Answered step by step

Verified Expert Solution

Question

1 Approved Answer

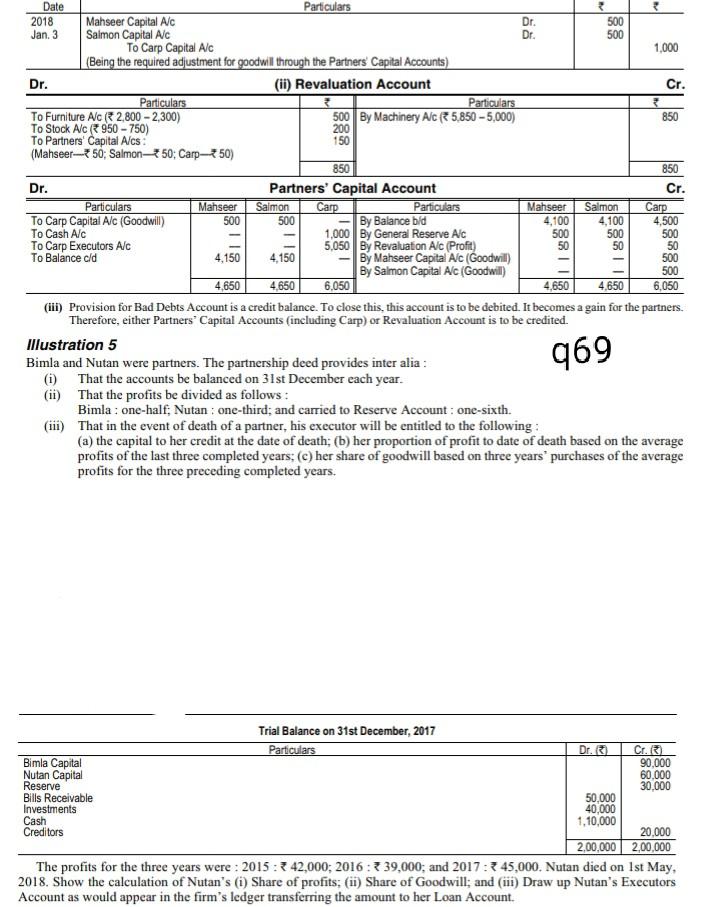

Date Particulars 2018 Mahseer Capital A/C Dr. 500 Jan. 3 Salmon Capital Alc Dr. 500 To Carp Capital Alc 1,000 (Being the required adjustment for

Date Particulars 2018 Mahseer Capital A/C Dr. 500 Jan. 3 Salmon Capital Alc Dr. 500 To Carp Capital Alc 1,000 (Being the required adjustment for goodwill through the Partners Capital Accounts) Dr. (ii) Revaluation Account Cr. Particulars ? Particulars To Furniture Ac (2,800 -2,300) 500 By Machinery Alc(5.850 - 5,000) 850 To Stock Alc950 - 750) 200 To Partners' Capital A/cs: 150 (Mahseer-50; Salmon50; Carp-250) 850 850 Dr. Partners' Capital Account Cr. Particulars Mahseer Salmon Carp Particulars Mahseer Salmon Carp To Carp Capital A/c (Goodwill) 500 500 By Balance bld 4,100 4,100 4,500 To Cash Alc 1,000 By General Reserve Alc 500 500 500 To Carp Executors Alc 5,050 By Revaluation Alc (Profit) 50 50 50 To Balance old 4,150 4.150 By Mahseer Capital Afc (Goodwil) 500 By Salmon Capital Alc (Goodwil) 500 4,650 4.650 6,050 4,650 4.650 6,050 (iii) Provision for Bad Debts Account is a credit balance. To close this, this account is to be debited. It becomes a gain for the partners. Therefore, either Partners' Capital Accounts (including Carp) or Revaluation Account is to be credited. Illustration 5 Bimla and Nutan were partners. The partnership deed provides inter alia : (1) That the accounts be balanced on 31st December each year. (ii) That the profits be divided as follows: Bimla: one-half, Nutan : one-third; and carried to Reserve Account : one-sixth. (iii) That in the event of death of a partner, his executor will be entitled to the following: (a) the capital to her credit at the date of death; (b) her proportion of profit to date of death based on the average profits of the last three completed years; (c) her share of goodwill based on three years purchases of the average profits for the three preceding completed years. 969 Trial Balance on 31st December, 2017 Particulars Dr. Cr.) Bimla Capital 90,000 Nutan Capital 60.000 Reserve 30,000 Bills Receivable 50,000 Investments 40,000 Cash 1,10,000 Creditors 20,000 2,00.000 2,00,000 The profits for the three years were : 2015: 42,000; 2016: 339,000; and 2017: 45,000. Nutan died on 1st May, 2018. Show the calculation of Nutan's (1) Share of profits; (ii) Share of Goodwill; and (iii) Draw up Nutan's Executors Account as would appear in the firm's ledger transferring the amount to her Loan Account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started