solution

Question

1 Approved Answer

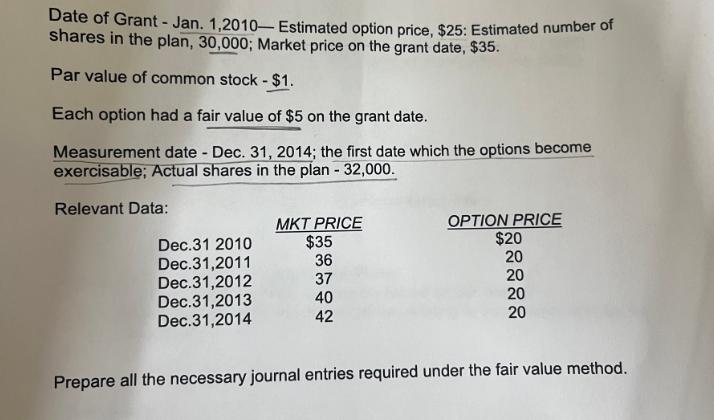

Date of Grant - Jan. 1,2010- Estimated option price, $25: Estimated number of shares in the plan, 30,000; Market price on the grant date,

Date of Grant - Jan. 1,2010- Estimated option price, $25: Estimated number of shares in the plan, 30,000; Market price on the grant date, $35. Par value of common stock - $1. Each option had a fair value of $5 on the grant date. Measurement date - Dec. 31, 2014; the first date which the options become exercisable; Actual shares in the plan - 32,000. Relevant Data: MKT PRICE Dec.31 2010 $35 Dec. 31,2011 36 Dec.31,2012 Dec.31,2013 Dec.31,2014 5429 37 40 OPTION PRICE $20 20 2220 Prepare all the necessary journal entries required under the fair value method.

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the necessary journal entries required under the fair value method for stock options we n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663df904ed294_960727.pdf

180 KBs PDF File

663df904ed294_960727.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started