Answered step by step

Verified Expert Solution

Question

1 Approved Answer

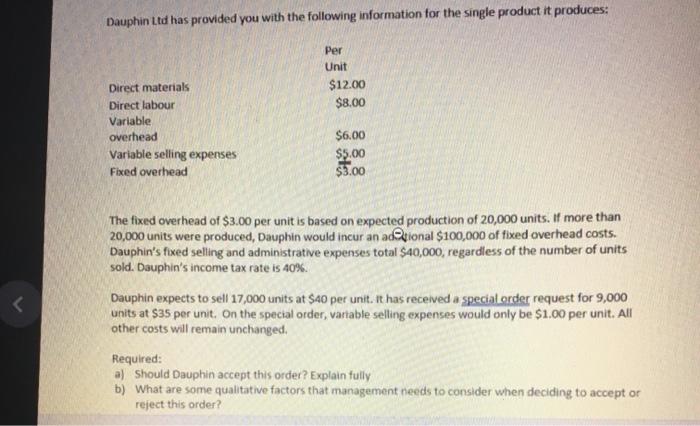

Dauphin Ltd has provided you with the following information for the single product it produces: Per Unit Direct materials Direct labour $12.00 $8.00 Variable overhead

Dauphin Ltd has provided you with the following information for the single product it produces: Per Unit Direct materials Direct labour $12.00 $8.00 Variable overhead $6.00 Variable selling expenses Fixed overhead $5.00 $3.00 < The fixed overhead of $3.00 per unit is based on expected production of 20,000 units. If more than 20,000 units were produced, Dauphin would incur an adtional $100,000 of fixed overhead costs. Dauphin's fixed selling and administrative expenses total $40,000, regardless of the number of units sold. Dauphin's income tax rate is 40%. Dauphin expects to sell 17,000 units at $40 per unit. It has received a special order request for 9,000 units at $35 per unit. On the special order, variable selling expenses would only be $1.00 per unit. All other costs will remain unchanged. Required: a) Should Dauphin accept this order? Explain fully b) What are some qualitative factors that management needs to consider when deciding to accept or reject this order

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started