Question

Date Particulars DEBIT CREDIT BALANCE 1/10/2021 Opening Balance 18,502.30 Cr 1/10/2021 Interest DD #12334 200.00 18,302.30 Cr 2/10/2021 Cash Sale for 00003240 605.00 18,907.30 Cr

| Date | Particulars | DEBIT | CREDIT | BALANCE | ||

| 1/10/2021 | Opening Balance | 18,502.30 | Cr | |||

| 1/10/2021 | Interest DD #12334 | 200.00 | 18,302.30 | Cr | ||

| 2/10/2021 | Cash Sale for 00003240 | 605.00 | 18,907.30 | Cr | ||

| 3/10/2021 | Techimports | 790.00 | 18,117.30 | Cr | ||

| 4/10/2021 | Payment, Hardcliiff Real Estate | 665.00 | 18,782.30 | Cr | ||

| 7/10/2021 | eGlobal Supplies | 1,342.00 | 17,440.30 | Cr | ||

| 12/10/2021 | Biron Chronicle | 220.00 | 17,220.30 | Cr | ||

| 14/10/2021 | Cash Sale for 00003244 | 869.00 | 18,089.30 | Cr | ||

| 15/10/2021 | Original Energy Electricity | 184.25 | 17,905.05 | Cr | ||

| 18/10/2021 | Payment MeEi Insurance | 2,970.00 | 20,875.05 | Cr | ||

| 19/10/2021 | Cash Sale for 00003245 | 357.50 | 21,232.55 | Cr | ||

| 20/10/2021 | Office Depot | 88.00 | 21,144.55 | Cr | ||

| 21/10/2021 | Australian Taxation Office | 2,024.20 | 19,120.35 | Cr | ||

| 21/10/2021 | Cash Sale for 00003247 | 297.00 | 19,417.35 | Cr | ||

| 21/10/2021 | Ozzie SuperAnnuation Fund | 760.00 | 18,657.35 | Cr | ||

| 24/10/2021 | MeEi Insurance #3241 | 17,517.50 | 36,174.85 | |||

| 24/10/2021 | MaxMus Distributors | 17,145.85 | 19,029.00 | Cr | ||

| 26/10/2021 | VodaVoice Phone/lnternet | 120.00 | 18.909.00 | Cr | ||

| 28/10/2021 | Cash Sale for 00003250 | 2,172.50 | 21,081.50 | Cr | ||

| 28/10/2021 | Biron City Council #3229 | 4205.00 | 22,286.50 | Cr | ||

| 29/10/2021 | Dan Brand | 6,536.00 | 15,750.50 | Db | ||

| 29/10/2021 | Beach Health Centre #00003249 | 12,262.25 | 28,012.75 | Cr | ||

| 30/10/2021 | Account Fees | 8.00 | 28,004.75 | Cr | ||

| Date of Issue 30th October 2021 | Total Debits 29,418.30 | Total Credits 38,920.75 | Balance 28,004.75 Cr | |||

Record the following adjustments for the month of October 2018:

| 30/10/2021 | Record $88 (inc. GST) credit sale for repairs completed to VHS for Geoff Hardcliff but not invoiced as #00003252. |

| 30/10/2021 | Record monthly depreciation amount of $250 for Fixtures & Fittings in the Journal Entry |

| 30/10/2021 | Record monthly depreciation amount of $115 for Office Equipment in the Journal Entry |

| 30/10/2021 | Record monthly rent expense of $2200 in the Journal Entry |

| 30/10/2021 | Record monthly insurance expense of $300 in the Journal Entry |

| 30/10/2021 | Unearned Revenue remains unearned |

| 30/10/2021 | Record accrued interest owing for the month of June of $66.70 in the Journal Entry |

| 30/10/2021 | Bad debts are calculated using the percentage of sales method and for the first year of trading Mike estimates they will be 0.25% of net sales in the Journal Entry |

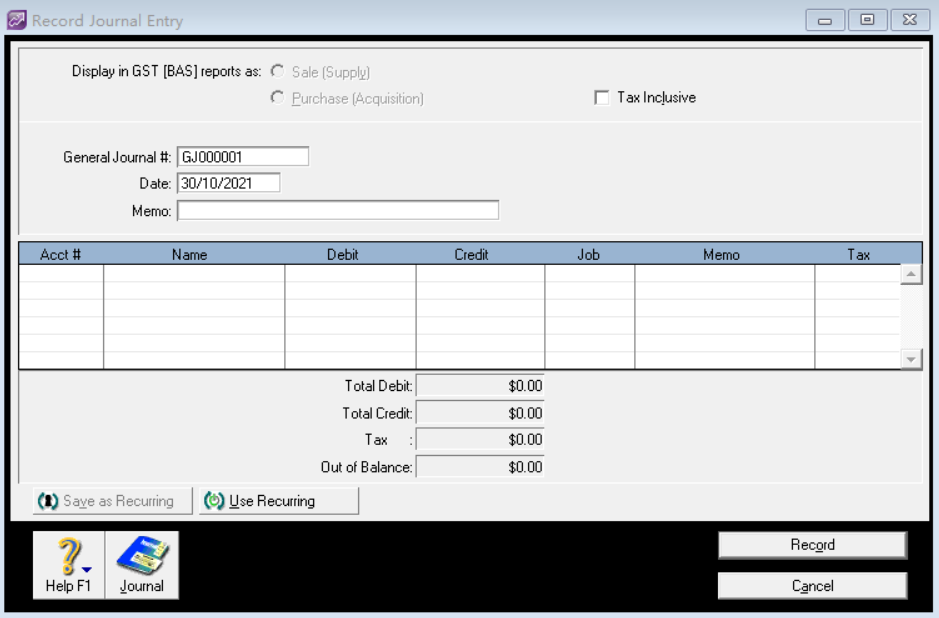

(ACCOUNTS Record Journal Entry): Record the appropriate adjustments in one journal entry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started