Question

Dave Krug contributed $2,500 cash along with inventory and land to a new partnership. The inventory had a book value of $2,300 and a

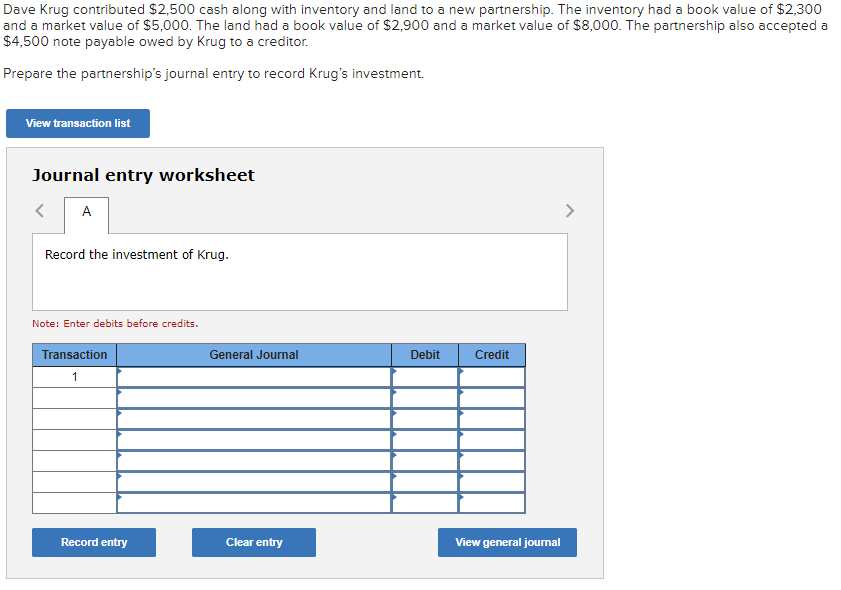

Dave Krug contributed $2,500 cash along with inventory and land to a new partnership. The inventory had a book value of $2,300 and a market value of $5,000. The land had a book value of $2,900 and a market value of $8,000. The partnership also accepted a $4,500 note payable owed by Krug to a creditor. Prepare the partnership's journal entry to record Krug's investment. View transaction list Journal entry worksheet A Record the investment of Krug. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Cash 2500 Inventory ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John Wild, Ken Shaw, Barbara Chiappetta

22nd edition

9781259566905, 978-0-07-76328, 77862279, 1259566900, 0-07-763289-3, 978-0077862275

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App