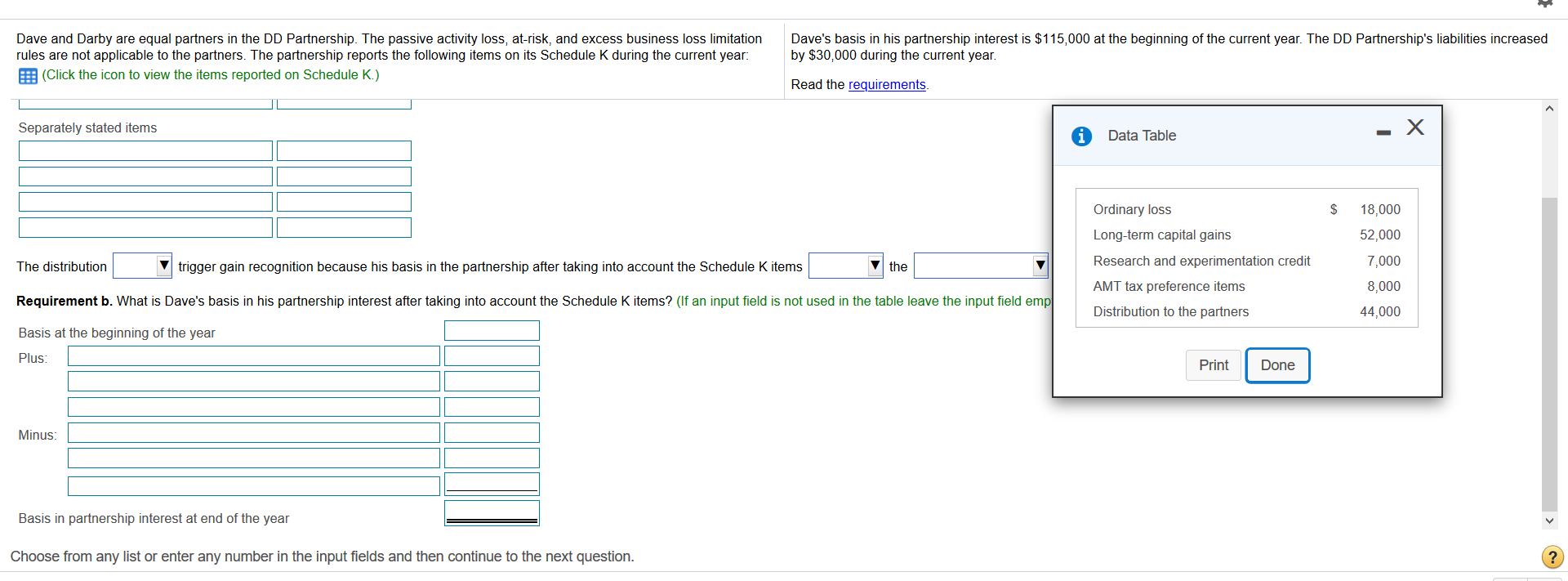

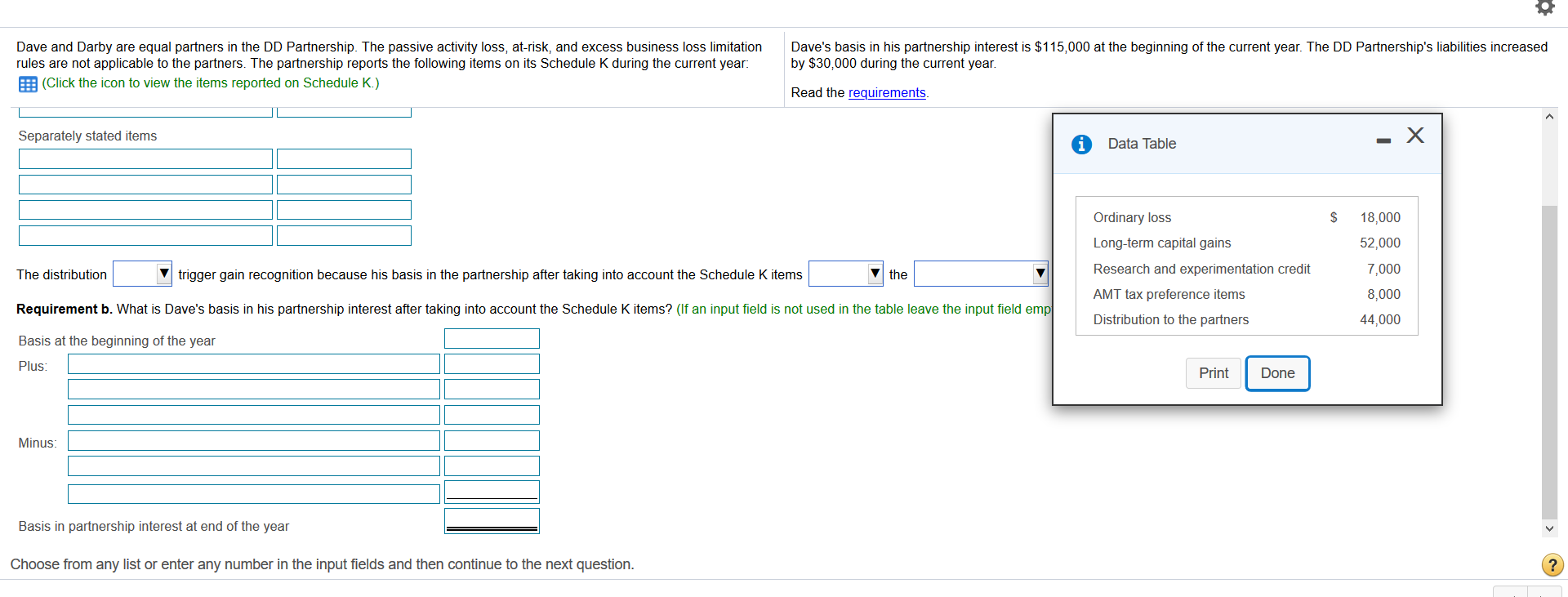

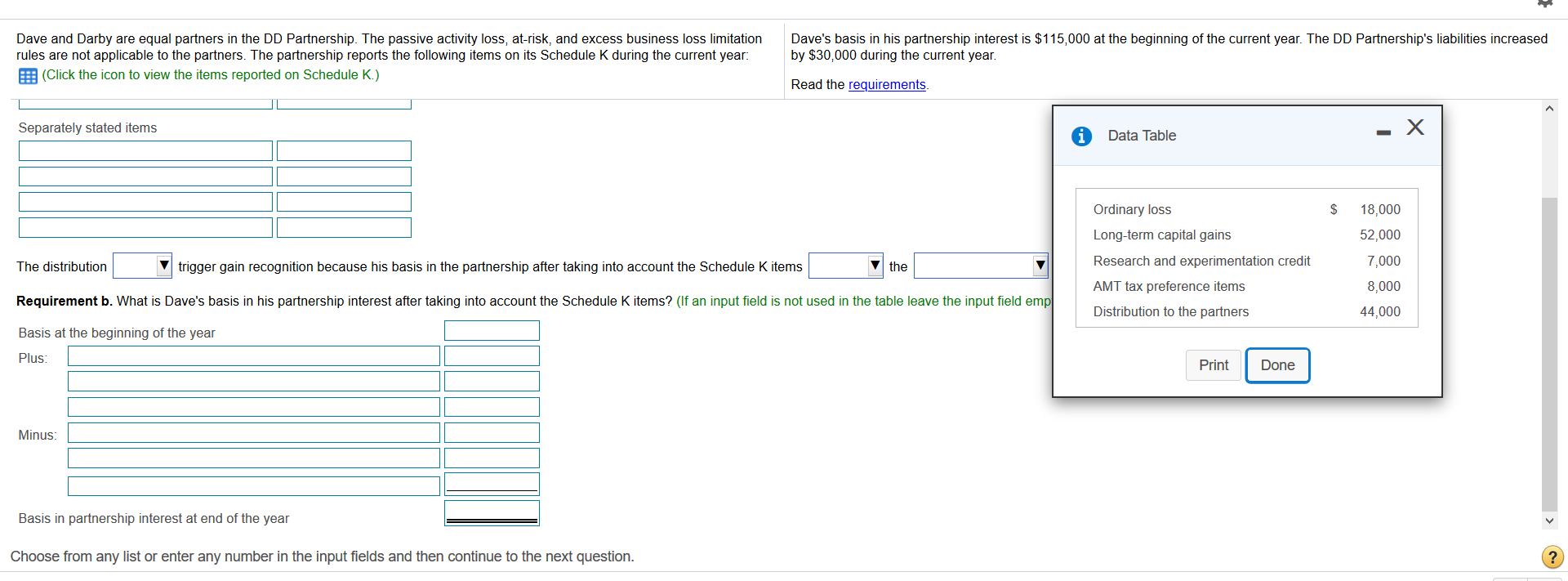

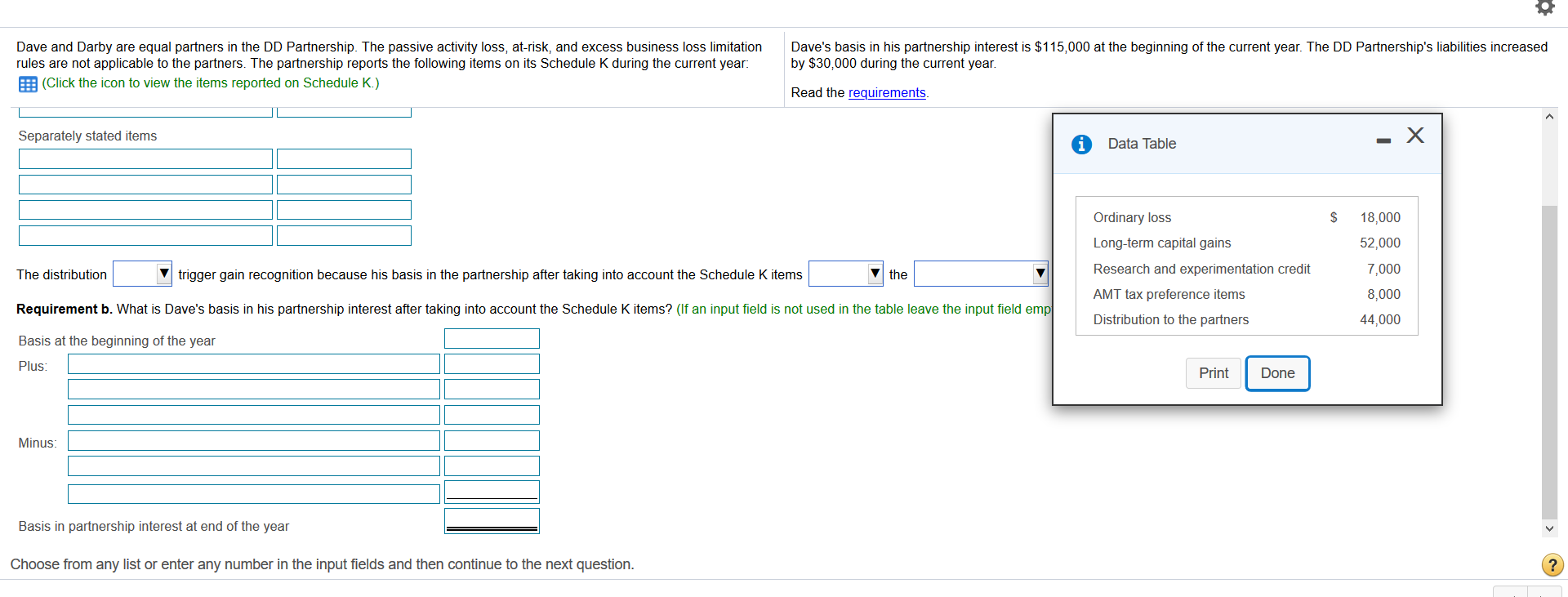

. Dave and Darby are equal partners in the DD Partnership. The passive activity loss, at-risk, and excess business loss limitation rules are not applicable to the partners. The partnership reports the following items on its Schedule K during the current year: (Click the icon to view the items reported on Schedule K.) Dave's basis in his partnership interest is $115,000 at the beginning of the current year. The DD Partnership's liabilities increased by $30,000 during the current year. Read the requirements. Separately stated items i X - Data Table $ The distribution trigger gain recognition because his basis in the partnership after taking into account the Schedule K items the Ordinary loss Long-term capital gains Research and experimentation credit AMT tax preference items Distribution to the partners 18,000 52,000 7,000 8,000 44,000 Requirement b. What is Dave's basis in his partnership interest after taking into account the Schedule K items? (If an input field is not used in the table leave the input field emp Basis at the beginning of the year Plus: Print Done Minus: Basis in partnership interest at end of the year Choose from any list or enter any number in the input fields and then continue to the next question. Dave and Darby are equal partners in the DD Partnership. The passive activity loss, at-risk, and excess business loss limitation rules are not applicable to the partners. The partnership reports the following items on its Schedule K during the current year: (Click the icon to view the items reported on Schedule K.) Dave's basis in his partnership interest is $115,000 at the beginning of the current year. The DD Partnership's liabilities increased by $30,000 during the current year. Read the requirements. Separately stated items 1 Data Table - X $ The distribution trigger gain recognition because his basis in the partnership after taking into account the Schedule K items Ordinary loss Long-term capital gains Research and experimentation credit AMT tax preference items Distribution to the partners 18,000 52,000 7,000 8,000 44,000 Requirement b. What is Dave's basis in his partnership interest after taking into account the Schedule K items? (If an input field is not used in the table leave the input field emp Basis at the beginning of the year Plus: Print Print Done Done Minus: Basis in partnership interest at end of the year Choose from any list or enter any number in the input fields and then continue to the next question. . Dave and Darby are equal partners in the DD Partnership. The passive activity loss, at-risk, and excess business loss limitation rules are not applicable to the partners. The partnership reports the following items on its Schedule K during the current year: (Click the icon to view the items reported on Schedule K.) Dave's basis in his partnership interest is $115,000 at the beginning of the current year. The DD Partnership's liabilities increased by $30,000 during the current year. Read the requirements. Separately stated items i X - Data Table $ The distribution trigger gain recognition because his basis in the partnership after taking into account the Schedule K items the Ordinary loss Long-term capital gains Research and experimentation credit AMT tax preference items Distribution to the partners 18,000 52,000 7,000 8,000 44,000 Requirement b. What is Dave's basis in his partnership interest after taking into account the Schedule K items? (If an input field is not used in the table leave the input field emp Basis at the beginning of the year Plus: Print Done Minus: Basis in partnership interest at end of the year Choose from any list or enter any number in the input fields and then continue to the next question. Dave and Darby are equal partners in the DD Partnership. The passive activity loss, at-risk, and excess business loss limitation rules are not applicable to the partners. The partnership reports the following items on its Schedule K during the current year: (Click the icon to view the items reported on Schedule K.) Dave's basis in his partnership interest is $115,000 at the beginning of the current year. The DD Partnership's liabilities increased by $30,000 during the current year. Read the requirements. Separately stated items 1 Data Table - X $ The distribution trigger gain recognition because his basis in the partnership after taking into account the Schedule K items Ordinary loss Long-term capital gains Research and experimentation credit AMT tax preference items Distribution to the partners 18,000 52,000 7,000 8,000 44,000 Requirement b. What is Dave's basis in his partnership interest after taking into account the Schedule K items? (If an input field is not used in the table leave the input field emp Basis at the beginning of the year Plus: Print Print Done Done Minus: Basis in partnership interest at end of the year Choose from any list or enter any number in the input fields and then continue to the next