Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the individual shared responsibility for each of the following taxpayers: 1. Talia and James are both under 65 and married filing jointly in

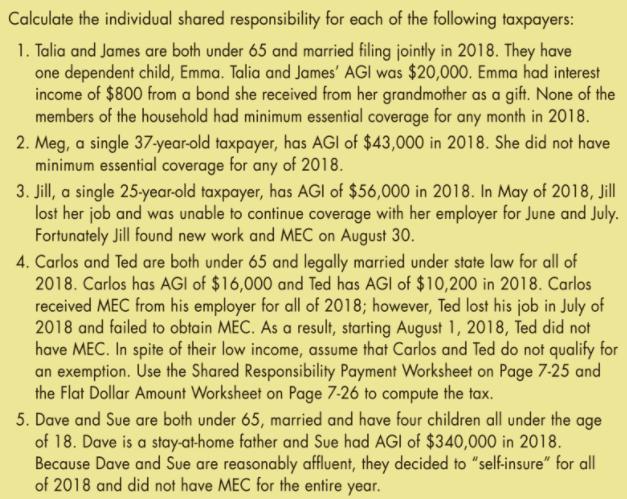

Calculate the individual shared responsibility for each of the following taxpayers: 1. Talia and James are both under 65 and married filing jointly in 2018. They have one dependent child, Emma. Talia and James' AGI was $20,000. Emma had interest income of $800 from a bond she received from her grandmother as a gift. None of the members of the household had minimum essential coverage for any month in 2018. 2. Meg, a single 37-year-old taxpayer, has AGI of $43,000 in 2018. She did not have minimum essential coverage for any 3. Jill, a single 25-year-old taxpayer, has AGI of $56,000 in 2018. In May of 2018, Jill lost her job and was unable to continue coverage with her employer for June and July. Fortunately Jill found new work and MEC on August 30. 4. Carlos and Ted are both under 65 and legally married under state law for all of 2018. Carlos has AGI of $16,000 and Ted has AGI of $10,200 in 2018. Carlos received MEC from his employer for all of 2018; however, Ted lost his job in July of 2018 and failed to obtain MEC. As a result, starting August 1, 2018, Ted did not have MEC. In spite of their low income, assume that Carlos and Ted do not qualify for an exemption. Use the Shared Responsibility Payment Worksheet on Page 7-25 and the Flat Dollar Amount Worksheet on Page 7-26 to compute the tax. of 2018. 5. Dave and Sue are both under 65, married and have four children all under the age of 18. Dave is a stay-at-home father and Sue had AGI of $340,000 in 2018. Because Dave and Sue are reasonably affluent, they decided to "self-insure" for all of 2018 and did not have MEC for the entire year.

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Both Talia and James are responsible for the shared responsibility payment because they did not ha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started