David and Hope Smith are married and have two children, Katelyn and Cory. They all live at 134 Crystal Lake Road, New Hope, PA

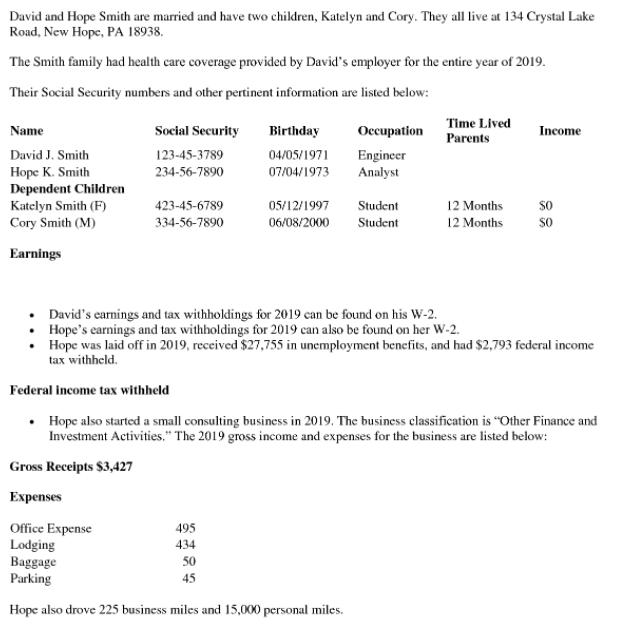

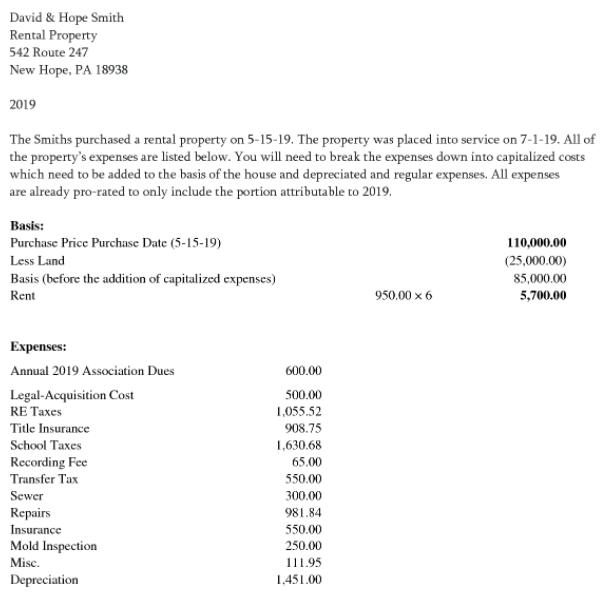

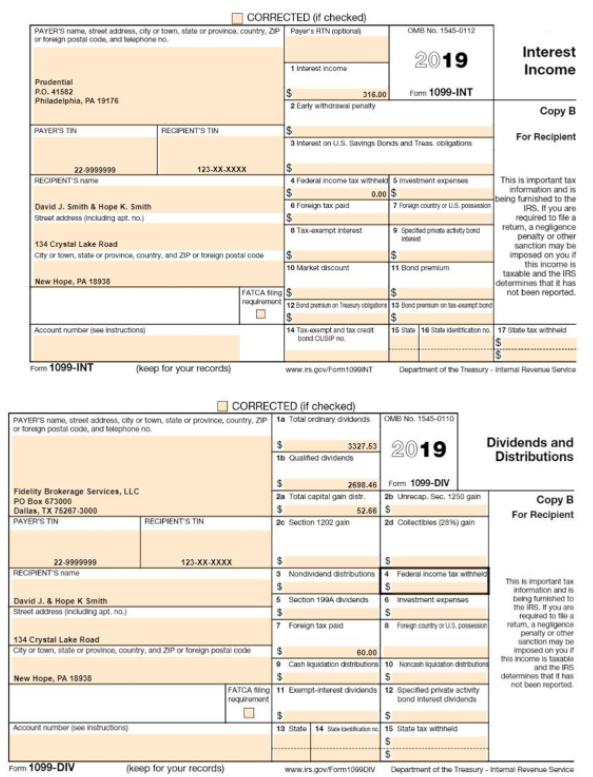

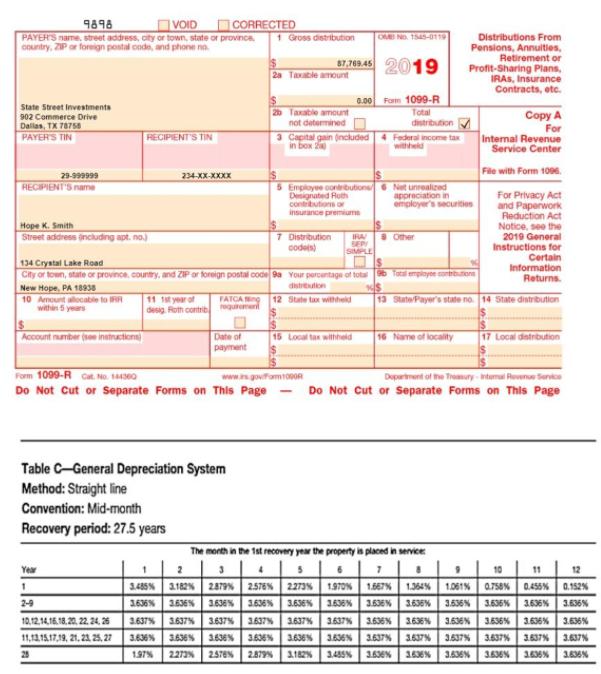

David and Hope Smith are married and have two children, Katelyn and Cory. They all live at 134 Crystal Lake Road, New Hope, PA 18938. The Smith family had health care coverage provided by David's employer for the entire year of 2019. Their Social Security numbers and other pertinent information are listed below: Name David J. Smith Hope K. Smith Dependent Children Katelyn Smith (F) Cory Smith (M) Earnings Social Security 123-45-3789 234-56-7890 423-45-6789 334-56-7890 Birthday 04/05/1971 07/04/1973 495 434 50 45 Occupation Engineer Analyst 05/12/1997 Student 06/08/2000 Student Office Expense Lodging Baggage Parking Hope also drove 225 business miles and 15,000 personal miles. Time Lived Parents 12 Months 12 Months Income David's earnings and tax withholdings for 2019 can be found on his W-2. Hope's earnings and tax withholdings for 2019 can also be found on her W-2. Hope was laid off in 2019, received $27,755 in unemployment benefits, and had $2,793 federal income tax withheld. SO SO Federal income tax withheld Hope also started a small consulting business in 2019. The business classification is "Other Finance and Investment Activities." The 2019 gross income and expenses for the business are listed below: Gross Receipts $3,427 Expenses David & Hope Smith Rental Property 542 Route 247 New Hope, PA 18938 2019 The Smiths purchased a rental property on 5-15-19. The property was placed into service on 7-1-19. All of the property's expenses are listed below. You will need to break the expenses down into capitalized costs which need to be added to the basis of the house and depreciated and regular expenses. All expenses are already pro-rated to only include the portion attributable to 2019. Basis: Purchase Price Purchase Date (5-15-19) Less Land Basis (before the addition of capitalized expenses) Rent Expenses: Annual 2019 Association Dues Legal-Acquisition Cost RE Taxes Title Insurance School Taxes Recording Fee Transfer Tax Sewer Repairs Insurance Mold Inspection Misc. Depreciation 600.00 500.00 1,055.52 908.75 1,630.68 65.00 550.00 300.00 981.84 550.00 250.00 111.95 1,451.00 950.00 6 110,000.00 (25,000.00) 85,000.00 5,700.00 22222 b Employer identification number (EIN) 99-9999999 e Employer's name, address, and ZIP code The Forumn 5101 Mountain Road New Hope Contrat number Employee's first name and t Hope 134 Crystal Lake Rd New Hope Employee's social securty number For Official Use Only OMB No. 1545-0008 234-56-7890 Employer's adds and ZIP code 15 Sm Employer's state ID number 99-999999 PA New Hope Con number Employee's first name and in David 134 Crystal Lake Rd New Hope PA 18938 22222 Employer identication number N 99-9999999 e Employer's name, address, and ZIP code Martin Aerospace 40 Aerospace Drive PA a Last name Smith W-2 Wage and Tax Statement Form Copy A For Social Security Administration - Send this entire page with Form W-3 to the Social Security Administration photocopies are not acceptable. 1 Employer's address and ZIP code 16 Empoy's state number 99-9999999 PA 18938 PA PA 18938 Phone Num# Country Last name Smith Phone Num # Country we's social cutty number For Official Use Only 123-45-6789 OMB No. 1545-0000 18938 16 state wages, tips, etc. 17 State income tax $50,481.00 $1,550.00 Country Phone Num # Country 7 Social security p Su 11 Nonquated plans 14 Other Other Socal security wag 2019 Medicare wages and tips Do Not Cut, Fold, or Staple Forms on This Page 14 Other $50,568.00 16 State wag tips, etc. 17 State come tax $95,844.00 $2,942.00 W-2 Wage and Tax Statement 2019 Form Copy A For Social Security Administration - Send this entire page with Form W-3 to the Social Security Administration; photocopies are not acceptable. $50,568.00 Wagt, other compensation $79,249.00 3 Soal tecurity wages Phone Num# Medicare wages and t $96,249.00 $96,249.00 $50,568.00 40 Do Not Cut, Fold, or Staple Forms on This Page SEE # $96,201.00 18 Local wages, tips, et 19 Local income tax $50,481.00 Federal income tax w 126 UF Social security tax withheld Medicare tax with 100 Department of the Treasury-tual Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat No 101340 82 10 Dependent care benefits 126 DD 100 12a Sou tractions for box 12 $88.00 120 120 2. Fedora income tax withd 4. Social security tax with Aloosted spe 10 Dependent care benefits $12,042.00 $858.00 New Hope Medans tax wihned 12 See instructions for tow 12 $406.00 $3,140.00 $12,374.00 $5,967.00 $1,396.00 $733.00 $17.000.00 $16,124.00 $962.00 New Hope Department of the Treasury-temal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions No. 101340 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country. ZP Payer's RTN (optiona or foreign postal code, and telephone no Prudential P.O. 41582 Philadelphia, PA 19176 PAYER'S TIN 22-9999999 RECIPIENT'S name David J. Smith & Hope K. Smith Street address (including apt. no.) Account number instructions) 134 Crystal Lake Road City or towns, state or province, country, and ZIP or toreign postal code New Hope, PA 18938 Form 1099-INT Fidelity Brokerage Services, LLC PO Box 673000 Dallas, TX 75267-3000 PAYER'S TIN 22-9999999 RECIPIENT'S name David J. & Hope K Smith Street address (including apt, no RECIPIENT'S TIN New Hope, PA 18935 123-XX-XXXX Account number e instructions) (keep for your records) Form 1099-DIV CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZP 1a Total ordinary dividends or foreign postal code, and telephone no RECIPIENT'S TIN 134 Crystal Lake Road City or town, stile or province, country, and ZIP or foreign postal code 123-XX-XXXX 1 Interest income (keep for your records) 316.00 2 Early withdrawal penalty 3 Interest on US. Savings Bonds and Traas obligations 4 Federal income tax withhe & investment expenses 0.00 $ 6 Foreign tax paid 8 Tax-xampt interest 14 Tax-empt and tax credit bond CUSIP www.ns.gov/Form1000NT 10 Market discount FATCA sing $ requirement 12 and promum on Treasury obiators 13 bond premum on tas-ampt bond 1b Qualified dividends OMB No 1545-0112 2019 Form 1099-INT 6 Section 1994 dividends $ 7 Foreign tax paid 7 Foreign country or US pomansion 9 Spected put actuy bond 2698.46 2a Total capital gaindist. $ 52.66 S 2c Section 1202 gain 11 Bond premium www.is.gov/form1000DIV 3327.53 2019 OMB No 1545-0110 Form 1099-DIV 2b Unrecap, Sec, 1250 gan 15 State Stataidwrtfication no. 17 State tax withheld 2d Colectibles (25) gain 3 Nondividend distributions 4 Federal income tax withheld $ Department of the Treasury - Internal Revenue Service 6 Investment expenses $ $ 60.00 Cash quidation distributions 10 Noncaston ditution $ $ FATCA ing 11 Exempt-interest dividends 12 Specified private activity requirement bond interest dividends 13 State 14 S 15 State tax withheld Interest Income Foreign county or US possession Copy B For Recipient This is important tax information and is being furnished to the IRS. If you are required to file a retum, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. Dividends and Distributions Copy B For Recipient This is important tax information and s being furnished to the IRS. If you are required to the a retum, a negligence penalty or other sanction may be imposed on you this income is taxable and the IRS determines that it has not been reported. Department of the Treasury-Internal Revenue Service VOID 9898 PAYER'S name, street address, city or town, state or province country, ZIP or foreign postal code, and phone no State Street Investments 902 Commerce Drive Dallas, TX 78758 PAYER'S TIN 29-999999 RECIPIENT'S name Hope K. Smith Street address including apt. no.) 10 Amount allocable to R within 5 years Account number (see instructions) RECIPIENT'S TIN Year 1 2-9 10,12,14,16,18,20, 22, 24, 26 11,12,15,17,19, 21, 23, 25, 27 234-XX-XXXX 25 CORRECTED 134 Crystal Lake Road City or town, state or province, country, and ZIP or foreign postal code 9a New Hope, PA 18938 11 1st year of desig Roth contrib Form 1099-R Cat No. 144360 Do Not Cut or Separate Forms on This Page Table C-General Depreciation System Method: Straight line Convention: Mid-month Recovery period: 27.5 years Date of payment 1 Gross distribution OMB No 1545-0119 2a Taxable amount FATCA ing 12 requiremen 87,769.45 2019 Taxable amount not determined distribution 3 Capital gain (ncluded 4 Federal income tax in box 20 withheld 5 Employee contributions Designated Ruth contributions or insurance premium 7 Distribution IRA/ code(s) SEPY 0.00 Form 1099-R Total www.s.govform1000 Your percentage of total distribution State tax withheld 15 Local tax withheld - Other Distributions From Pensions, Annuities, Internal Revenue Service Center File with Form 1096. For Privacy Act and Paperwork Reduction Act Notice, see the 2019 General Instructions for Certain Information Returns. 13 State/Payer's state no. 14 State distribution Net unrealized appreciation in employer's securities ployee s Retirement or Profit-Sharing Plans, IRAS, Insurance Contracts, etc. 16 Name of locality Copy A For 17 Local distribution Department of the Treasury-Internal Revenue Service Do Not Cut or Separate Forms on This Page The month in the 1st recovery year the property is placed in service: 7 10 11 12 3.485 % 0.152% 3.636% 2 3.182% 2879% 2.576% 2273% 1970% 1.667% 1.364% 1.061% 0.758% 0.455% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.637% 3637% 3637% 3637% 3.637% 3.637% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.637% 3637% 3.537% 3.637% 3.637% 3.637% 1.97% 2.273% 2.570% 2.879% 3.182% 3.485% 3.636% 1636% 3.636% 3.636% 3.636% 3.636%

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Employees SSN 123456789 Do NOT carry SSN from Background Wkst Note We do not carry ITINS from the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started